US Credit Unions – Credit Card Benchmarking Trends for 2024

Credit unions saw a slowdown in severe delinquency impacting their credit card portfolios to finish 2024, with increases in average monthly spend and average balance

The data shared from the FICO® Risk Benchmarking service shows 2024 ended more positively for credit unions, specifically for credit card portfolios, than the overall bankcard industry. Credit unions continue to have positive trends in monthly usage and have a lower percentage of accounts in severe delinquency. The opposite is observed in US bankcards, where usage has trailed off for the past six months and delinquencies are rising across all stages of collections.

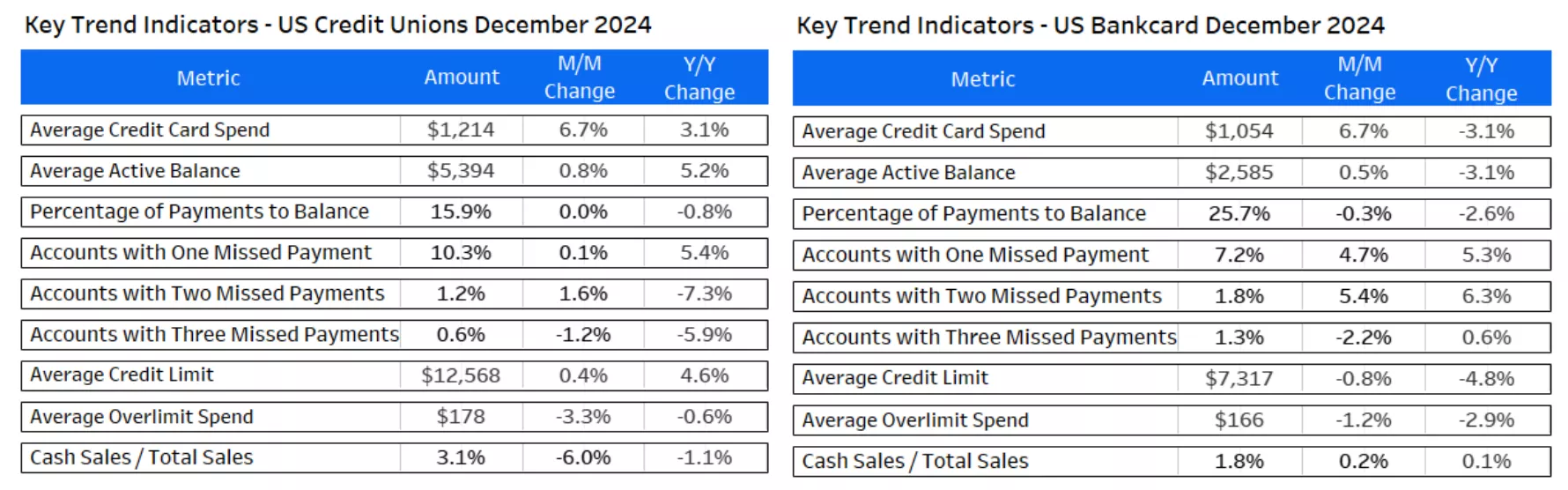

Here are the US credit union and US bankcard highlights:

We’ll dig further into these trends represented by a national sample of approximately 130 million US accounts gathered from FICO client reports generated by FICO® TRIAD® Customer Manager and Adaptive Control System solutions.

