US Bankcards Industry Benchmarking Trends: 2023 Q4 Update

Credit card balances continue to rise, early-stage delinquency begins to show signs of flattening

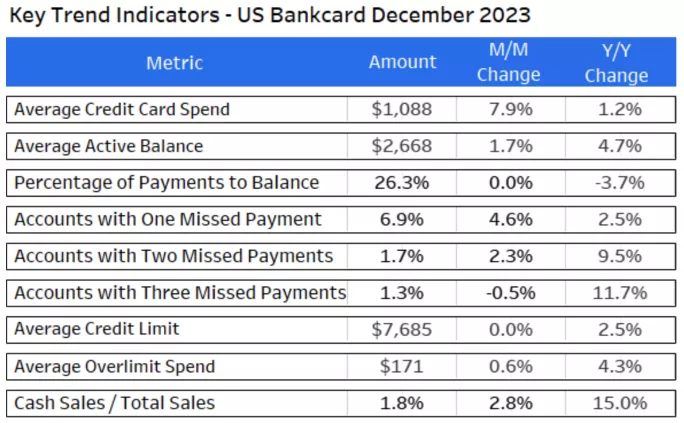

Talks of a US recession appear to be off the table for now, but consumers are still struggling to keep up with credit card payments, as shown by the latest data from FICO. Balances rose again in December, as did the active cards rate. Delinquency rates were also higher, though not rising as fast as the previous year. Here are the US Credit Card and Consumer Spending Highlights:

Economic Context

Many economists (approximately 76% of those surveyed) believe the chance of recession is 50% or less, according to a December survey from the National Association of Business Economics. Here are some of the signals:

The US Real Gross Domestic Product (GDP) ended 2023 with a 2.5% increase over the 2022 annual level as released by the U.S. Bureau of Economic Analysis. Primary reasons for the positive results were increases in consumer credit card spending in areas of service and goods (led by health care and recreational goods and vehicles).

U.S. Retail and food sales transactions, reported by the U.S. Census Bureau, increased 0.6% from November to December and are up 5.6% year-over-year. It is important to note that sales are adjusted for seasonal variation and holiday and trading-day differences, but not for price change.

- The U.S. Bureau of Labor statistics announced the unemployment rate was steady at 3.7% in December and is 0.2% higher than December 2022. These figures remain better than expected when compared to the Federal Reserve’s forecast that unemployment would rise to 4.1% by the end of 2023.

The average APR on a 30-year fixed rate mortgage has decreased over the past two months after peaking at 7.8% in October. Average rates are steady around 6.7%.

The rate of Inflation (the year-over-year comparison of the Consumer Price Index) was reported at 3.4% in December. The Consumer Price Index appears to have peaked for now with month-over-month decreases since October 2023.

The Federal Funds Effective Rate has been held at 5.25%-5.5% since the last rate increase in July despite speculation that there would be another increase of 0.25% before year-end. Due to lower inflation, the Federal Reserve is now penciling in rate cuts for 2024 beginning in March.

There are conflicting headlines regarding how severe credit card losses will be over the next two years. Capital One believes their credit card delinquency and subsequent losses may not turn out to be as bad as what was predicted shortly following the pandemic. On the other hand, Goldman Sachs released a report citing “credit card companies are racking up losses at the fastest pace in almost 30 years, outside of the Great Financial Crisis.” The report concludes that losses may not peak until the end of 2024/beginning of 2025.

Fortunately, a leading indicator to loss is credit card delinquency. The data shared below from FICO® Advisors’ Risk Benchmarking solution shows an upward trend in credit card delinquency, but this appears to be flattening over the last several months. We’ll dig into credit card delinquency trends, as well as other credit score figures that represent a national sample of approximately 130 million US accounts gathered from FICO client reports generated by FICO® TRIAD® Customer Manager and Adaptive Control System solutions.

Credit Card Usage and Payments

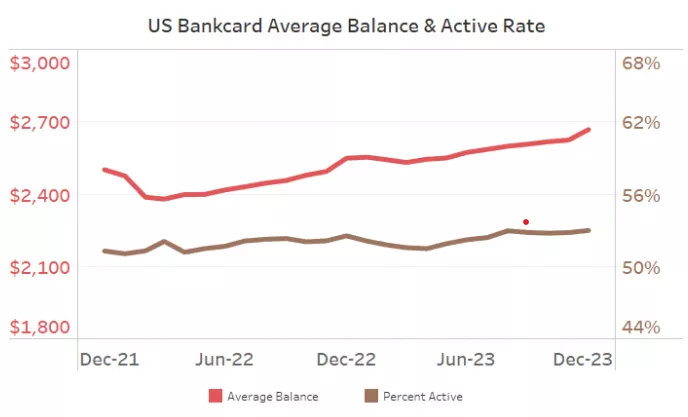

With elevated interest rate inflation, increased spend on travel and leisure, and a higher cost to carrying credit card debt, credit card balances have been climbing consistently for nearly two years.

