Is Your Portfolio Management Strategy Maximizing Resilience for Better Loss Forecasting?

FICO® Resilience Index unlocks more accurate loss forecasts and stronger portfolio performance.

I’m often asked how lenders sharpen their portfolio risk management efficacy in managing resilience risk and risk tolerance, especially in the face of economic uncertainty. Proactively addressing borrower resilience is essential for improving loss forecasting accuracy and KPIs like Current Expected Credit Loss (CECL) and provision modeling. A truly effective portfolio management strategy, which is the systematic approach financial institutions use to prioritize, monitor, and adjust assets to achieve specific risk and return objectives, begins with a thorough comprehension of financial resilience within your accounts. This proactive analysis not only strengthens risk management strategy but also positions your portfolio to seize opportunities amid change.

A key method for gaining this insight is through stress testing—an essential regulatory requirement that helps banks evaluate how their portfolios would perform under adverse economic conditions. As outlined in the Office of the Comptroller of the Currency’s (OCC) guidance for banks (OCC Bulletin 2012-14) and the Basel III framework on capital adequacy, stress testing is a foundational tool and a great portfolio strategy for understanding and preparing for financial shocks. When done routinely, stress testing can reduce the operational friction of recurring reserve adjustments by building confidence over time in your risk framework.

Advanced tools that measure borrower resilience to economic shifts can enhance stress testing by quantifying the stability of accounts and allowing lenders to prioritize improved risk assessment and outcomes across portfolios. These insights support targeted and efficient capital planning and achievement of strategic objectives. Beyond ongoing portfolio monitoring, resilience metrics can inform account origination by evaluating the resilience of prospects and applicants before extending credit. By understanding a borrower's potential reliability and risk tolerance from the outset, lenders can significantly improve origination strategies and strengthen long-term performance.

Measuring resilience is crucial for portfolio management

To seize new opportunities within your portfolio, understanding which accounts are more susceptible to economic shocks and taking targeted action to strengthen your portfolio’s overall stability is a crucial objective. Pairing a resilience indicator like the FICO® Resilience Index (FRI), our resilience portfolio model, with the traditional FICO® Score creates a layered view of each consumer’s susceptibility to economic shifts, enabling more accurate stress testing, proactive risk management strategy, and data-driven loss mitigation to reveal hidden risks and strengthen your portfolio’s stability.

Optimizing lending strategies via portfolio resilience and sensitivity analysis

Analyzing how different customer groups behave during both economic downturns and normal conditions can significantly reduce portfolio risk. Recognizing these sensitivities through an integrated approach reduces potential losses. Additionally, it presents significant revenue opportunities, such as the application of more precise loss forecasting strategies and the active management of resilient and sensitive loans. This combination empowers institutions to optimize lending strategies by borrower, capitalize on emerging market segments, and strengthen overall profitability even amidst economic turbulence.

Integrating the resilience index into portfolio stress testing strategies

Integrating the resilience index allows for sharper loss forecast predictions and more targeted risk management. To demonstrate its advantages, I’ll outline two scenarios:

Scenario 1 (Baseline Portfolio): The portfolio distribution is only observed, but no FRI-driven management is applied.

Scenario 2 (Resilience-Optimized Portfolio): The portfolio is actively managed by reallocating accounts based on FRI insights.

This comparative analysis demonstrates the tangible value of integrating FRI into your overall risk management strategy.

Scenario 1: Baseline portfolio without FICO® Resilience Index management

In this scenario, we stress-test the portfolio using both FICO® Score and FICO® Resilience Index data without altering the current distribution of accounts. This approach establishes a baseline for evaluating the impact of active portfolio management.

