US Bankcards Industry Benchmarking Trends: 2023 Q1 Update

Bankcard delinquencies exceed pre-pandemic levels, higher losses are forecasted ahead

FICO releases quarterly United States Bankcard Industry Benchmarking trends, to catch up on the last quarter click here.

2023 started off with unexpected growth, mild recession still predicted this year

Reviewing earlier forecasts, many economists were predicting a mild recession to begin in the first quarter of 2023. Despite the 200k+ workers that have been laid off, the job sector remained strong, and consumers were still spending after the holiday season leading to mild growth in the economy. However, consumer spending slowed in February and March, showing the first signs of stress.

The numbers:

- First quarter 2023 GDP released by the U.S. Bureau of Economic Analysis showed the economy grew at a pace of 1.1%. Visa is predicting negative GDP in Q2 and Q3 with a return to growth in Q4 2023.

- The unemployment rate dropped from 3.6% to 3.5% in March. But according to the Federal Reserve, unemployment is expected to rise to 4.3-4.9% by the end of 2023.

- The National Association of Realtors reported that sales of previously owned homes declined 2.4% in March compared with February. Overall, housing prices are expected to hold their ground in 2023 while inventories return to more normal levels than in previous years.

- U.S. Census Bureau reports advanced estimates that retail sales were down 1.2% from February 2023 to March 2023.

- Inflation (the year-over-year comparison of the Consumer Price Index) continued to slow in March to 5%; however, prices continue to rise month-over-month.

- The Federal Funds Effective Rate was raised twice in Q1, 0.25% in February and 0.25% in March, landing at a target rate of 4.75%-5.00%.

Trends in the macro environment are seen throughout the credit card industry

Rising prices, increases in the cost of securing and carrying debt, and the fear of higher unemployment rates are trickling through to consumer behavior on credit cards. Compared to Q4 2021, the average interest rate on general purpose credit cards has increased nearly 800 basis points (Source: Federal Reserve G.19 report on Consumer Credit) translating to ~$70 more in interest per $10,000 in debt. While average rates have remained stable in Q1, past increases are leading to a smaller percentage of each payment going towards paying down the principle balance each month. The result is an increase in the average balance and rising delinquency rates as consumers try their best to keep up.

The following card performance metrics help us understand the impact of the macro environment on the credit card industry at an aggregate level. These figures represent a national sample of approximately 130 million accounts that comprise FICO® Advisors’ Risk Benchmarking solution. The data sample comes from FICO client reports generated by FICO® TRIAD® Customer Manager and Adaptive Control System solutions.

