BNPL Success: How FICO Platform Addresses 5 Key Challenges

Risk management is a critical issue for Buy Now, Pay Later (BNPL) lending - discover how FICO Platform promotes growth and responsible lending

The BNPL Challenge: Growth Meets Complexity

As buy now, pay later (BNPL) adoption accelerates, lenders face mounting challenges: assessing risk for younger consumers with thin credit files, managing regulatory compliance under tightening credit laws, and delivering seamless customer experiences within milliseconds. Success requires sophisticated solutions that balance profitability, risk management, and regulatory requirements.

What Is Buy Now, Pay Later (BNPL)?

Buy Now, Pay Later (BNPL) programs allow consumers to split purchases into smaller, interest-free installments — often over four to six payments. Once a niche offering, BNPL has rapidly become a mainstream payment method, driven by demand for flexible financing and seamless digital checkout experiences.

In the US Federal Reserve’s 2024 Survey of Household Economics and Decisionmaking, 15% of adults overall reported using BNPL, though usage was higher (19%) among 30-44 and 18-29 age groups. Major retailers and e-commerce platforms have integrated BNPL options at checkout, and financial regulators are now paying closer attention to how these loans are underwritten and reported.

For lenders and financial institutions, this shift introduces both opportunity and complexity: how to extend credit responsibly, manage short-term exposure, and maintain customer satisfaction — all in real time. That’s where FICO’s data-driven innovation comes in.

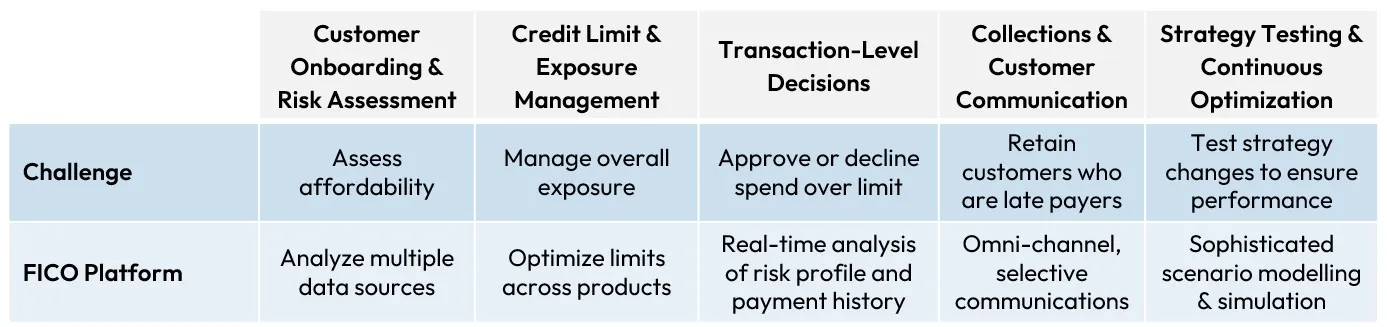

The FICO Platform Advantage: End-to-End BNPL Management

FICO Platform provides integrated solutions across the entire BNPL lifecycle—from initial customer assessment through ongoing portfolio management. The same spirit of innovation that led to FICO® Score 10 BNPL — incorporating BNPL data into credit scoring — also powers the ongoing research and development behind FICO Platform. Both reflect FICO’s commitment to helping lenders adapt confidently to evolving market dynamics.

1. Customer Onboarding & Risk Assessment

The Challenge

Globally, many lenders now need to perform upfront affordability checks to ensure customers can repay their purchases, and mitigate the potential for unsustainable debt. This can be a challenge, especially as many BNPL customers are younger with limited credit histories. Having access to additional data sources such as transactional data, open finance data and other BNPL data alongside traditional sources such as spend and payment history will help to make more informed decisions.

How FICO Platform Solves It

FICO Platform transforms risk assessment by integrating multiple data sources into real-time scoring models. When a customer makes a purchase, the platform scans the card authorization and instantly evaluates their eligibility based on performance data from other products, BNPL activity, transactional data, etc. This comprehensive approach enables lenders to offer BNPL options through FICO® Platform – Omni-Channel Engagement Capability to qualified customers at the point of sale, turning a standard card transaction into a personalized installment opportunity with a simple "yes" from the customer.

The platform's ability to incorporate alternative data sources means lenders can confidently serve customers such as those with thin credit files while maintaining sound risk practices and regulatory compliance.