Credit Card Usage and Payments

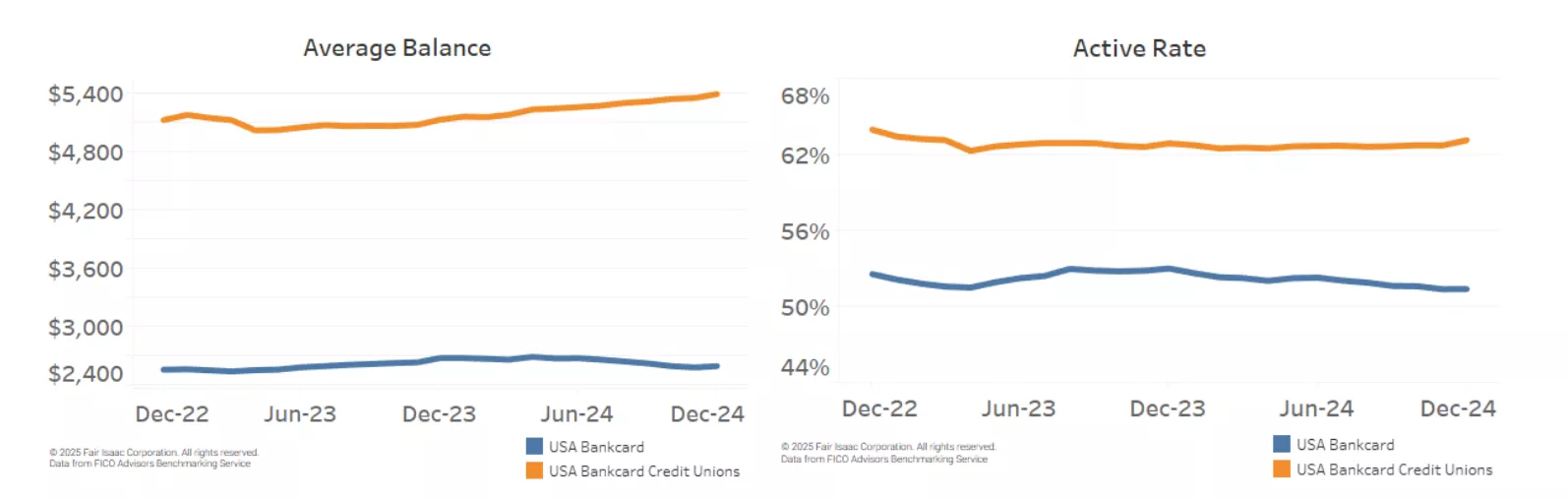

According to data tracked by the Federal Reserve, the average interest rate on credit cards with balances accruing interest is 22.8%. Higher interest rates in combination with elevated monthly spending have resulted in a year-over-year increase in the average balance for credit union credit cards, up 5.2%. The average balance for credit union credit cards is more than double that of overall bankcards ($5,394 vs. $2,585), which is down 3.1% year-over-year due to a slowdown in average monthly spend.

The active rate for credit union credit cards is also much higher than for bankcards, likely due to the existing relationship cardholders have with credit unions creating more loyalty. The active rate has been relatively stable over the past year for credit union credit cards while dropping ~3% for bankcards (CU: 63.1%, Bankcard: 51.4%).

