Loan Origination Automation: Faster Approvals, Reduced Risk

Optimize your loan origination process with automation that speeds approvals, cuts costs, and improves customer satisfaction for credit risk leaders

Loan origination automation has become a defining priority for lenders. The pressure to modernize is relentless: borrowers expect fast, digital-first approvals, while credit and risk leaders must safeguard against dishonesty and fraud. The traditional, form-heavy approach to origination — built on paperwork, manual reviews, and redundant questions — can no longer keep pace.

Those who embrace automation are discovering that it delivers more than efficiency gains. It reshapes the lending journey, making it faster, more secure, and far less frustrating for the customer, while giving institutions the confidence that risk is being managed in real time.

The Changing Expectations of Borrowers

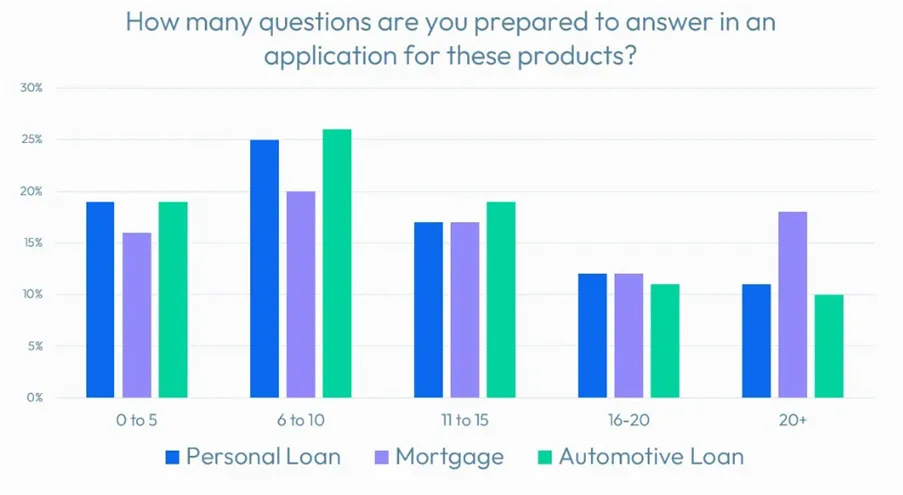

Recent survey data from 1,000 American adults reveals just how sharp the disconnect has become between consumer expectations and traditional origination practices. Nearly half of borrowers say they will not tolerate more than ten questions in an application.

In the same survey, nearly 20% of UK consumers said they had abandoned credit and insurance applications because there were too many questions. Results were similar for other countries.

What is perhaps more unsettling is that a significant share of consumers worldwide said they believe it is acceptable — even normal — to misrepresent information on a loan application. This creates a difficult reality for lenders. On the one hand, they cannot afford to ignore dishonesty in the origination process. On the other, attempts to tighten controls by adding steps or documents often backfire, driving away good borrowers who refuse to endure lengthy forms. In fact, up to one in five applicants abandon their loan application when the process feels too complex.

Consumers are also clear about timing. Most expect to complete the origination process in less than an hour. Many expect a decision in 30 minutes or less, and for personal loans, some even set the bar at 10 minutes. Anything beyond that threshold is now uncompetitive.

These insights highlight the urgency of loan origination automation. By using technology to streamline applications, prefill known data, and dynamically adapt questions based on risk, lenders can meet rising consumer expectations without compromising control.

Why Automation Is Now Essential

For decades, the instinct in credit risk management was to add more steps. More documents, more reviews, more manual oversight. But each new requirement adds friction. And in today’s digital-first market, friction no longer just delays decisions, it causes borrowers to abandon applications entirely.

The cost of failing to automate is not just lost business; it is also operational strain. Manual origination processes consume enormous amounts of staff time, often tying skilled underwriters to routine cases that could be handled automatically. This misallocation of talent creates inefficiencies and raises costs. Automation ensures valuable staff resources are reserved for the cases that genuinely require human judgment. Intelligent routing directs complex or high-risk applications to experts, while straightforward applications are processed end-to-end by automated systems. At the same time, multi-channel automated engagement strategies (including SMS, email, and in-app updates) can collect missing information, guide customers through the process, and keep them informed, all without increasing staff workload. In short, automation lowers costs while improving both efficiency and customer experience.

Loan origination automation changes the equation for lenders. Instead of forcing the borrower to provide endless documentation, automation draws on existing data, validates it instantly, and pushes the decision process forward. Instead of human underwriters slowing the process with manual reviews, AI-powered decisioning models flag anomalies, validate identity, and issue approvals in real time. Instead of treating abandonment as a sales issue, institutions can now see it for what it is: a risk issue, where prime, low-risk borrowers are being lost to faster, more automated competitors.

Automation is not just a tool to reduce costs. It is the foundation of a new competitive reality in which speed, transparency, and convenience define success.

