UK Credit Cards: Summer Saw Spending and Balances Rise

FICO UK Credit Report shows worrying trends as average spend per credit card rose while payments to balance rose and fell

UK credit card holders continue to show up-and-down activity on card spending and payments. Our FICO UK Credit Card Market Report for July/August 2023 shows a number of trends that could make lenders worry for the winter months ahead.

UK Credit Card Spending Highlights

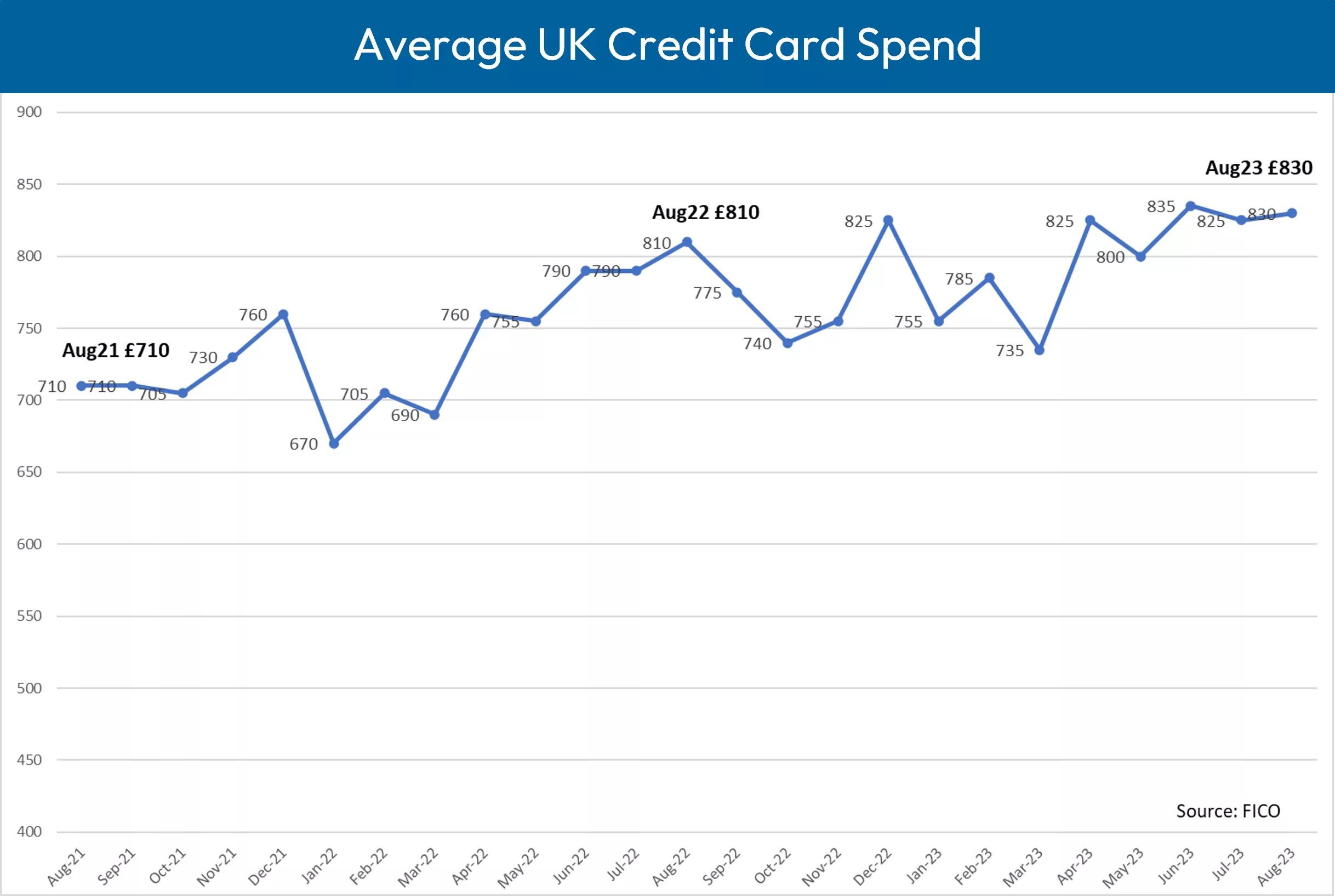

- Average credit card spending levelled out over the summer months to £825 in July and £830 in August, but remained significantly higher than the same period in 2022 (£790 and £810, respectively)

