What Is the Best Way to Automate Telco Collections Communications?

By predicting customer scenarios and automating collections communications, telco operators can improve collections and lower costs

In any business, the collections process is critical. For those built on recurring cash flows, like telecommunications operators, any reduction in the cost to collect, and any incremental improvement in collections processes, go straight to the bottom line. The opportunities to use automation to both improve processes and reduce the cost of collecting are greater than ever.

The right automation strategy reduces an operator’s cost to collect and provides capabilities that enable operators to:

- Optimize collections processes and maximize returns.

- Resolve more types of collections cases through digital self-serve channels.

- Detect and contact distressed customers to prevent late and failed payments.

- Communicate easily with good customers when they forget to pay.

- Sort fraud cases from bad debt.

Collections cases span a variety of scenarios, ranging from customers in a financial bind to those who forget to pay for legitimate reasons and then pay in full. Automation that is both flexible and intelligent can help a telecommunications operator address the full range of scenarios proactively.

Detect Trouble and Offer Help

Late payments that result in a customer’s service being suspended are worst-case scenarios that operators and customers both prefer to avoid. A more effective approach, enabled by automation, is to detect customers who are struggling and offer a helping hand with options that address what’s owed without chasing good customers away.

Operators can use automation to monitor customer behavior and detect when a paying customer has begun to struggle. Five examples of customer behavior changes that signal a potential late payment or non-payment are:

Erratic payment behavior: When a customer’s payments are often late or arrive in different amounts at varying times of the month, this could signal a missed payment is imminent.

Multiple extensions: When a customer requests extra time to pay bills more than once, it is a red flag that the customer is falling behind and failure to pay is likely.

Buying less: When customers begin using less of a pay-per-use product or downgrade subscriptions to reduce their monthly rates, it may signal a future failure to pay.

Credit inquiries: If a customer’s credit report reveals a flurry of inquiries, it can signal financial trouble, indicating a future failure to pay.

Carousel of excuses: Customers who make payment promises and offer elaborate excuses for delayed or partial payments may be more likely to fail to pay soon.

Many of these examples can be addressed through omnichannel, automated customer communications. Operators can automate a substantial portion of the communications that relate to collections. They can connect with the correct parties in a timely manner, and according to their communications preferences, obtain payments and payment promises faster, and avoid creating negative experiences for good customers, thus increasing customer satisfaction.

FICO® Customer Communication Services leverage digital self-service, virtual agents and other automated resolution methods across any of an operator’s communication channels. This model reduces dependence on human agent interactions to improve speed and reduce cost while still providing consumers the option to speak with a staff member.

Send Gentle Reminders

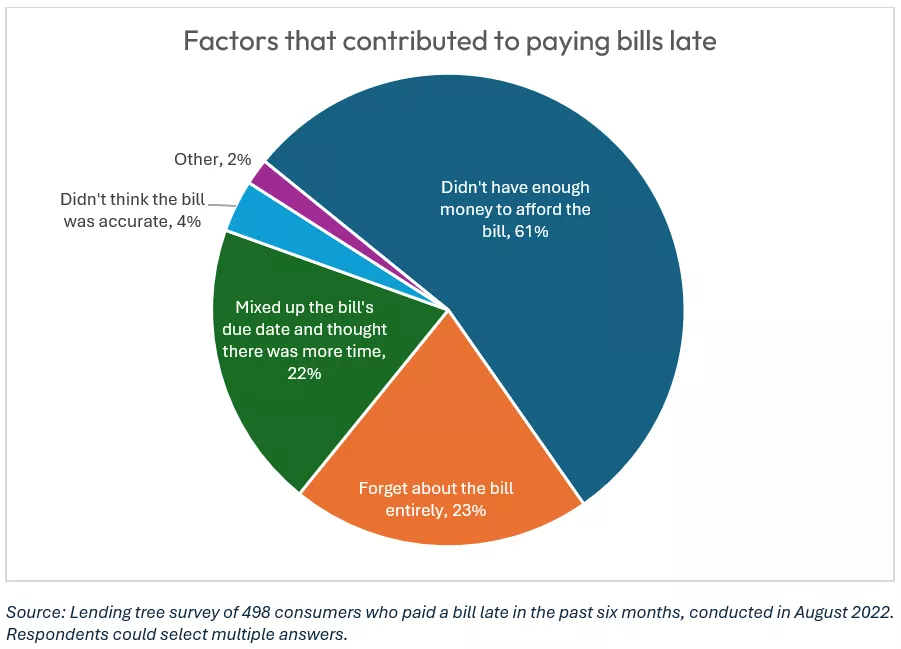

While there are some clear markers for those who are struggling to pay, operators face a different challenge in detecting customers who intend to pay but forget to do so. Surprisingly, nearly a quarter of late-paying customers simply forgot to pay their bill. A 2022 study by Lending Tree found that though 61% of the people who failed to pay a bill did so because they could not afford it, another 23% admitted it was because they completely forgot about it (see chart).

