4 Key Ways to Drive Profitability With Overlimit Authorisations

Enhance your customer management strategies to boost enterprise revenue through overlimit authorisations

As economic indicators continue to improve in many countries, including easing of interest rates by central banks, the consumer sentiment and their appetite to spend on their credit cards tend to increase at a similar pace. For example, a recent report from Barclays consumer spending trends shows that discretionary entertainment spending on UK credit cards is up 14.4 % compared to last year.

In a highly competitive payment market, enterprises that struggle to deploy timely risk-based and customer-centric decisions will likely have to endure higher client attrition and abandonment.

To ensure consumer demand for credit is continuously met, proactive credit card issuers are consistently enhancing their customer management strategies. This includes assessing their customer’s overlimit transactions (where the transaction is valued above their assigned credit limit) and providing the approval or decline decisions in real time.

Situations like this can increase customer attrition at crucial times. Imagine how upset and frustrated a customer would be, after waiting hours in a queue to purchase Oasis reunion tour tickets, only to have their transaction denied!

The Demand for Overlimit Transactions Is Growing

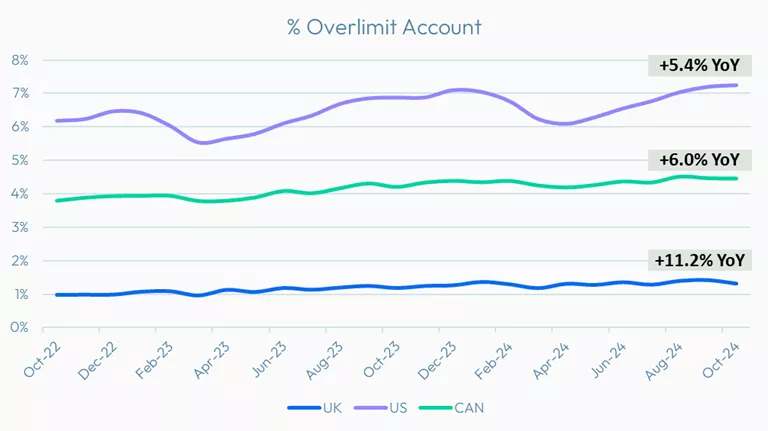

The percentage of credit cards with overlimit balances from the US, Canada, and UK share a similar trend – all have been increasing since July 2022. With the rise of overlimit instances, this presents an opportunity for credit card issuers to review their overlimit strategy.

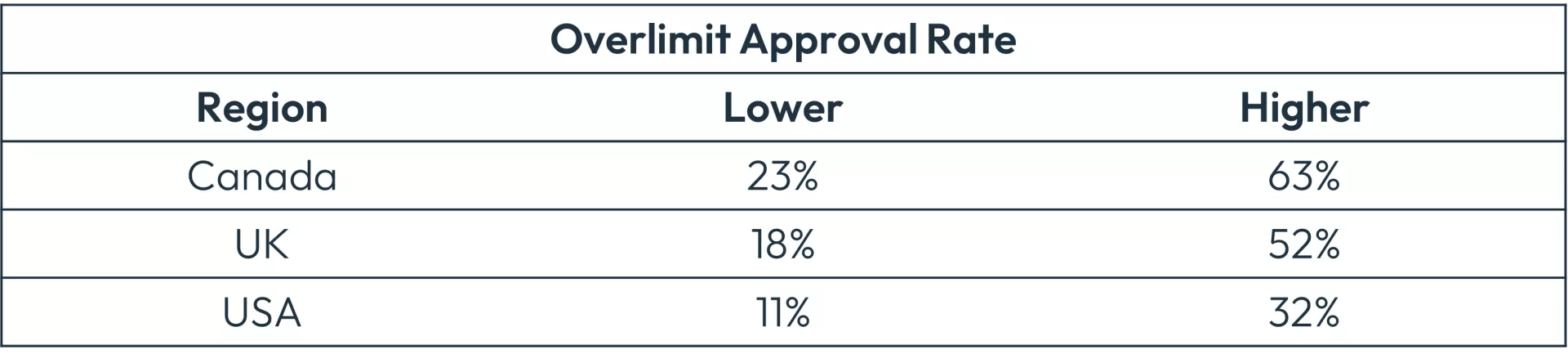

When issuers receive a request to approve an overlimit transaction, it doesn’t mean the request will be approved, as issuers need to evaluate the risk for each transaction. FICO® Benchmark Reporting Service provides insightful information regarding industry thresholds observed between the highest and lowest percentage of overlimit approval rate for each region, varying from 11% in the US and up to 63% in Canada.

