Average Canadian FICO® Score Holds Steady at 762

Monitoring a consumer's FICO® Score helps us understand how we got here and what may lie ahead for the average FICO Score

The FICO® Score is an important credit scoring tool in the Canadian lending environment. Lenders and participants throughout the credit ecosystem leverage the FICO Score as a trusted, broad-based, and independent standard measure of credit risk that drives consistency and fairness.

FICO® Scores are used by 90% of the top Canadian lenders and credit unions. Being such an integral component of the credit and financial ecosystem, FICO Scores are dynamic as they interpret and summarize evolving consumer behavior as it’s captured in the credit bureau data, stored, and maintained by the two Canadian consumer reporting agencies (CRAs).

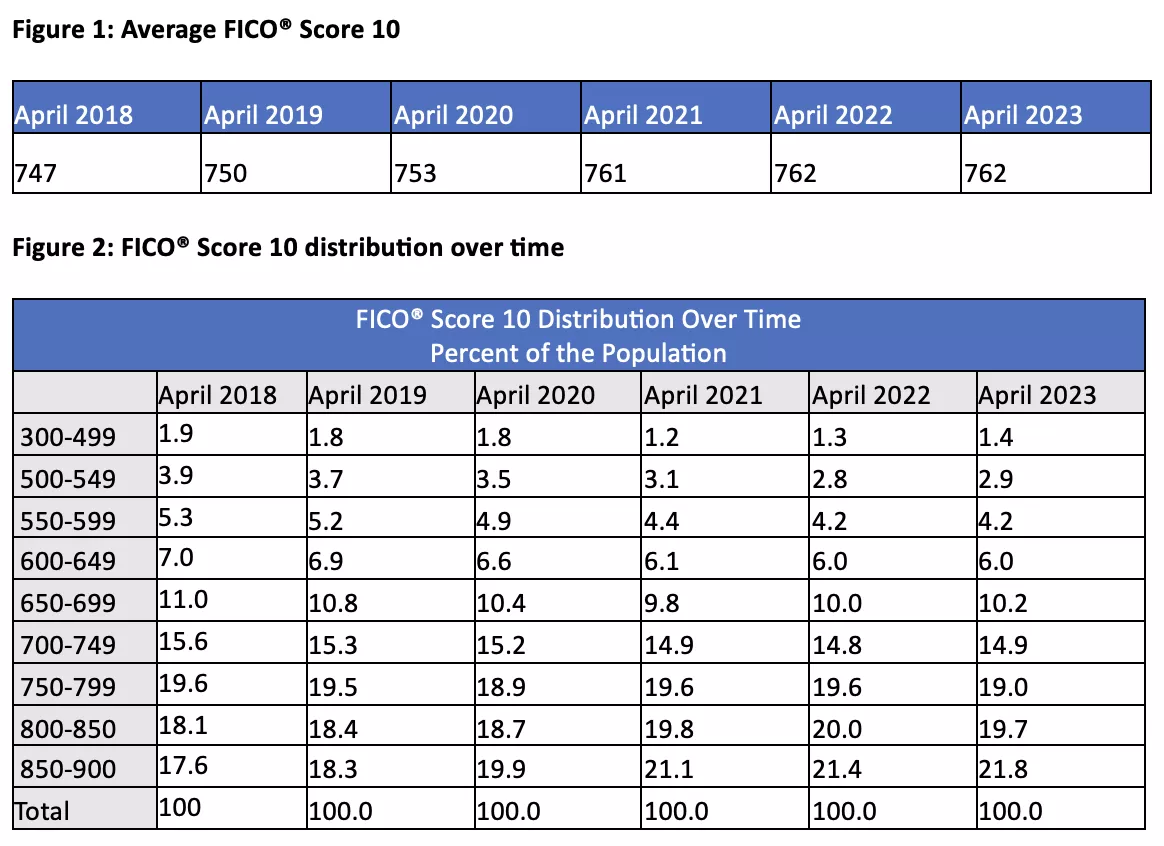

Monitoring the average FICO® Score of Canadian borrowers has become an important barometer of the overall financial health of the Canadian credit population. This became even more essential as we navigated through the COVID-19 pandemic and its ripple effects throughout the credit ecosystem. As noted in last year’s blog post, the average FICO Score in Canada increased from 753 in April 2020 to 761 in April 2021. The average FICO Score then leveled off in the second year of the pandemic, rising by one point to 762 in April 2022. This was largely driven by the winding down of government stimulus and payment accommodations by lenders, and a slow ramp up in consumer spending as society re-opened.