These forgetful customers eventually paid in full, demonstrating there is an opportunity to improve collections by gently reminding them to pay on time. Three effective, automation-driven best practices for working with forgetful payers include:

- Send reminders: Regular, automated text and email reminders are typically appreciated and expected, especially by those who might otherwise pay late and incur fees.

- Offer grace: A short grace period, allowing for a bit of forgetfulness in exchange for a full payment, can be extended automatically before any late fees are charged.

- Provide easy options: Bots may reach out to remind a customer that payment is due while providing simple, digital ways to make a payment immediately.

FICO® Customer Communication Services enables these best practices, and many more, by providing an omnichannel communications manager that is preconfigured for collections operations to take on and optimize most collections cases. This frees agents to focus on high value and high-risk accounts that require human intervention or a personal touch. It also automates compliance with local, regional and national regulations that govern privacy in customer communications, including fully compliant consumer opt-in/opt-out capabilities.

Avoid Embarrassment

Sometimes a collections intervention by a member of your collection’s team is not the right approach. Embarrassment is a major reason people avoid receiving collections calls from an agent, making collections more difficult and expensive. Responding to an automated, digital process that offers privacy may help overcome this fear and reduce cost.

Text messaging, messaging through a private chat app like WhatsApp, or messaging via the operator’s branded app are three low cost and discreet channels through which to communicate with delinquent customers and collect, while avoiding the higher cost and embarrassment of a phone call. A recent study from Lead Inferno of 2,000 US consumers found that though about 30% of respondents still like a phone call to communicate with a business, nearly 38% prefer text messaging, another 20% choose email, and just over 12% want to use WhatsApp or Facebook Messenger.

Reaching out via the consumer’s preferred channels with reminders and pre-delinquency assistance –help to avoid payment failure – is an automation best practice. Expertise comes to bear in knowing which days and times a customer in early-stage debt is most likely to be receptive to these automated communications, which can also be accompanied with self-serve payment options. This creates a collections intervention that is far less confrontational and embarrassing to the customer, offers a range of options that give the customer some control over a stressful situation, and is more likely to result in payment.

Sort Out Uncollectible Fraud

Maybe the biggest hurdle a collections process can face is when fraud cases are prevalent. Fraud is by definition uncollectible, meaning it belongs in a fraud remediation process, not in the collections process and certainly not mixed in with the cases sent (or sold) to a collection’s agency.

Telco operators have good reason to sort fraud from bad debt. First, any effort spent to collect on fraudulent accounts is wasted and better used collecting late payments or looking after good customers. Agent productivity can be undermined resulting in missed bonus targets. Financial models can be skewed when fraud is categorized as bad debt. And regulatory compliance may be compromised. Fraud misclassified as bad debt also raises the company’s floor of uncollectible debts, which in turn can impact its ability to sell its own debt (e.g., bonds, notes) and raise capital.

Automation can be applied to detect and differentiate fraud from collectible or bad debts. Once again, through a combination of behavioral analysis, automated communications and integrated processes, an operator can greatly improve its ability to separate and handle fraud and collections cases distinctly and accurately.

Several of the analyses the FICO® solution performs to automate fraud detection and collections management include:

- Analyze payment history: Various changes in account behavior can signal fraud versus difficulty paying. Expert automation can analyze and differentiate these patterns to sort fraud from debt.

- Monitor usage: Unusual shifts in usage patterns that deviate from previously measured norms can signal fraud. Automation can track this history and warn when anomalies are detected that look like fraud.

- Verify identity: Strong identity verification processes should be in place to prevent and detect both synthetic and stolen identities fraudsters use to steal from telcos.

- Apply fraud detection: AI and machine learning-based solutions can now identify and diagnose suspicious activities automatically while advising stakeholders to act.

- Communicate with customers: When in doubt, communicating directly with a customer to verify their identity and confirm their actions is the best way to prevent fraud and other disputes that may lead to bad debts.

Have a Closer Look at how FICO Improves Collections through Automation

FICO provides automation, infused with expert AI and machine learning, that enables telco operators to maximize the effectiveness and productivity of their business-critical collections processes.

With FICO® Customer Communication Services, the collections operation can automate two-way interactions across any mix of email, SMS, apps, IVR, webpages, and virtual or human agents.

Sequences of timed actions and intervals are orchestrated across channels, while data and outcomes from each action are used to improve and optimize future actions.

Learn More About How FICO Helps Telco Companies with Collections

- Learn more about FICO Customer Communication Services

- Read a case study about how FICO has helped a telco organization revolutionize their collections operations.

- Understand how FICO helps telco organizations optimize collections

- Understand how FICO helps telco organizations

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.