Usage & Payments

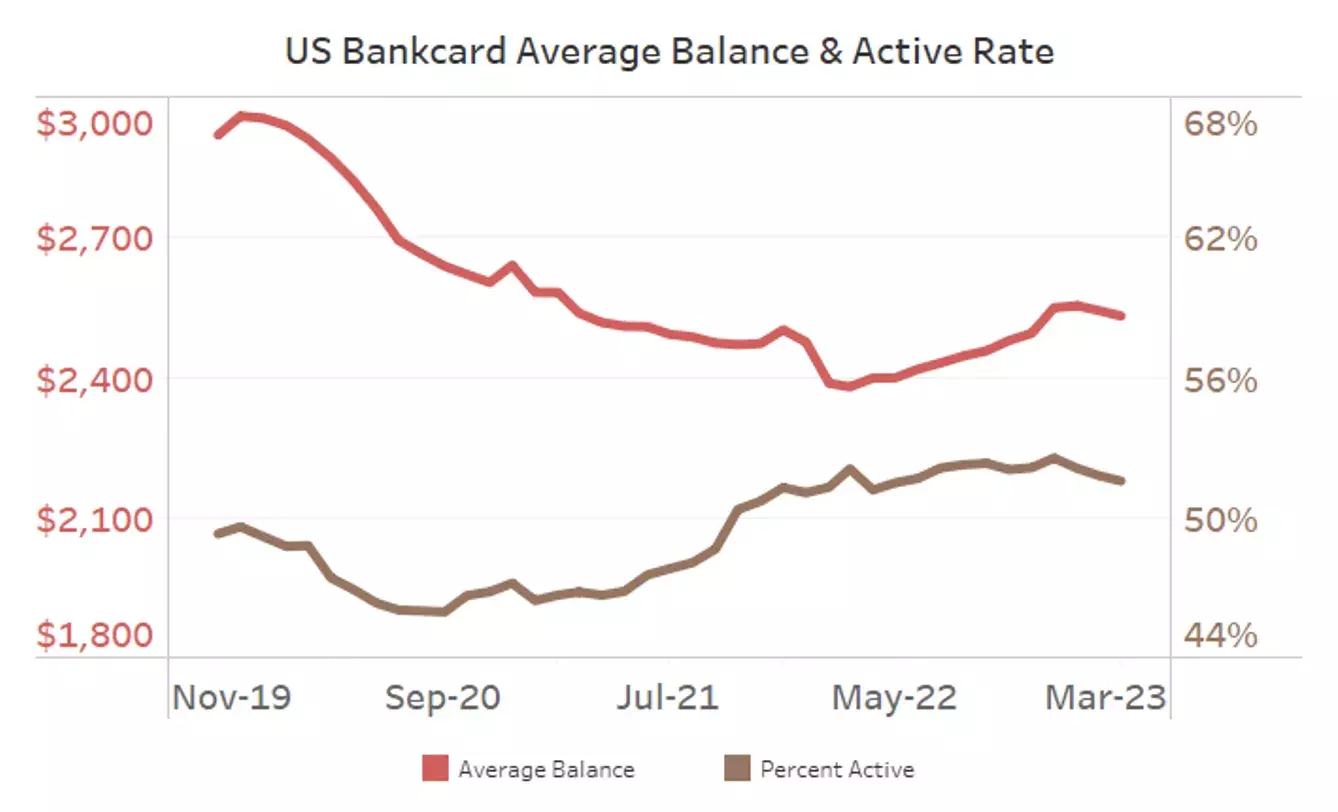

After the holiday shopping season, the average balance dropped slightly to $2,531 in March, but remains 6.4% higher than one year ago when average balance bottomed out post-COVID. The average monthly spend continues to be stable (around $1,000 per month), so we can attribute this rise in balances to lower payment rates and a return to revolve-type behavior that was more typical prior to the pandemic.

The percentage of customers actively using their card in March is off by 1% year-over-year. However, the active rate of 52% continues to be higher than historically observed compared to a stable rate around 49% in 2019. It is possible that active rates will continue to trend higher as consumers reach deeper in their wallet to support necessary spending.

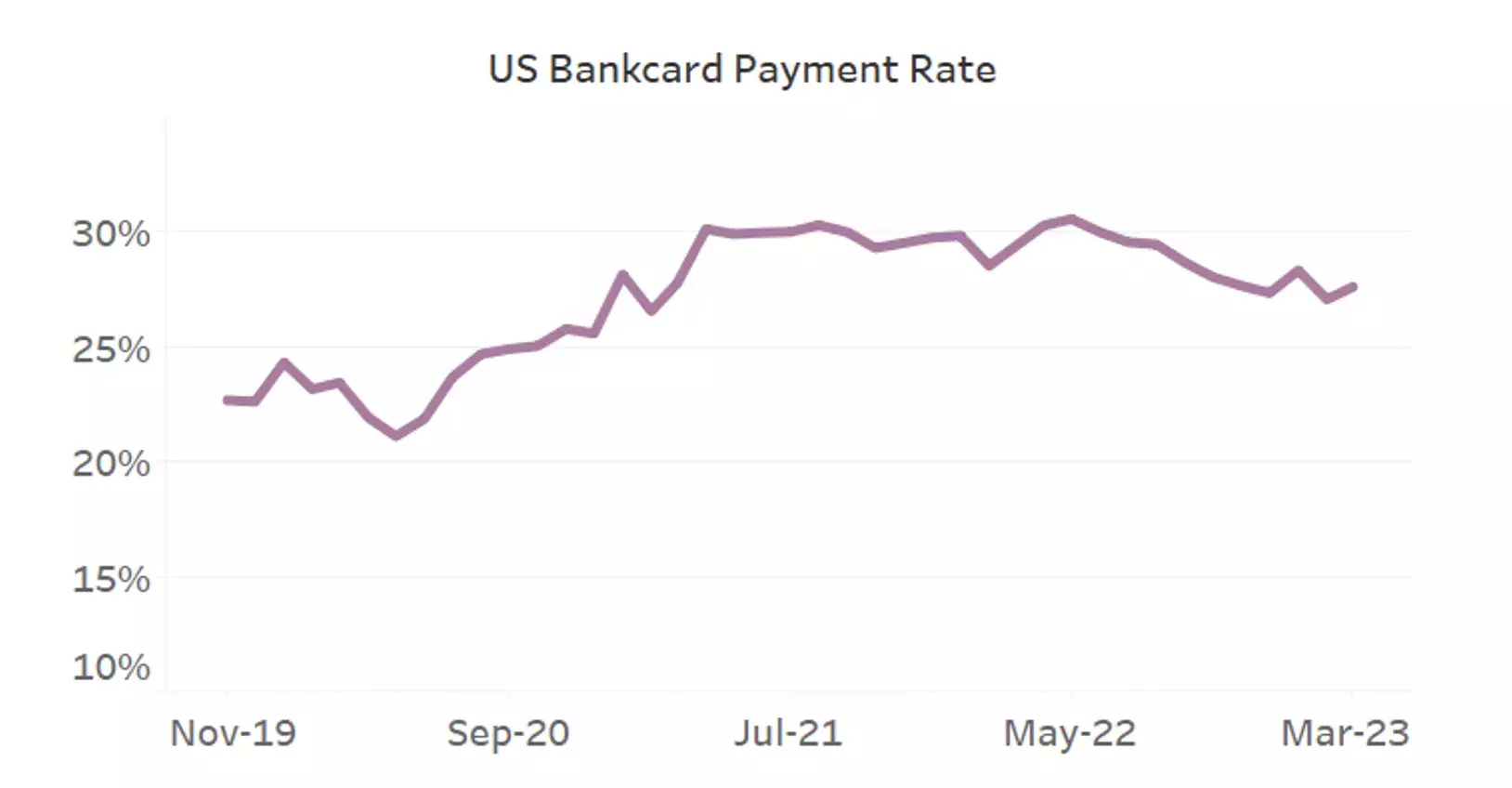

The current payment rate of 27.6% is 6% lower year-over-year and has been trending downwards as more consumers are revolving their balances. Although personal savings rates, according to the Bureau of Economic Analysis, have risen slightly since September they remain at near-historic lows, indicating that consumers are feeling the squeeze.