Addressing Fraud Without Adding Friction

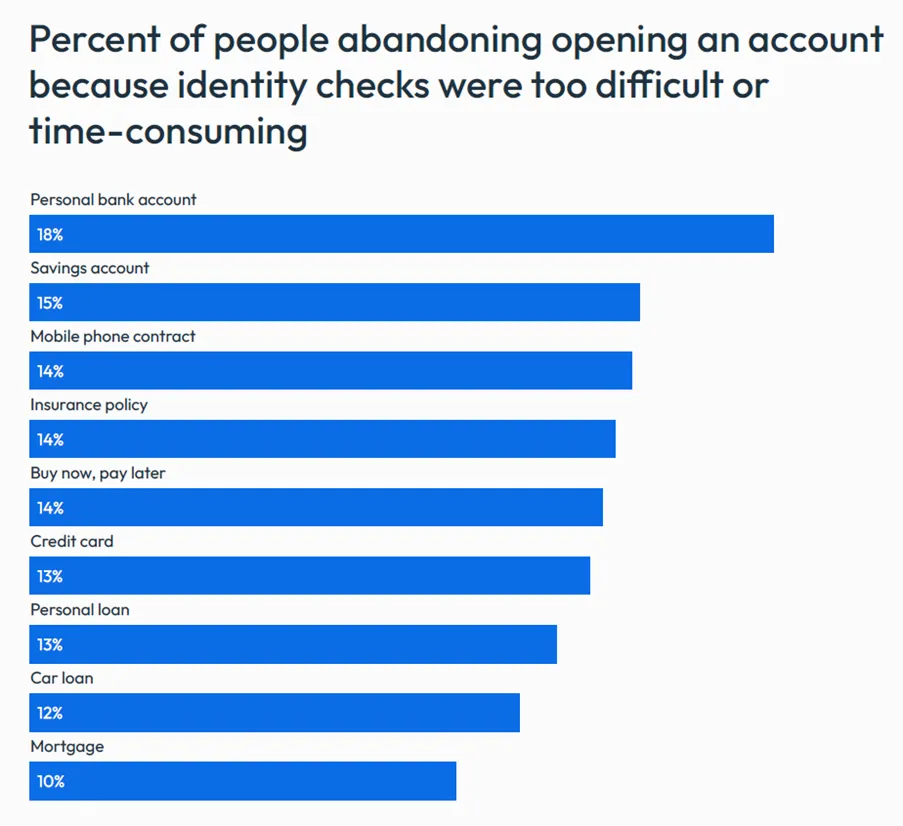

Of course, speed alone is not enough. Fraud and identity risk remain among the greatest challenges in origination, and lenders cannot afford to lower their guard. Yet survey results confirm that complex fraud checks are a major driver of abandonment: 16% of borrowers walk away from auto loans when identity verification feels too complicated, and 20% abandon personal loans for the same reason.

Here again, automation provides the solution. Advanced digital identity tools allow verification to happen invisibly in the background, validating information against real-time data sources without burdening the applicant. Fraud detection models, fueled by behavioral analytics, can flag suspicious patterns without interrupting the majority of borrowers who are acting in good faith.

By embedding these automated controls into the workflow, lenders can strike the balance consumers demand: security without visible friction.

The Broader Case for Loan Origination Automation

Several market dynamics make automation an urgent priority. Fraud pressures are rising, as synthetic identities and digital scams become more sophisticated. Operational costs are under scrutiny, and large manual underwriting teams are increasingly unsustainable. Consumers have little patience for delays and now equate fast, simple origination with trust in the institution. Regulators, meanwhile, are demanding more consistency and explainability in credit decisions — something automation can deliver far more reliably than manual processes.

Taken together, these forces point in one direction: automation is not a “nice to have.” It is the backbone of sustainable lending.

The Future of Originations

The lending market is at a paradoxical crossroads. Borrowers want faster, simpler origination, yet credit risk, dishonesty and fraud remain entrenched realities. Manual processes cannot resolve this tension. Loan origination automation can.

By embedding intelligence, analytics, and verification into every step of the borrower journey, lenders can deliver instant, digital-first decisions without sacrificing risk control. With as many as one in five applications abandoned due to friction, and most consumers unwilling to wait more than an hour for approval, the institutions that embrace automation will not just survive, they will thrive.

How FICO Helps Lenders Automate Loan Originations

FICO® Platform is designed to help lenders achieve end-to-end loan origination automation. It brings together AI-driven decisioning, advanced analytics, and real-time data integrations to create a seamless, consistent experience across every channel. Fraud and identity verification run invisibly in the background, while personalized risk assessments ensure that each borrower receives a fair and explainable decision.

For CROs and heads of credit risk, FICO provides the agility to adapt origination strategies quickly, improve approval rates, and strengthen portfolio quality. More importantly, it allows institutions to meet rising consumer expectations for speed and simplicity — without ever losing sight of risk.

FICO® Platform provides lenders with the technology foundation to scale and modernize their loan originations process. By unifying advanced decisioning, AI-driven analytics, and real-time data integration, FICO platform allows organizations to automate key parts of the origination journey from identity verification and fraud detection to credit scoring and personalized risk assessment. This not only reduces friction for legitimate borrowers but also enhances control for risk leaders, ensuring consistent, explainable decisions across channels. For CROs and Heads of Credit Risk, FICO Platform delivers the agility to adapt origination strategies quickly, improve approval rates, and strengthen portfolio quality while meeting consumer expectations for speed and simplicity.

Learn More About How FICO Can Help You with Loan Origination

- Discover FICO solutions for originations

- Explore FICO Platform

- Read the results of our 2025 Consumer Survey: USA Fraud, Identity and Digital Banking

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.