4 Components of a Successful Overlimit Strategy

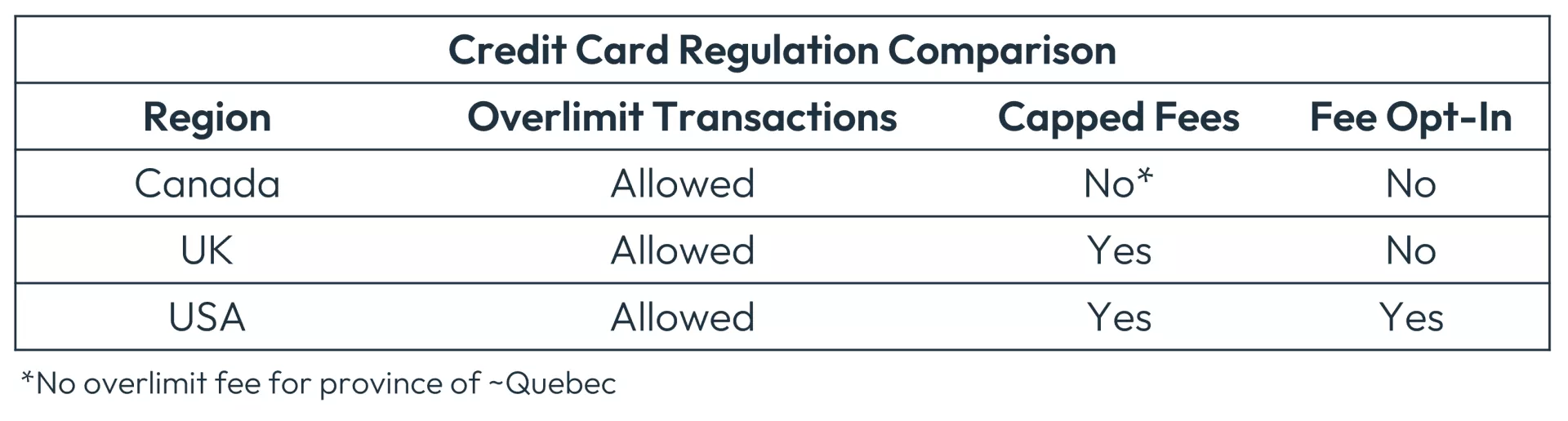

1. Ensure compliance with local regulations

Most major markets permit credit card issuers to offer overlimit services as part of their product offering, provided that the customer is explicitly informed of the terms and any associated fees (typically provided in the Terms and Conditions at the time of origination). However, there may be nuanced conditions to comply with, such as the capped overlimit fee of £12 in the UK.

2. Data-driven customer profiling

Customer-level data provides insights for total exposure and balances of all products and financial institutions across the customer lifecycle. Enterprises can provide hyper-personalized credit solutions to drive engagement rates and improve customer experience. On this matter, affordability metrics are mainly used within the limit management space to determine whether a customer can afford a credit limit increase. Enterprises can consider embedding a subset of this data type into the decision process to determine if a customer’s extra spending is sustainable, whether the account is overlimit or delinquent. Financial institutions should be using both internal and external data while looking at the affordability spectrum to enhance their credit decisioning.

3. Interactive customer communication is crucial to success

Having the ability to leverage capabilities to engage with customers through their preferred channels – whether it’s SMS, email, phone, or social media – can drive higher engagement and responsiveness. In an overlimit scenario, an outreach to the customer informing them of the event, offering possible solutions to address the situation, and capturing the customer’s response in real time can lead to long-term customer loyalty.

4. Alignment with credit limit management

Throughout the customer journey, an overlimit event may be a signal that the current credit limit does not meet the customer’s needs. Select only the most profitable accounts, which have had transactions declined due to insufficient funds on a few occasions, in order to drive incremental engagement through credit line increase offers. Additionally, take the opportunity to examine the adequacy of your credit line management strategy – perhaps it’s time to initiate a credit line increase program.

Reach out to your designated FICO Advisor or sales executive today if you are interested in learning more about customer relationship management or similar topics.

How FICO Can Help You Manage Cards to Greater Profitability

- Explore how FICO® Platform can help you reduce losses, and increase approval rates through automation, analytics, and informed customer insights.

- Explore our solutions for customer management

- Read more posts on trends in UK cards

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.