The latest credit score data is in, and the average FICO® Score of Canadian borrowers has remained steady relative to last year at 762, as seen in figure 1. While there are current economic headwinds and others potentially looming, such as persistent inflation, rising interest rates in response to the highest Consumer Price Index (CPI) levels in decades, and hourly wages unable to keep pace with the rising CPI, competing factors such as robust employment growth and rising household incomes have helped to offset, overall, the economic strain Canadian consumers have experienced.

Credit Delinquency Trends

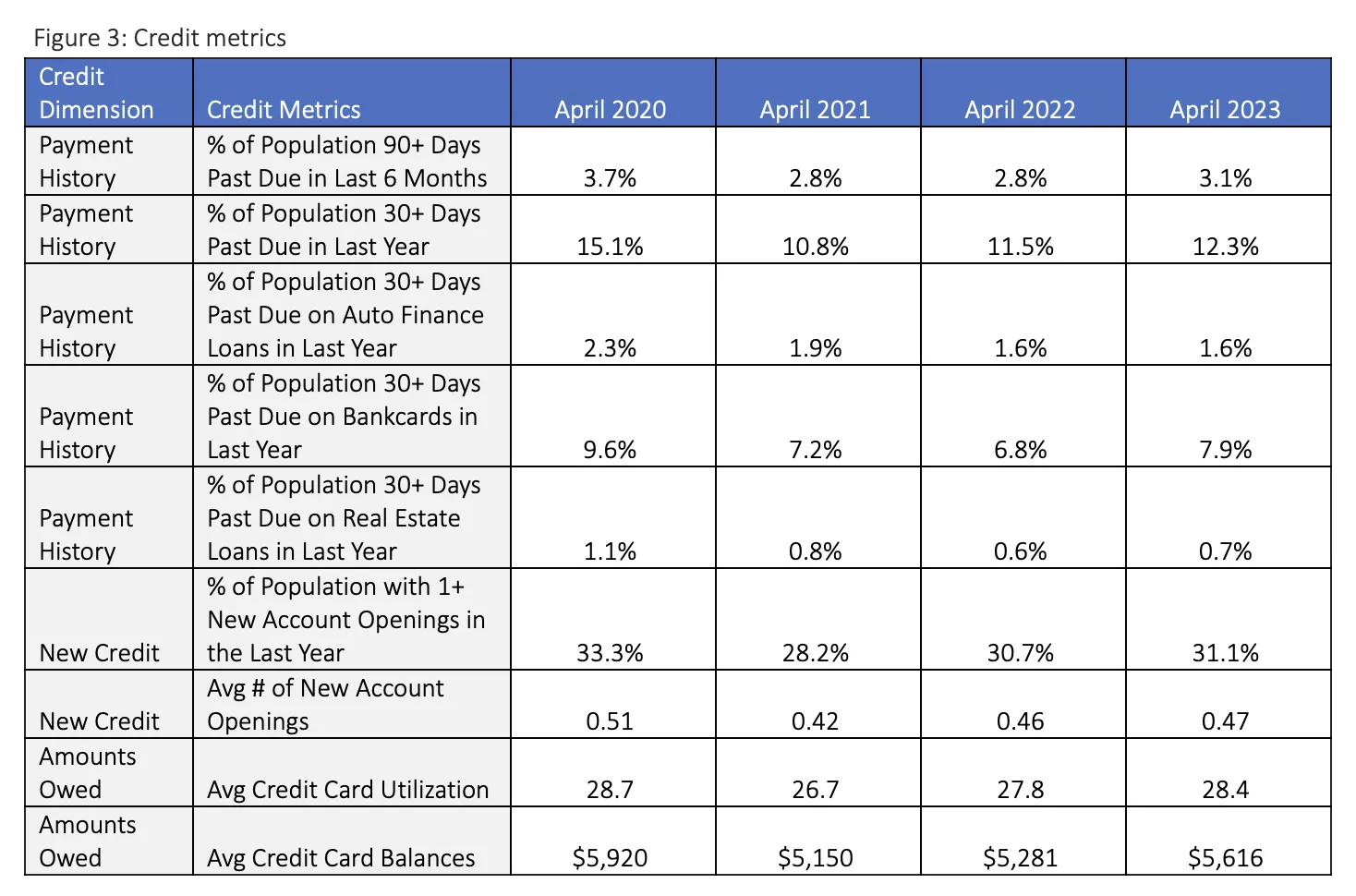

Examining credit delinquency trends, we observed a notable drop in the percentage of the population that has been 90+ days past due on their credit obligations in the last six months, from 3.7% in April 2020 to 2.8% in April 2021 (as seen in figure 3). We then saw this metric level off in April 2022, but also observed that the relative percentage of consumers that were 30+ days past due in the last year increased by 6% from 10.8% in April 2021 to 11.5% in April 2022. This indicator of credit risk was telling, as now that we examine data from April 2023, we see an 11% relative uptick in the percentage of Canadian credit borrowers that are 90+ days past due on their credit obligations in the last six months. While the percentages of consumers that are 30+ and 90+ days past due haven’t quite returned to pre-pandemic levels, they are on the rise. While the uptick in credit delinquencies appears to have been driven primarily by bankcard and line-of-credit products, it is also prudent to monitor auto finance and mortgage originations and renewals going forward in this new high-interest rate environment to understand how interest rates will impact repayment behavior.

Credit Utilization and Indebtedness Trends

The amount of debt that Canadian borrowers hold is also a key metric to help better understand what may be on the horizon. As was directionally the case with delinquencies, the early stage of the pandemic saw the average Canadian credit consumer reduce their credit card balances by 13% relative to the prior year from $5,920 in April 2020 to $5,150 in April 2021, apparently driven in large part by government stimulus and a shuttering of the broader economy that resulted in less discretionary spending such as travel, dining, and entertainment. Average credit card balances increased modestly as of April 2022 to $5,281 but increased by a relative 6% in April 2023 to $5,616. Average credit utilization for the Canadian credit consumer has followed a similar trend and is now at 28.4% -- just 0.3% shy of pre-pandemic credit utilization levels.