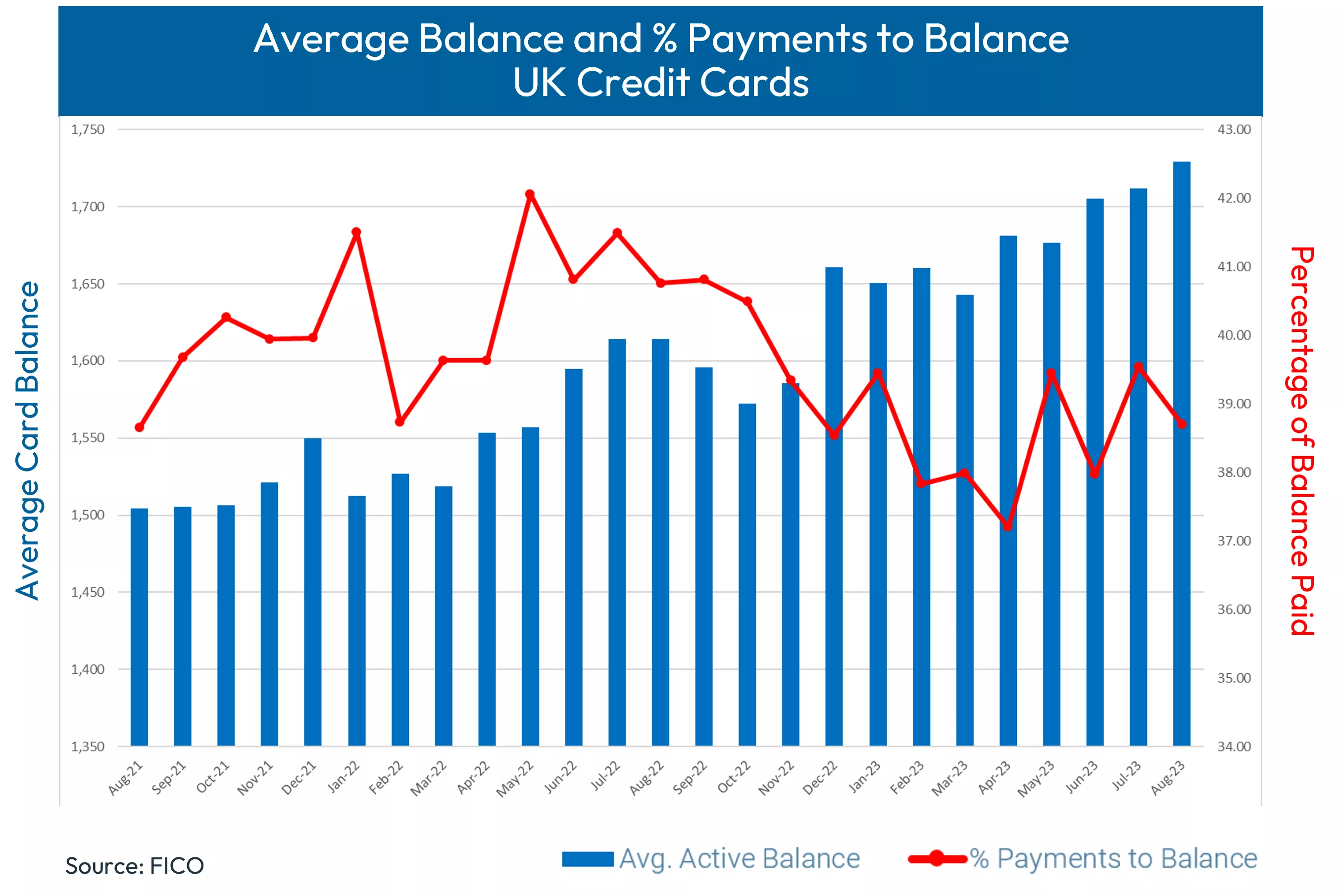

- The average consumer credit card balance increased slightly in July to £1,710 and in August to £1,729, continuing the upward trend seen over the last two years.

- Although the percentage of payments to balance has increased from 38% in June to 38.7% in August, it remains a much lower level that the same period last year. Intramonth movements demonstrate erratic credit management, having increased 1.5%, to 39.5% in July, before falling back again in August.

- Year on year, the percentage of customers missing one, two and three payments has risen, with customers missing two payments 11.9% higher and for those missing three payments a worrying 20.3% higher.

- The use of credit cards to take out cash was at 3.6% in July and 4% in August, which is still significantly lower than the 6% seen before COVID. However, cash spending has been steadily increasing since March.

Average UK consumer spending on credit cards over the summer has been relatively flat, albeit still at the highest point since FICO records started in 2006. The average balance has also continued to increase month on month, trending upwards for the last two years. Both of these factors reflect the general inflationary pressures across the UK economy.

The FICO analysis also illustrates the delicate balancing act credit card holders are managing, with the percentage of payment to balance yo-yoing over the last few months following a significant drop in the spring. This can be expected to continue whilst households struggle with the combined burden of higher prices and higher credit card balances. The percentage of customers missing one, two and three payments is also significantly higher than the same period in 2022, reflecting the challenges faced by those without a savings cushion to fall back on.

The initial increase in missed payment began during the Christmas 2022 prime spending period and has trended upwards across one, two and three missed payments since. In particular, the average missed payment balance has been increasing since May 2023 for those consumers missing one payment and since March 2023 for those with two missed payments. The erratic pattern of payments continued in August with the number of customers missing one payment down 6.3% after an increase of 5.8% in July. However, the increase seen in July has rolled through to August for those customers now missing two payments.

The other warning flag for UK lenders is the use of credit cards for cash withdrawal transactions. Recent reports from UK Finance stated that consumers’ cash spending had risen for the first time in a decade. This increase in cash usage is reflected in the FICO benchmarking figures, which have shown a steady increase since March 2023 in the percentage of customers using their credit cards to take out cash. However, this is still significantly lower than before COVID, when over 6% of customers used credit cards to take out cash.

The new card data provides important insights for UK lenders as they prepare for the next wave of winter fuel costs hitting customers’ disposable income.

These credit card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80% of UK card issuers. For more information on these trends, contact FICO.

How FICO Can Help You Manage Credit Card Risk and Performance

- Explore our solutions for customer management

- See my post on UK Credit Card Trends: From 2008 Crash to Cost-of-Living Crisis

- Read more posts on UK cards

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.