2. Credit Limit & Exposure Management

The Challenge

The total amount of credit a customer can access is unknown to them, but BNPL providers will determine a spending limit that matches their risk tolerance. With emerging credit regulations and responsible lending standards, providers will need to continuously assess a customer’s affordability and credit readiness, ensuring they are not already overindebted when taking out new payment options.

Managing the overall exposure for a customer, across products internally and externally to the provider, is essential for controlling any future risk but also for assessing opportunities to provide more borrowing options.

How FICO Platform Solves It

FICO Platform’s optimization capability revolutionizes limit management by creating intelligent strategies that adapt to each customer's evolving profile. The platform establishes affordability by combining customer-provided information with existing account performance and third-party credit data.

The system continuously evaluates whether customers can handle additional exposure, ensuring that limit expansion aligns with their demonstrated ability to repay while maximizing the lender's profitability opportunities.

3. Transaction-Level Decision Making

The Challenge

When customers approach their available spending limit, lenders face a critical decision point. Automatically declining all transactions protects against risk but sacrifices revenue from creditworthy customers who could safely handle additional exposure.

How FICO Platform Solves It

The platform enables hyper-personalized transaction decisions by analyzing each customer's unique risk profile and payment history. Rather than applying blanket rules, the system identifies low-risk customers who can safely transact above standard thresholds. This sophisticated approach allows lenders to say "yes" more often to the right customers, capturing additional revenue while maintaining disciplined risk management.

The real-time decisioning capability ensures these personalized treatments happen instantly, preserving the seamless customer experience that BNPL users expect.

4. Collections & Customer Communication

The Challenge

Effective BNPL collections require a delicate balance between payment recovery and customer retention. Traditional collection strategies can be aggressive and damage the customer relationship and harm the brand, while overly passive approaches lead to mounting delinquencies. The key is identifying which customers need intervention and delivering the right message through their preferred communication channel.

How FICO Platform Solves It

FICO® Platform – Omni-Channel Engagement Capability transforms collections into a customer-centric process that recognizes most customers will self-cure with minimal intervention. Omni-Channel Engagement Capability adapts to each customer's changing circumstances and communication preferences in the determination of the best channel, timing, and messaging. Some customers respond well to automated SMS reminders, others prefer in-app notifications, while those experiencing financial hardship benefit from a direct conversation with support representatives.

The system dynamically adjusts its approach as customer situations evolve. For instance, if a new customer behavior is observed, Omni-Channel Engagement Capability recognizes new behavior and adjusts subsequent communications accordingly. This intelligent orchestration maintains effective strategies while ensuring timely intervention when needed.

5. Strategy Testing & Continuous Optimization

The Challenge

BNPL programs generate vast amounts of performance data, but translating insights into improved strategies requires sophisticated testing capabilities. Teams must understand which customers are likely to take out BNPL offers and repay on time. They also need to understand which elements of their collections processes work effectively. Testing this, along with changes to risk criteria or marketing strategies, before deploying modifications into live systems is critical.

How FICO Platform Solves It

FICO Business Outcome Simulator empowers teams to move beyond reactive analysis to proactive strategy optimization. The platform enables comprehensive testing of proposed changes through sophisticated scenario modelling, allowing teams to explore "what-if" situations before committing resources.

This capability proves particularly valuable when delinquency trends emerge, helping teams determine whether the solution lies in collections strategy adjustments or whether the underlying issue is with the data and rules used to accept the BNPL in the first place. The result is continuous improvement based on data-driven insights rather than intuition.

The Integrated Advantage for Managing BNPL Risk

The true power of the FICO Platform lies in its integrated approach. Each component feeds insights to others, creating a learning system that becomes more effective over time. Risk assessment improves based on collections outcomes, spending limit strategies evolve based on customer behavior patterns, and communication approaches refine based on response data.

This integration ensures consistent customer treatment throughout their journey while maintaining the flexibility to adapt to changing market conditions, tightening credit laws, and regulatory priorities.

Conclusion: Building Sustainable BNPL Success

The BNPL market's explosive growth presents tremendous opportunities, but sustainable success requires more than just quick deployment. FICO Platform provides the sophisticated infrastructure necessary to capture market opportunities while building the risk discipline and customer relationships that drive long-term profitability.

How FICO Can Improve the Success of Your BNPL Program

Ready to transform your BNPL program from a simple payment option into a competitive advantage? FICO Platform delivers the integrated capabilities that turn BNPL challenges into growth opportunities.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.