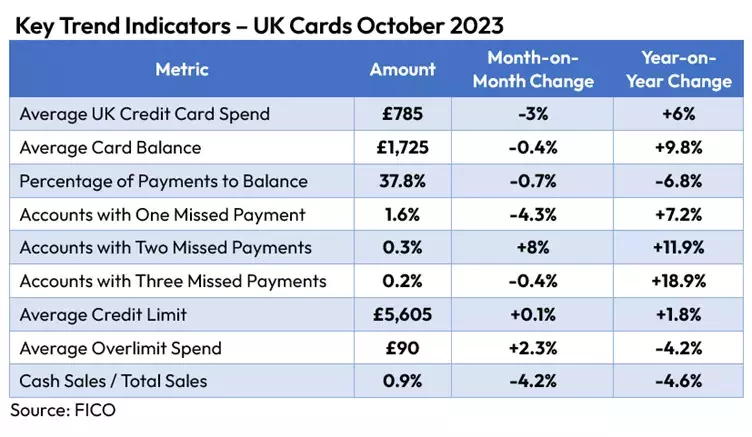

UK Credit Cards: Pre-Holiday Spending and Payments

UK card sales and cash spend fell before the usual Christmas upturn, although inflation means spending was higher than the same period in 2022

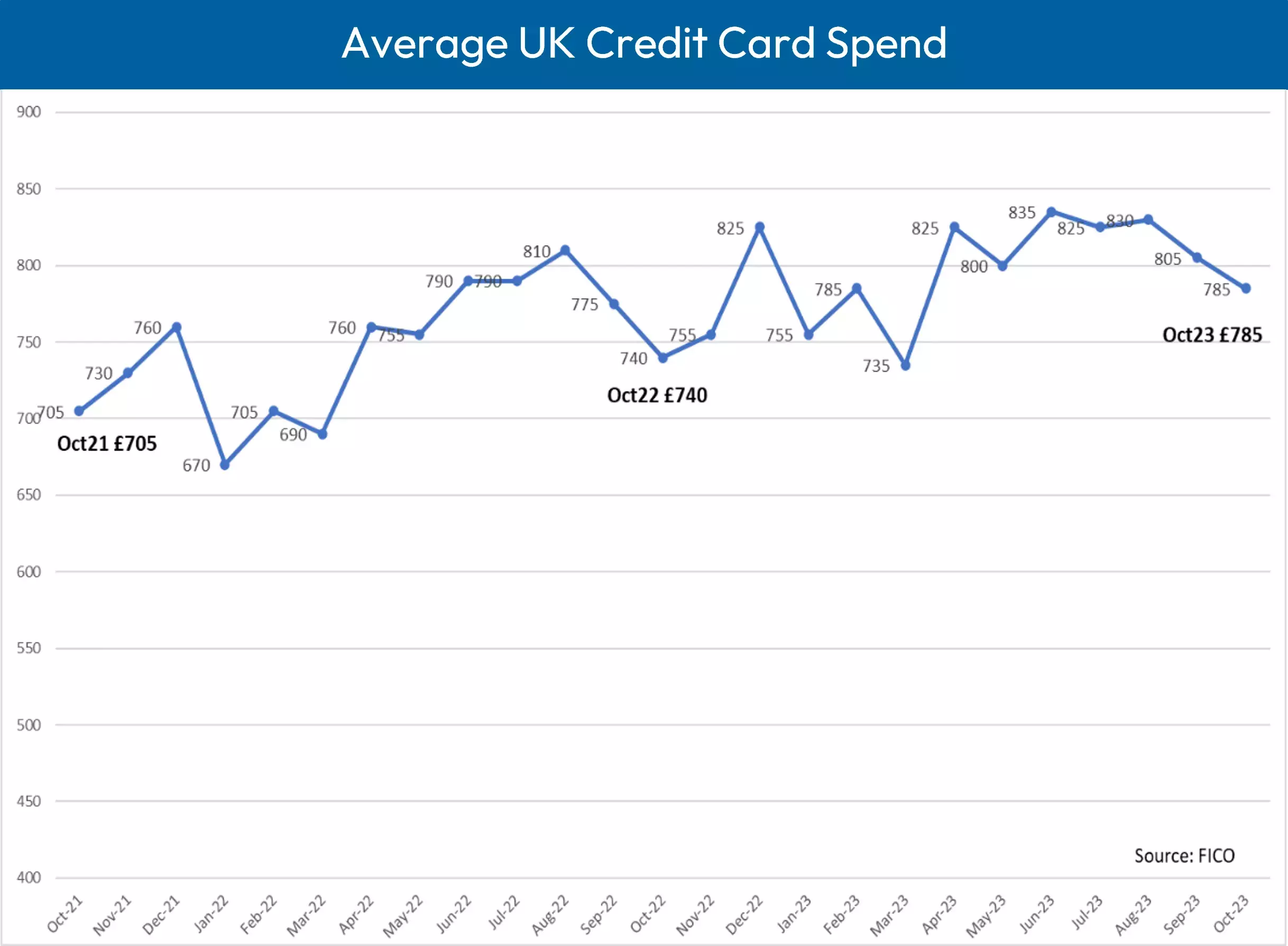

UK consumers generally spend less in the autumn as they prepare for the higher spending during the holiday season. The FICO UK Credit Card Market Report for October 2023 reflects this trend, showing that spending dipped in October by 3% month-on-month. Still spending was still higher than October 2022, probably due at least in part to higher prices.

