3 Frauds Demanding Urgent Adaptation By Australian Telcos

Subscription fraud, scams, and account takeover fraud all impact the bottom line and risk damaging reputation.

As of 2023, Australia boasted 32.71 million cellular mobile connections, translating to 1.24 devices per person—a significant surge underscoring the remarkable evolution of an industry that was virtually non-existent just a generation ago. However, such rapid growth brings challenges. The flourishing landscape provides ample opportunities for fraudsters to exploit networks and defraud customers, with global telco fraud losses escalating by 12% between 2021 and 2023, as reported by the CFCA. This surge in fraudulent activities has led to a diversification of fraud types and attack vectors, placing telcos at the forefront of combating an array of fraud challenges. Coping with this complexity requires fraud teams to cultivate a broader skillset and wield a more robust toolkit to navigate the intricate landscape of modern telecommunications.

So, what fraud types are creating concern as we head into 2024 and what can be done to manage both criminal behaviour and customer experience?

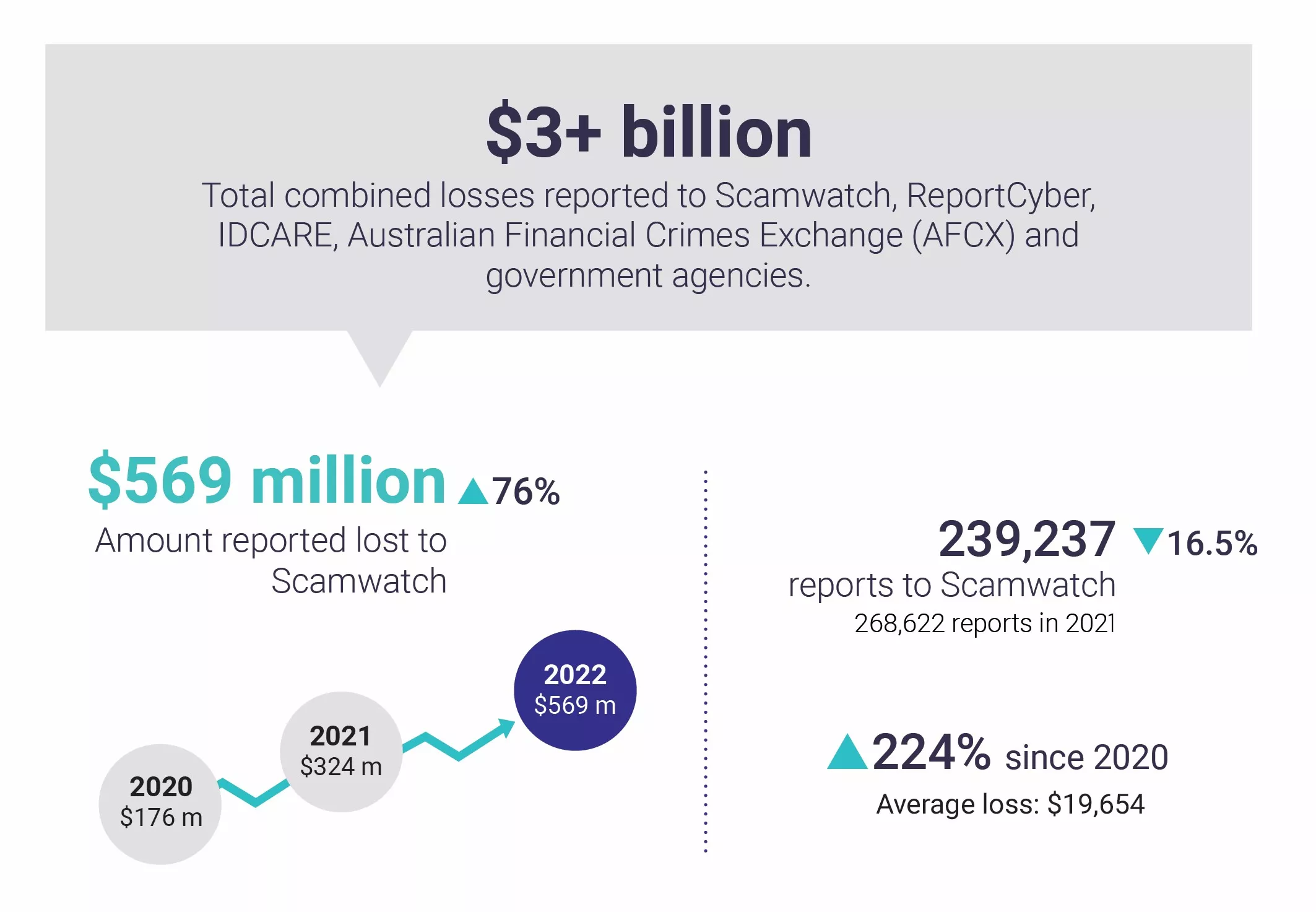

1 - The Scamdemic

A scam is a type of fraud where the victim, one of your customers, is tricked into taking an action that is detrimental to them. This affects telco’s both indirectly, when the telco network is used by fraudsters as a tool targeting other organizations, and directly when their customer is tricked into using the network in a way that generates income for fraudsters.

Indirect attacks – people sending money to scammers.

