US Bankcards Industry Benchmarking Trends: 2023 Q3 Update

More consumers are carrying credit card balances despite high rates, and delinquency rates continue to rise

Credit card balances continue to sour, despite high interest rates and unrelenting inflation. The CFPB (Consumer Financial Protection Bureau) released their annual report on October 25th regarding debt loads on credit cards in 2022. They found that consumers paid a record-high $130 billion in credit card interest and fees and total outstanding debt balances hit $1 trillion for the first time since data has been collected. There were also many areas of concern cited. Of the $25 billion in credit card fees collected by card issuers, $14.5 billion was due to missed payments as consumers are not able to keep up on their debts. More consumers are also carrying debt balances month to month and nearly one in ten cardholders pay more interest each month than they pay towards their principal balance.

There are mixed signals in the macroeconomic data, leaving fewer economists still forecasting a recession in the next 12 months (46% according to the September survey by Bankrate, down from 59% in the June survey). Other economic signals bear this out:

The US Real Gross Domestic Product (GDP) came in at a surprising 4.9% for the third quarter of 2023 when released by the U.S. Bureau of Economic Analysis. They cited increases in consumer spending, higher inventories and exports and increased residential investment and government spending as the reasons for the large increase.

The U.S. Bureau of Labor statistics announced the unemployment rate was steady at 3.8% in September and is 0.3% higher than September 2022. Updated expectations from the Federal Reserve are that the unemployment rate will rise to 4.1% by the end of 2023 and 4.7% by the end of 2024.

The average APR on a 30-year fixed rate mortgage is nearing 8% for the first time in 23 years. This compares to rates around 3% just two years ago.

Retail sales and spending, reported by the U.S. Census Bureau, increased 0.7% from August to September and are up 3.8% year-over-year. It is important to note that sales are adjusted for seasonal variation and holiday and trading-day differences, but not for price change.

The rate of Inflation (the year-over-year comparison of the Consumer Price Index) has increased slightly from its low in June of 3.0% to 3.7% in September. The Consumer Price Index continues to rise month-over-month.

The Federal Funds Effective Rate has been steady at 5.25%-5.5% after its last increase in July – this is the highest the rate has been in 22 years. There is speculation that the Fed may increase the rate an additional 0.25% by the end of the year.

The data shared below from FICO® Advisors’ Risk Benchmarking solution show many of the same observations as the CFPB report and reveal that the trends continue worsening in 2023. These figures represent a national sample of approximately 130 million credit accounts gathered from FICO client reports generated by FICO® TRIAD® Customer Manager and Adaptive Control System solutions.

Credit Card Usage and Payments

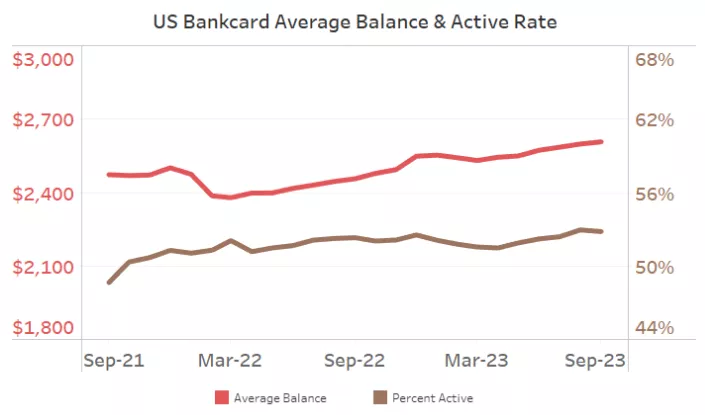

As mentioned in the CFPB report, consumers are building on their credit card balances after paying them down significantly during the pandemic. The average account balance has grown 6.1% over the past year, ending September at $2,607. More consumers are using their credit cards for everyday transactions each month as well, landing the active rate at almost 53% in September. This is great progress for credit card issuers, who work hard to increase transactions and overall usage of their product, however it should be monitored closely by risk managers if consumers are picking up their plastic after a long hiatus.

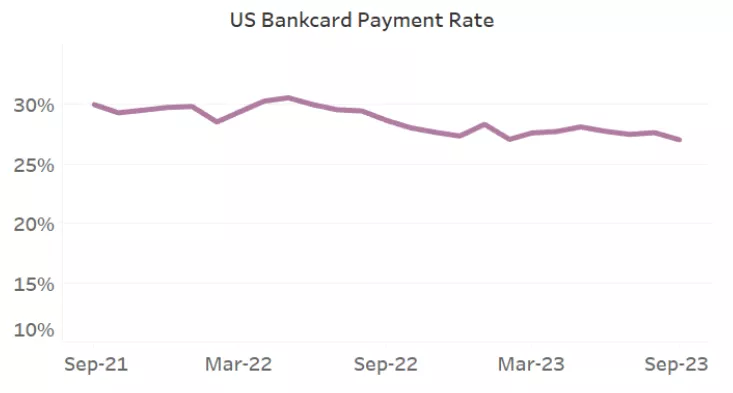

The industry payment rate (percentage of previous month’s balance that was paid back) has been volatile in the past several years due to changes in consumer’s cash flow. In September, the payment rate of 27.0% is 5.7% lower year-over-year but remains markedly higher than the pre-COVID average of ~23%.

Credit Card Delinquency Rates

Despite some positive news in the macroeconomic environment with steady unemployment rates and lower inflation than 2022, many consumers are still finding themselves unable to make on-time payments. The US bankcard industry trends show an increasing percentage of accounts entering collections and rolling towards charge-off.

The proportion of credit accounts that have missed one payment has grown by 30.2% from September 2021 to September 2023, along with a 24.7% increase in the balances on accounts that are one payment past due. The monthly rates are now 6.9% and 7.2%, respectively, the highest one payment past due rates in more than six years.

Not surprisingly, the proportion of customers missing two credit card payments has also increased, nearly doubling over the past two years. It is important for consumers and issuers to work out payment plans early on as the probability of repayment drops significantly when a customer misses multiple payments in a row.

Continued monitoring of the macro environment as well as consumer behavior will be extremely important for risk managers over the next six to twelve months. Although economists aren’t predicting a recession at this point, many consumers may find themselves with limited cash flow if prices don’t ease, leading to higher credit card usage for everyday transactions and the inevitable risk that accompanies this behavior.

Financial institutions and credit card issuers can reach out to your FICO Solution Success Advisor or FICO Client Partner for a discussion and current state assessment if you need help completing an evaluation of your portfolio.

If you have questions or are interested in discussing these insights in more detail, please leave a comment on this post.

How FICO Can Help You Manage Credit Card Risk and Performance

Explore our solutions for customer management.

See my previous posts on US card performance.

Consumers who are struggling can find tools at myFICO.com to help keep track of their credit usage and FICO Score.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.