Changes in Average Credit Score

Turning our attention back to how the FICO® Score is evolving in this dynamic Canadian credit environment, we’ve also looked at the one-year change in average FICO Score by different credit score bands and compared this over the last few years, as seen in figure 4. This is important to put FICO Score dynamics, as well as their underlying credit drivers, into context and understand the profile and credit history of consumers that may be experiencing more pronounced shifts.

We see that lower-scoring consumers – those in the 550-650 credit score range – saw the most pronounced increases in the early pandemic period (April 2020 to April 2021), and subsequently, the most pronounced pull-back as the pandemic entered its second year (April 2021 to April 2022). Adding the most recent data to the analysis demonstrates that these lower-scoring consumers have more muted credit score changes compared to their pre-pandemic credit history (April 2019 to April 2020).

It is likely that these consumers disproportionately benefited from the accommodations and government stimulus during the first year of the pandemic. They were also more likely to experience strain from higher prices and borrowing costs in more recent years.

Higher-scoring consumers are relatively consistent with their pre-pandemic FICO® Score dynamics.

Figure 4: Change in average FICO® Score 10 by score band

History of the FICO® Score in Canada

For more than 25 years, FICO® Scores have been an industry standard measure of risk in Canada. The FICO Score is used by 90% of top Canadian lenders and credit unions. Available via the two Canadian CRAs, FICO Scores are calculated using the credit bureau data available via consumer credit reports. The score is based on five predictive characteristics with relative importance - Payment History (35%), Outstanding Debt (30%), Credit History Length (15%), New Credit (10%), and Credit Mix (10%). FICO Scores allow lenders to evaluate potential borrowers’ credit risk more accurately based on credit history.

Learn more about the FICO® Score in Canada:

Learn more about FICO® Score 10 in Canada and FICO® Score Open Access in Canada

Read about FICO Score 10, Most Predictive Credit Score in Canadian Market

FICO Advisors state Rising Delinquencies in Canada Point to Need for Stress Testing

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.