The average credit card balance finished off 2023 at $2,668, a 4.7% increase compared to December 2022. The rate of a consumer using their credit card for transactions also continues to rise. December’s active rate of 53.0% is another half a percentage point higher than last December and greater than three percentage points higher than the pre-COVID average.

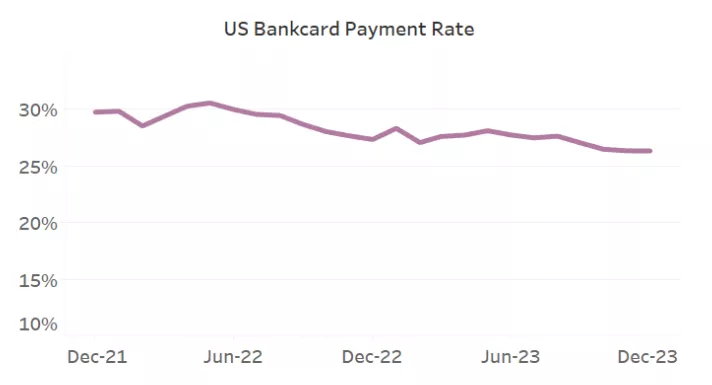

The credit card industry payment rate (percentage of previous month’s balance that was paid back) continues its downward slide since peaking in mid-2022 at 30.6%. December’s credit card debt payment rate was 26.3%, which remains higher than the pre-COVID rate of 23.0%. Fewer customers pay their credit card debt balance in full (45.1% vs. 48.5% in December 2021) and more customers are paying only the minimum due on their credit cards (8.0% vs. 6.7% in December 2021).

Credit Card Delinquency Rates

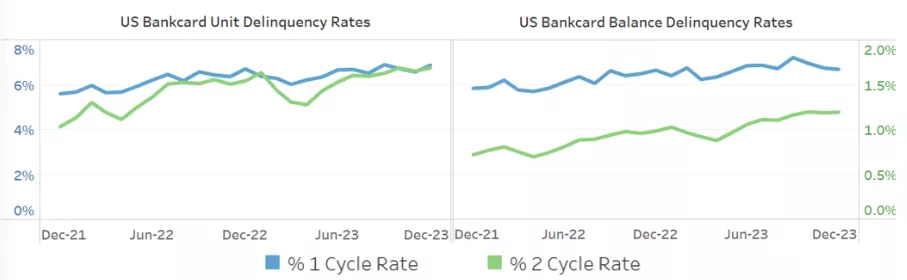

As mentioned above, Goldman Sachs predicts that credit card losses will peak in late 2024 or early 2025. Similarly, the 1-cycle delinquency trends from the US bankcard industry shown below indicate that unit and balance delinquency rates of credit cards may have started to level off leading to the potential of lower losses in approximately six months.

The proportion of credit card accounts that have missed one payment grew 2.4% year-over-year in comparison to the 19.9% growth from December 2021 to December 2022. A similar smoothing effect has occurred with the 1-cycle balance rate, only increasing 0.5% year-over-year compared to the 13.9% increase from December 2021 to December 2022.

Although the rate of consumer credit card accounts and balances missing two payments has been calmer as well, there were still substantial increases year-over-year, 9.7% and 21.4% respectively. This compares to the year-over-year increases of 49.5% and 36.1%, respectively, from December 2021 to December 2022.

We will continue to watch the macro environment change, as lower interest rates are more likely to have a positive impact on consumers and issuers alike. It is critical as a risk manager to monitor credit card delinquency rates frequently along with regularly updating loss forecast models. If you are a consumer who is struggling, there are tools available at myFICO.com to help keep track of credit card usage and your FICO Score.

Credit card issuers can reach out to your FICO Solution Success Advisor or FICO Key Account Managers for a discussion and assessment, if you need help completing an evaluation of your portfolio.

If you have questions or are interested in discussing these insights in more detail, please leave a comment on this post.

How FICO Can Help You Manage Credit Card Risk and Performance:

Explore our solutions for customer management.

See my previous posts on US card performance.

Consumers who are struggling can find tools at myFICO.com to help keep track of their credit usage and FICO Score.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.