This kind of attack, also known as authorised push payment fraud, can take many forms, common categories include romance, courier, investment, and bank impersonation scams. In each case the victim is persuaded to send money to a fraudster. The launch of Australia’s New Payments Platform in 2018, gave scammers an easy way to rapidly access the funds from scams by persuading their victims to make payment through a real-time bank transfer. Unfortunately, the first contact between scammer and victim is frequently made through telco channels, with fraudsters initially contacting victims by mobile phone call, SMS, or messaging app. With losses mounting, the Australian Securities and Investment Commission has stepped in and has introduced a new code that holds all parts of the ecosystem; banks, telcos, and social media platforms responsible and liable to refund scam victims.

Direct attacks – Premium rate number scams

Often referred to as wangiri, these scams happen when criminal organizations obtain a premium rate number. They then use automation to execute calls to as many mobile numbers as possible. The intention is not to get their victims to answer but to leave a ‘missed call’. They are playing the odds, knowing that if they make hundreds of thousands of calls enough people will call back not realising, they are responding to a premium rate number. Even if people connect for just a few seconds, when they do so in sufficient numbers wangiri rapidly becomes a very profitable scam.

2 - The subscription fraud balancing act

Telco organizations are no strangers to fighting subscription fraud and implementing identity checks to ensure that they onboard legitimate customers. Keeping fraudsters out is important and given the rise in stolen and synthetic identities a continuous challenge, but there is another side to this equation – customer experience.

Keeping customers happy is a delicate balancing act between ensuring that they are protected and preventing fraud controls from introducing unnecessary friction that ruins the customer experience. A November 2023 FICO survey of 13,000 people in 13 countries found that 26% of people have abandoned a digital account opening for a new mobile phone contract because the identity checks they were asked to do were too difficult or time-consuming. These customers are then likely going to a competitor.

Maintaining good fraud controls and preserving customer experience is dependent on two factors:

- Reducing false positives – Identifying an application as potentially fraudulent means taking action, however when that action wasn’t really warranted it leads to a poor experience for customers. It’s also costly to unnecessarily investigate and pay for additional checks that aren’t needed.

- Improvement of the fraud prevention experience for customers by streamlining processes and limiting checks to those that are really necessary.

Managing subscription fraud is complicated by the different typologies within that description.

- First-party fraud occurs when someone uses their own information to obtain an account and handset with no intention to pay. This is often misidentified as bad debt and ends up creating an impossible task for collection departments. According to CFCA as much as 20% of bad debt could be attributed to fraud. The cost-of-living crisis is occupying the minds of many Australians and New Zealanders and committing fraud to obtain a handset may seem their only option. FICO’s recent consumer survey found that 24% of people think that it is OK to lie about income in an application for a telco account and another 19% think that it is normal behaviour to do so.

- Third-party fraud, using stolen identities. Due to data breaches the identity information of many people was made available to fraudsters to use to impersonate their victims and open accounts. In some ways this type of fraud is self-limiting, each identity can only be used a limited number of times, and the true owners of that identity are likely to realize their identity has been stolen and report it – stopping the fraud.

- Synthetic identity fraud uses a combination of real personal data and fabricated data to create fake identities. The vast amount of personal data available can be augmented by technology such as generative AI to create an almost endless supply of convincing fake identities.

3 - Account takeover fraud

Historically less prevalent in the telecommunications sector, this form of fraud has surprisingly surged to become one of the top five reported methods, as highlighted in the 2023 CFCA report, with losses totaling $2.72 million USD. It has overtaken globally recognized methods like spoofing, wangiri, and SMS phishing. This particular fraud primarily targets business accounts, employing techniques such as social engineering and spear-phishing to pilfer the necessary credentials for unauthorized access. Subsequently, fraudsters exploit compromised accounts to place orders for new phones and accessories, enabling them to sell the acquired items discreetly.

How FICO helps telcos fight fraud

The fraud types discussed are some of the most prevalent or emerging fraud trends that 2023 has seen, but telcos are also wrangling with other fraud types such as PBX fraud, SIM swap and international revenue share fraud. There’s a temptation to layer in ever more solutions to tackle these issues but taking a step back and considering a common set of resources that can be bought to bear against them all could be the wisest investment.

FICO Platform offers capabilities that are ideal for tackling many of the frauds that telcos face:

- Data Connection and Ingestion: bring together all the data that can help with fraud decisions. Whether that is your own data, scattered in different systems across the organization, or third-party data, for example, that from identity solution providers. FICO Platform facilitates the formatting and classification of that data so it’s ready for use.

- Applied Analytics and Machine Learning: Using linking and matching analytics, data can be cross-referenced at scale across datasets to look for those connection and anomalies that indicate fraud. Advanced analytics such as machine learning and AI look for fraud signals. FICO Platform even gives in-house data scientists a route to get their models into production.

- Driving meaningful action: The insights derived from analytics and machine learning must be transformed into actions that manage fraud. FICO Platform facilitates this with capabilities to build and manage rules and decision trees. Case management can be supported with integrated customer communications, which keeps customers informed and helps them to supply information to aid case resolution. This improves customer satisfaction and cuts operational costs.

- Simulation and reporting: These capabilities work together so that fraud strategies can be tested before they go into production and the effectiveness of deployed fraud strategies can be understood and articulated.

FICO Platform is flexible and extensible, meaning that the capabilities used to detect and manage fraud can also be deployed for other use cases such as account originations and customer management, giving you economies of scale and a fast time to value.

Further reading:

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.