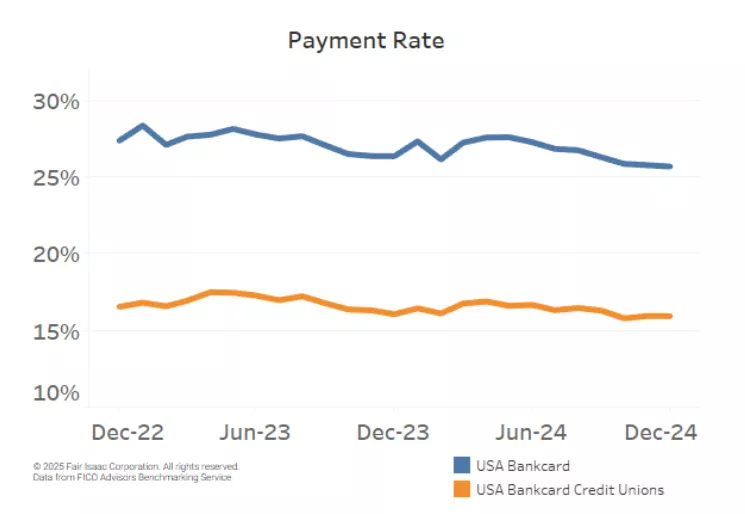

With increased usage of credit over the past several years, an early indicator of issues is the borrowers’ ability to pay back their debts. The percentage of balance borrowers repay each month, also known as payment rate, is a way for credit card portfolio managers to monitor if customers are able to keep up or if they are beginning to slip, long before there is a rise in delinquency rate. Overall, payment rates were very stable prior to 2020. Inability to spend and government stimulus caused payment rates to increase substantially from 2020 to 2022, when the trend began to shift downward. As of December 2024, the payment rate for credit union credit cards, 15.9%, is flat year-over-year and the payment rate for Bankcard, 25.7%, is down 2.3% year-over-year. These rates are both higher than prior to the pandemic and appear to be stabilizing (December 2019 – CU: 13.3%, Bankcard: 22.6%).

Credit Card Delinquency Rates

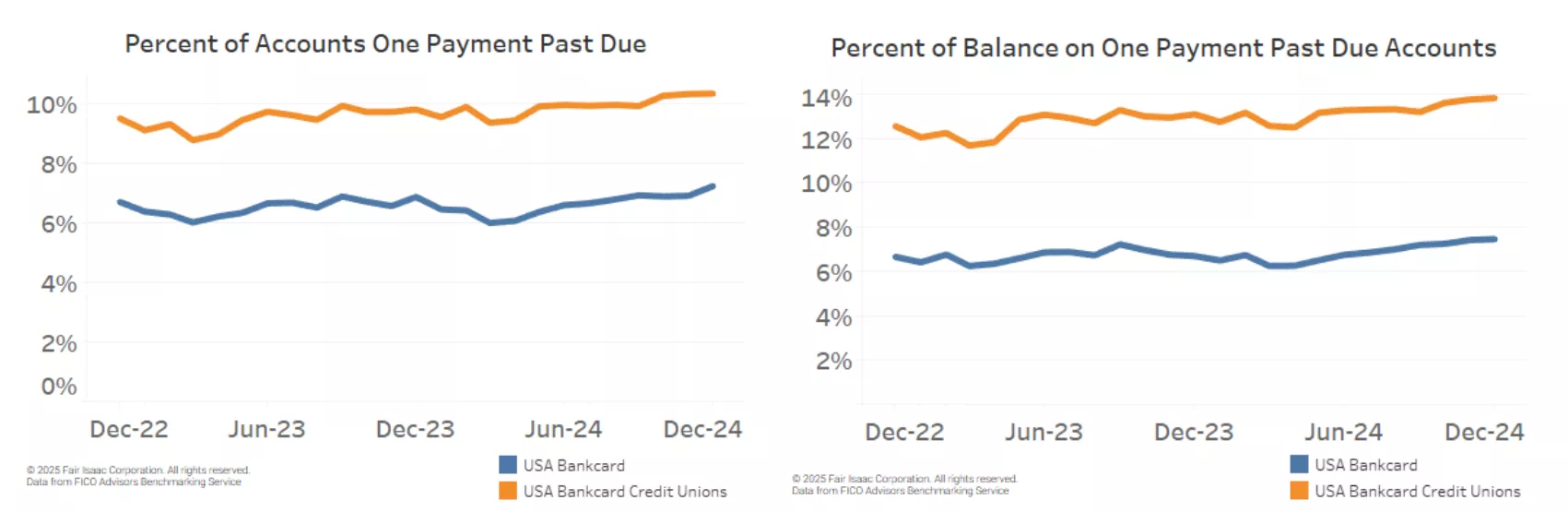

As we’ve seen with the usage data, consumers began experiencing financial strain approximately two and a half years ago. This is also when delinquency rates started rising and eventually exceeded pre-pandemic levels. For credit union lenders, the percentage of customers missing one payment on their credit card continues to trend upward year-over-year, from 9.8% to 10.3%, while the percentage for bankcards has increased from 6.9% to 7.2% year-over-year. Similarly, the percentage of balances on one payment past due accounts increased from 13.1% to 13.8% year-over-year for credit unions, while the percentage for bankcards saw a larger increase from 6.7% to 7.4% year-over-year.