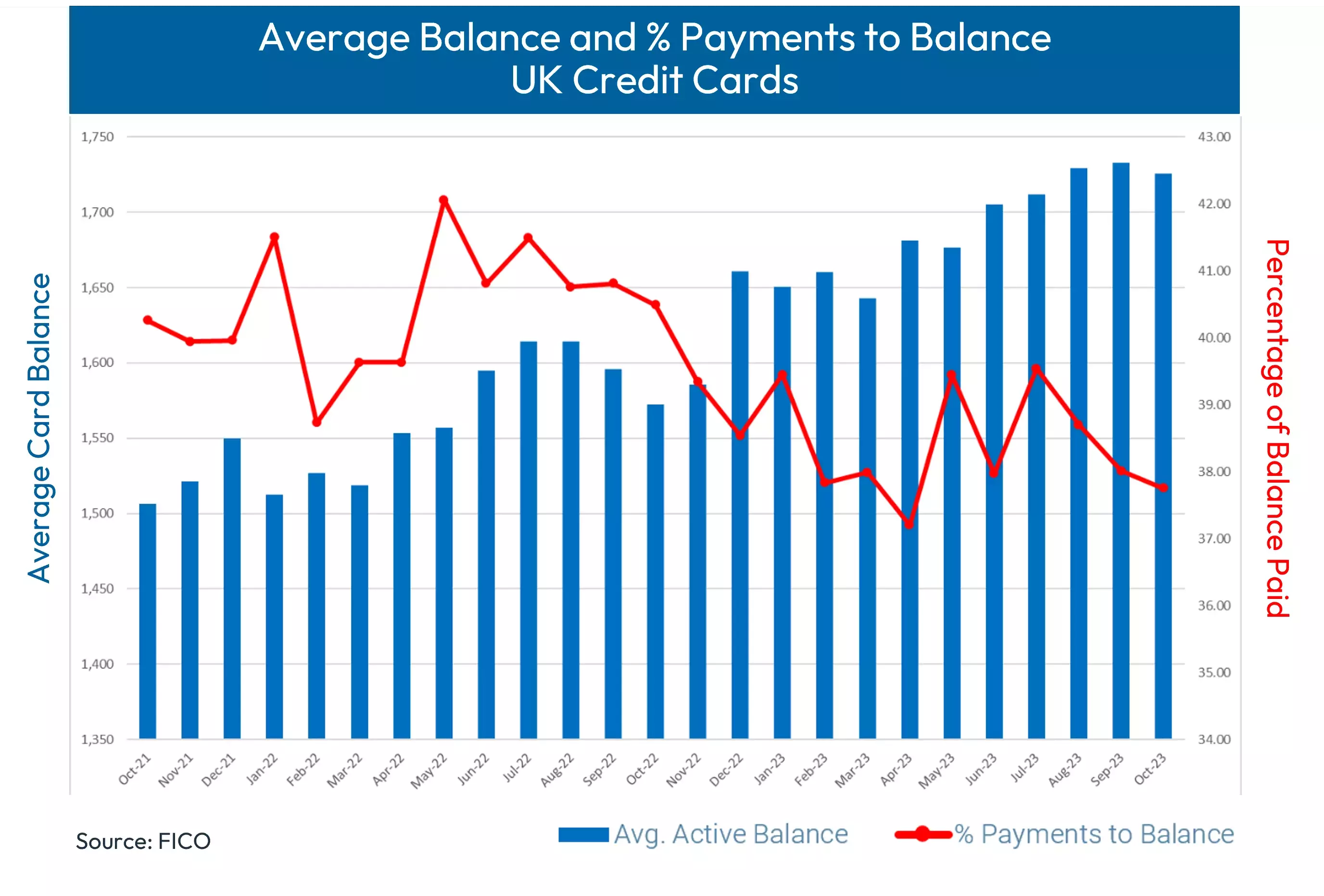

The financial pressures facing many UK households are also evidenced in falling monthly and annual payments to balance as more consumers lean on credit to meet their lifestyle needs.

UK Credit Card and Consumer Spending Highlights

- Sales transactions dropped 3% from September, but are still 6% higher than October 2022

- Average card balances fell slightly month-on-month, down 0.4%, but remain 9.8% higher than the previous year