Step 1.1: Calculate stress factors by the credit score and the FICO® Resilience Index segment

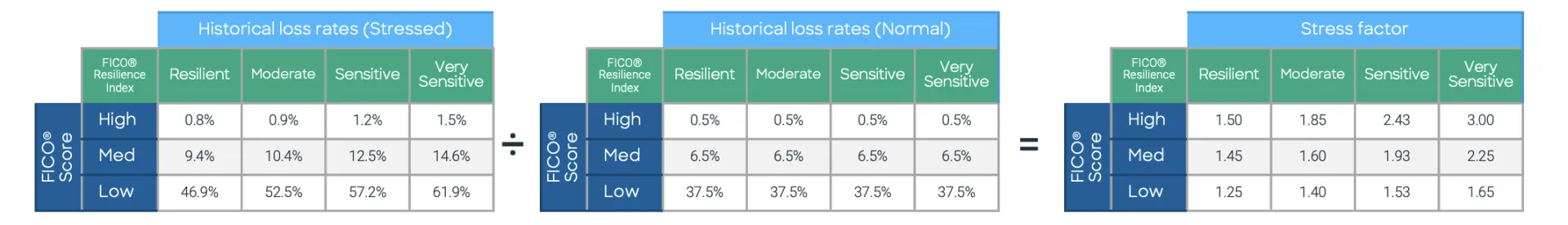

We begin by calculating stress factors for each FICO® Score band and FICO® Resilience Index segments. These factors reflect the degree to which default rates increased during the Great Recession relative to normal periods. The following charts, grounded in empirical industry data, provide the foundation for forecasting performance under economic stress. These stress factors help predict how consumer segments will perform under economic pressure.

Table 1.1. Stress factor calculation by FICO® Score and FICO® Resilience Index segment.

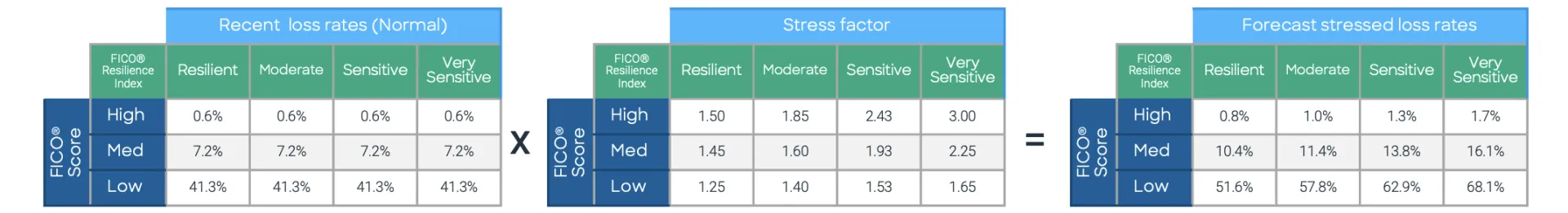

Step 1.2: Forecast stressed loss rates by segment

Next, we estimate the performance of each portfolio segment under stress by combining recent “normal” loss rates with the stress factors from Step 1. For every FICO® Score and FICO® Resilience Index combination, the stable-condition loss rate is adjusted upward based on historical stress multipliers. The result is a detailed, segment-level forecast of projected loss rates in a downturn.

Table 1.2. Forecasted stress loss rates by applying stress factors to recent loss rates.

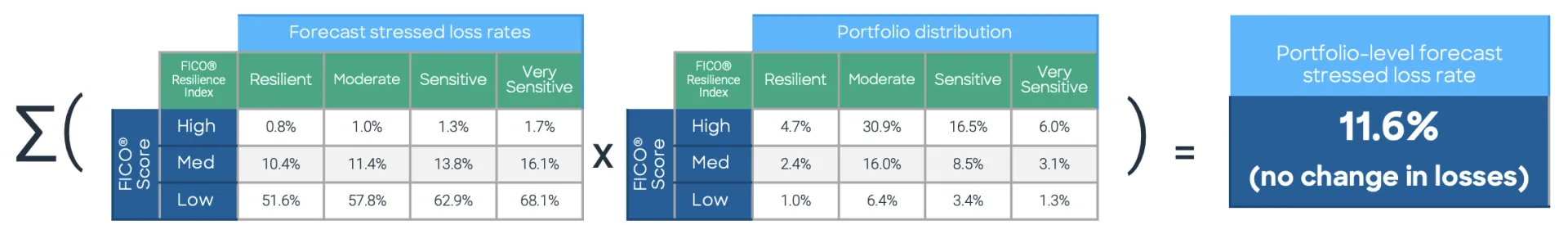

Step 1.3: Portfolio-level loss rate calculation

Finally, we aggregate the segment-level stressed loss rates by weighting them according to the portfolio’s actual account distribution. For instance, if a significant share of accounts falls into the “moderate” FRI and “medium” FICO® Score bands, those weighted loss rates dominate the portfolio forecast.