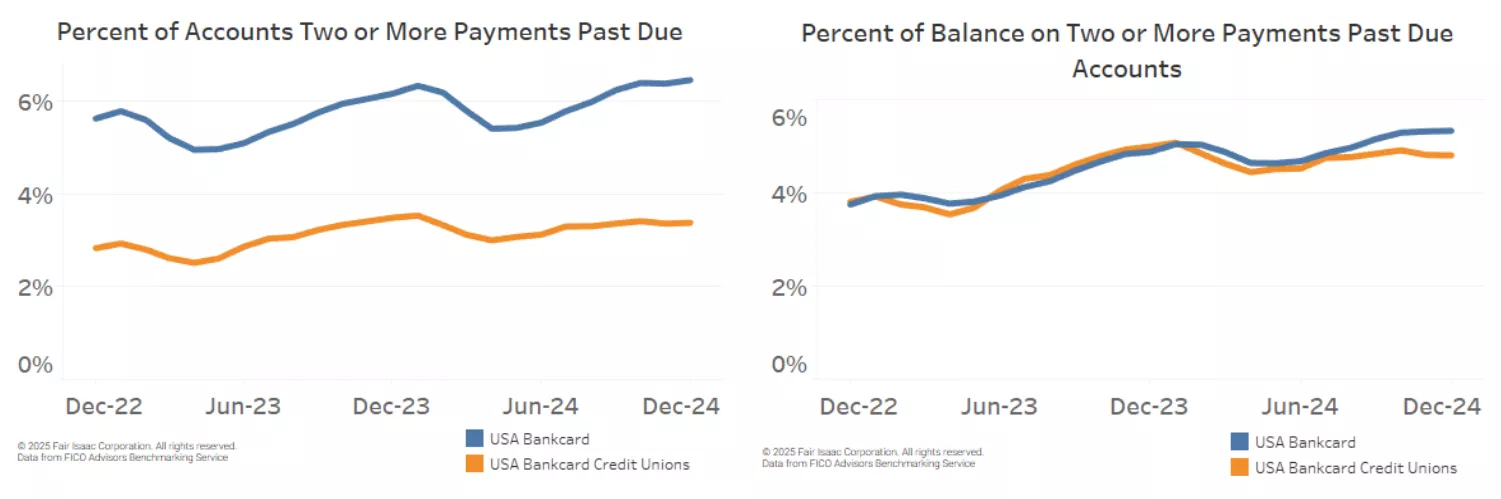

In contrast to the rise in the percentage of accounts and balances that are one payment past due for credit union credit cards, the percentage of accounts and balances that are two or more payments past due has decreased. This trend is also unique to credit union lending, as bankcards continue to experience a rise in later-stage delinquencies. For credit unions, the year-over-year credit card account and balance rates decreased slightly from 3.5% to 3.4% and from 5.0% to 4.8%, respectively. This compares to the year-over-year increases in bankcards of 6.2% to 6.5% for accounts and 4.9% to 5.3% for balances.

With instability in the overall industry, it is imperative to keep a close eye on consumer behavior. Tracking trends for monthly spend, average balance, payment rates and delinquency helps inform how strategies need to be modified across the credit life cycle. While adjustments may be necessary, it is important for financial institutions to take a targeted approach to remove risk without interrupting the growth of profitable accounts in your credit card portfolio. Reach out to your FICO Solution Success Advisor or FICO Key Account Manager for help with an assessment and to discuss which changes would be best in our current environment.

If your customers are struggling, you can help them by directing them to myFICO.com for tools to help keep track of credit card usage and your FICO® Score.

How FICO Can Help You Manage Credit Card Risk and Performance:

Explore our solutions for customer management.

See my previous posts on US card performance.

Make more informed and profitable decisions with FICO’s Scoring Solutions.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.