Delinquency

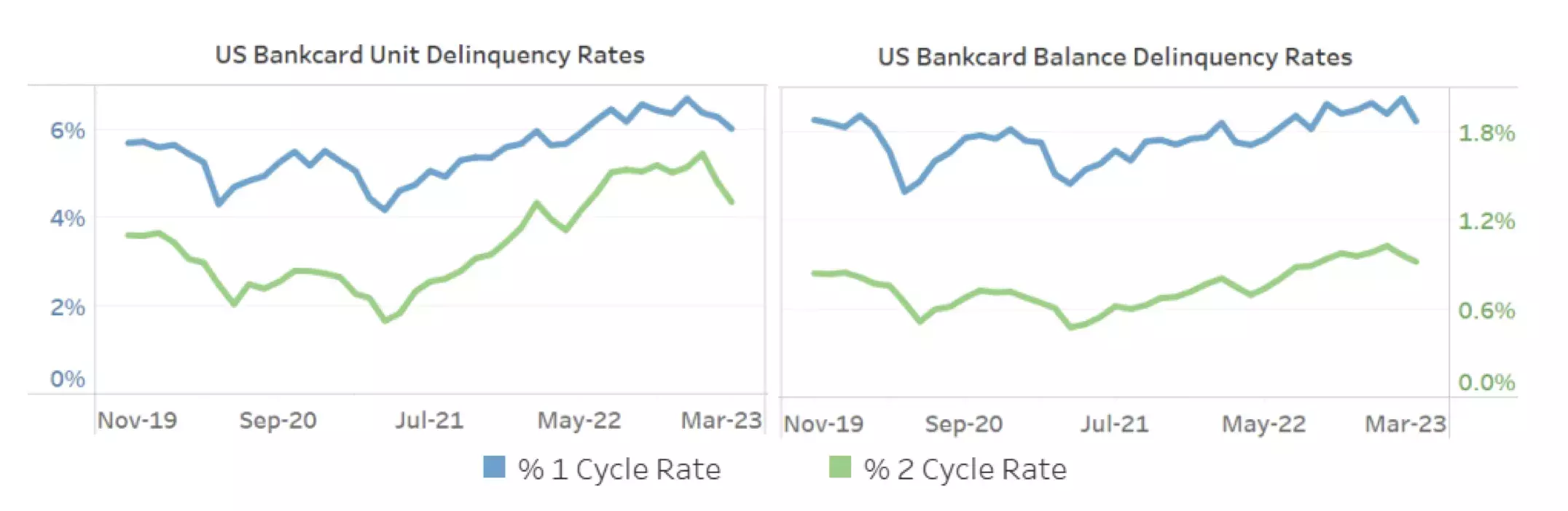

Delinquency rates took a seasonal turn in the first quarter of 2023. Rates typically peak after holiday shopping then come down as consumers receive their tax refunds and use it to pay down debt. The larger concern is the upward trend of customers missing one or two payments that have occurred since mid-2021, exceeding levels seen prior to the pandemic (up 6.6% and 9.7% year-over-year, respectively). With the return to increasing average balance that was discussed earlier, balance delinquency rates are starting to climb even faster. The rate of balances that are one payment behind, is up 8.2% year-over-year while the rate of balances that are two payments behind is up a whopping 22.4% year-over-year.

Credit card lenders are not only dealing with higher loss forecasts in 2023. Changes to the accounting rules on calculating reserves (CECL – Current Expected Credit Losses) went into effect on January 1, 2023, possibly leading institutions to be required to hold more funds than before. More information on the impact will be available later this year.

Looking ahead, 2023 could have some bumps in the road for consumers and those who are trying to manage risk in a credit card portfolio. If you are a consumer that is falling behind, you can reach out to your credit card issuer for help. Most companies offer short-term or long-term payment plans depending on the expected length of the hardship. Tools at myFICO.com are also available to help consumers track their credit usage and FICO® Score.

If you are a Risk Manager, you should be reviewing lending strategies to ensure customers are receiving the right treatment across the lifecycle and getting the help that is needed if debts cannot be fulfilled. Reach out to your Solution Success Manager or Client Partner at FICO for a discussion and current state assessment if you need help completing this evaluation.

If you have questions or are interested in discussing these insights in more detail, please contact me, Leanne Marshall, through comments on this blog or at leannemarshall@fico.com.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.