By totaling the weighted loss rates across all segments, we obtain the total portfolio-level stressed loss rate. In this baseline scenario, the result is 11.6%. The key takeaway: We added FRI as a second dimension to obtain a more informative risk segmentation than based on the FICO® Score alone, while we haven’t actively managed the portfolio in this baseline scenario.

Table 1.3. Portfolio-level stressed loss rate calculated by weighting segment-level losses using the current portfolio distribution.

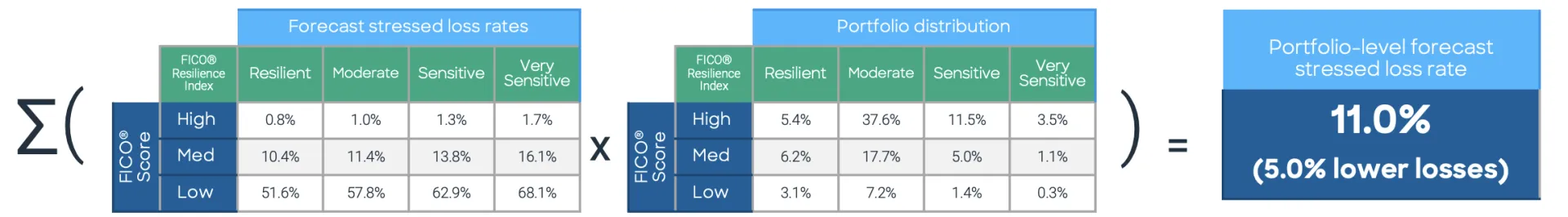

Scenario 2: Actively managed portfolio using the FICO® Resilience Index

Now let’s explore the impact of actively managing portfolio distribution with FICO® Resilience index. In this scenario, we shift the account distribution to favor more resilient consumers and reduce exposure to sensitive segments. All other assumptions, such as stress factors and loss rates, remain the same as described in Scenario 1 (Steps 1.1 and 1.2) To calculate the overall portfolio-level stressed loss rate we follow the same process as in Step 1.3, except that we are now weighting the segment-level stressed loss rates according to the portfolio’s actively managed account distribution(note how the distribution percentages in have changed versus Step 1.3), thus reflecting the impact of active portfolio management.

Table 2.3. Portfolio-level stressed loss rate with improved FRI distribution

The key takeaway: the overall portfolio-level stressed loss rate declines from 11.6% to 11.0%, a 5% reduction in projected losses, by virtue of actively managing the portfolio based on FRI insights. Notably, this improvement is achieved without altering the FICO® Score account distribution, underscoring how the incremental risk management value of FRI-informed strategies complements traditional credit risk assessment to deliver enhanced portfolio performance under both normal and stressed economic conditions.

Conclusion: measurement is good, but management is better

These two scenarios highlight a critical distinction. Merely measuring resilience is helpful but actively managing it can materially reduce risk. By optimizing the share of accounts in resilient and moderate FICO® Resilience Index segments, lenders can significantly strengthen portfolio performance during economic stress. Even modest changes to portfolio FRI composition can yield meaningful improvements in loss forecasts.

Embedding the FICO® Resilience Index into your credit strategy enables lenders to proactively manage risk, improving loss forecasting accuracy, targeting risk mitigation efforts, and safeguarding portfolio growth in resilient segments. Monitoring the FICO Resilience Index is valuable, but it’s the active management that delivers the greatest impact.

For more information on stress testing portfolios and minimizing credit losses, refer to our video on Using FICO Resilience Index in Stress Testing and review the following articles about strategies for building resilient portfolios:

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.