- Once again the percentage of payments to balance fell, now standing at 37.8%

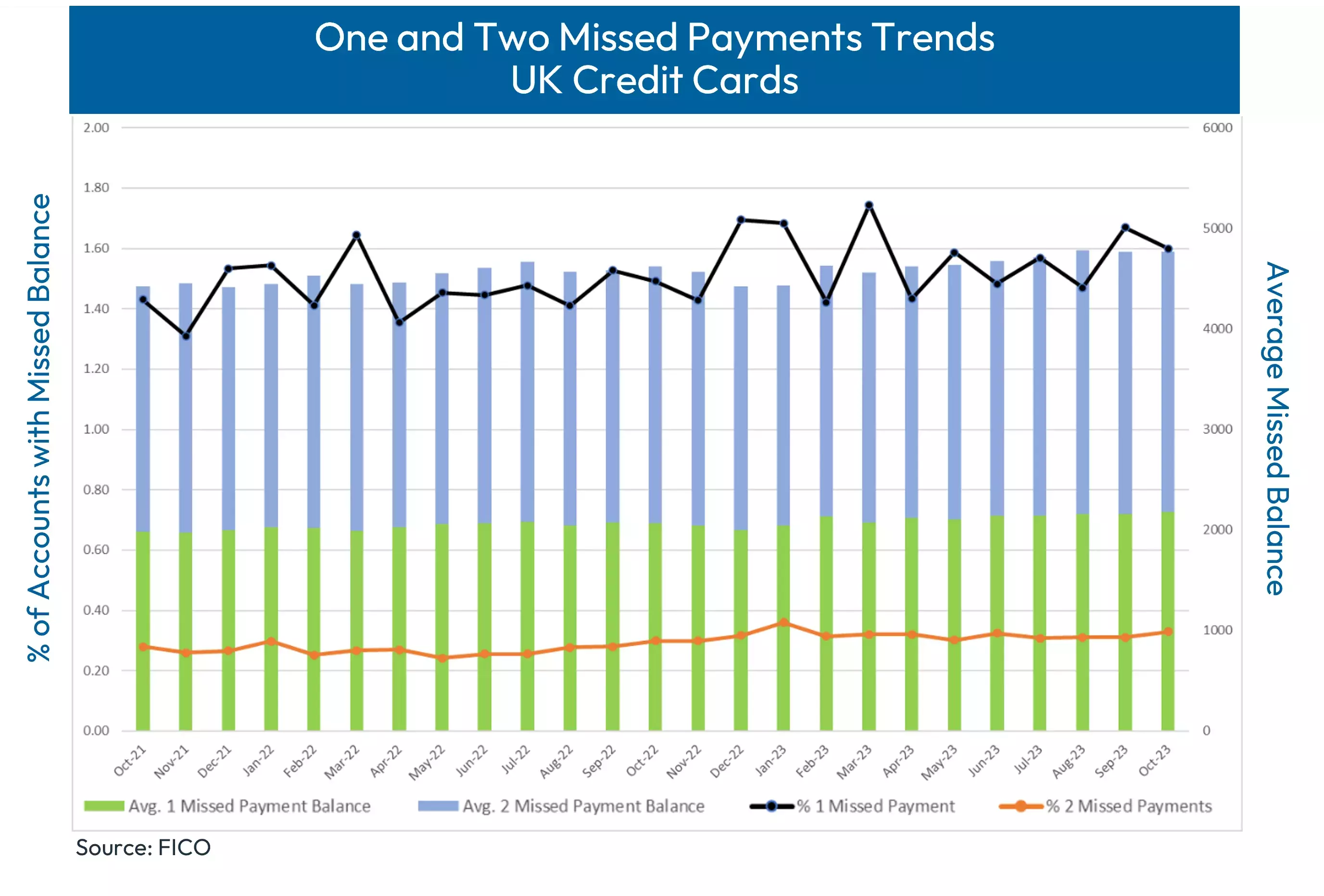

- Consumers missing one payment decreased month-on-month by 4.3%

- The number of consumers missing two card payments rose by 8%.

- The average balance where one payment has been missed continued on an upward trend, rising 1% from September and 5.5% year-on-year, now standing at £2,180

Looking at outstanding balances, while the average card balance decreased 0.4% month-on-month, the balance for customers who have missed card payments is trending upwards and the percentage of payments to balance has decreased for four months in a row.

37.8% of card balances were paid in October, a reduction of 0.7% month-on-month and 6.8% year-on-year. 2022 saw a similar reduction, before increased payments in January 2023, however it is likely this figure will continue to fall over the next couple of months due to continued financial hardship and increased spend over the festive period.

The number of customers missing one payment decreased by 4.3% from September to October, which was expected after the 13.5% increase seen in September. The September increase has rolled forwards and subsequently there has been a larger increase in customers now missing two card payments in October — an 8% increase month-on-month. Customers missing three payments have experienced more stability, dropping by just 0.4% on the previous month. However, the number of customers missing one, two or three payments remains significantly higher year-on-year.

The average balance for customers missing card payments has continued to trend upwards during 2023, with the average balance for one missed payment increasing 1% month-on-month to £2,180 and 5.5% year-on-year. A similar pattern is seen for the average balance for three missed payments, increasing 0.4% month-on-month to £2,950 — a 2.4% increase year-on-year. However, customers missing two payments have seen their average balance reduce by 0.7% to £2,585, although this is still 1.3% higher than the same month in 2022.

Although the average missed payment balance has been increasing throughout much of 2023, when comparing the ratio of missed payment balances to the overall credit card balance, this has been fairly stable. This suggests missed payment balances have not increased at a faster rate than the overall balance. However, this ratio has increased by 1.48% month-on-month for the average one missed payment balance. With increased seasonal spend expected over the coming months, risk teams should monitor this closely.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80% of UK card issuers. For more information on these trends, contact FICO.

How FICO Can Help You Manage Credit Card Risk and Performance

- Explore our solutions for customer management

- See my post on UK Credit Card Trends: From 2008 Crash to Cost-of-Living Crisis

- Read more posts on UK cards

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.