How to Tame Credit Originations Complexity and Data Overload

With the right technology it is now possible to drive out manual or high-friction interventions and offer seamless, near-instant credit decisions across multiple sales channels

In an ever-more competitive market, banks are seeing a lot of business going begging. There may be numerous culprits, but a choppy onboarding experience, avoidable friction and an inability to provide finance to customers through the right channels are common factors for most organisations.

Customer experience has become critical, with banks with the highest advocacy scores, growing revenues 1.7 times faster than those with the lowest. This makes the experience provided during the embryonic, originations stage of the customer relationship critical. Given that poor process and customer experience is typically a result of technology constraints, it's important to consider how technology can be used to provide the best originations experience. Get it right and it's possible to avoid missing out on profitable lending. Get it wrong and the opportunity is gone for good.

In the past, customers have been prepared to accept an appropriate level of friction within onboarding for certain products, such as mortgages; it’s now becoming apparent that customers are looking for quicker decisions across the board. Banks are responding to this customer demand by seeking to bringing more efficiency into even their traditionally most intricate and complex new lending decisions. For instance, in a Q4-24 mortgage efficiency survey in the UK, almost every respondent put “developing more support for underwriters and improving internal system performance with external data” as their desired first area to improve. The leading firms in this respect are now able to make same or next day mortgage offers for 40% of their new lending applications.

Never has it been more true: too much friction, or a fragmented process, and applicants may abandon the transaction completely.

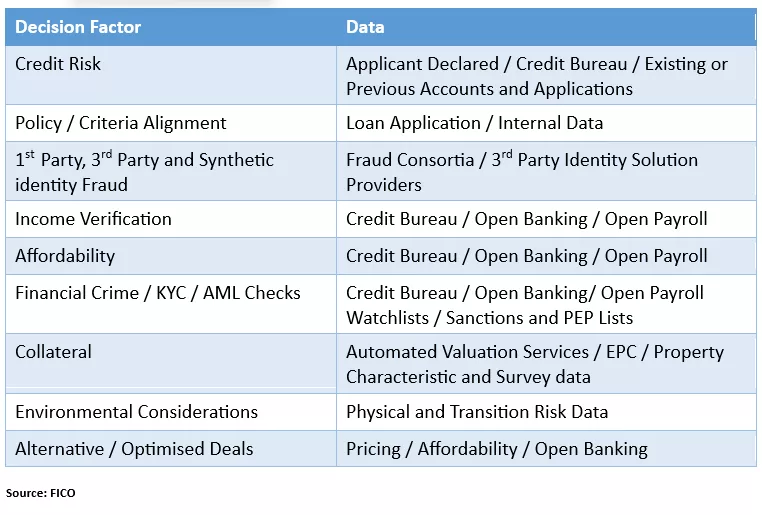

Originations management is multi-faceted and underpinned by a combination of critical decision factors, where the sum of the parts combine to create the overall lending decision. Each decision factor requires different data sources, which if they are to be used as efficiently as possible, require different levels of analytical sophistication.

The Anatomy of Originations Decisions

Exploring the Originations Decision Management Challenges

For many lenders, the multiple decision factors have been a cause of disjointed originations processes, which elongate the journey – because they involve requests for documents, or a switch to costly and needlessly time-consuming legacy decision-making systems. More friction and breaks in the process mean more applicants are likely to go with a competitor who is able to provide a more seamless journey. The challenge for lenders is to create originations processes with acceptable levels of friction, whilst maintaining robust risk assessments, to effectively comply with regulation and manage levels of delinquency and loss.

The emergence of new channels through which customers obtain finance represents a further origination technology challenge. But it’s one that can unlock the convenient, seamless experiences on which customers are placing increasing value. Price comparison websites have been a cornerstone within many markets for years, and embedded finance options, such as those where a finance option is selected at the check-out of an e-commerce portal, are growing rapidly. The amount of lending that is going to move into this emerging channel is expected to be huge, with a Q1-25 estimate from the World Economic Forum, predicting that the total market size will reach $7.2 trillion by 2030. To maximise market share and achieve their fair share of this huge borrowing migration, banks need systems that can meet the different requirements of their internal sales teams and multiple third parties.

Facing the Originations Challenges

With the right technology it is now possible to drive out manual or high-friction interventions and offer seamless, near-instant credit decisions across multiple sales channels, without compromising on risk controls at all. There are three critical assets, which should be used in combination:

1. Open Architectures

API-enabled architecture is key to providing the flexibility required for connecting a common strategy system with multiple sales interfaces and data sources. When combined with the capability to tailor the response message via the favoured requesting channel, without significant amounts of complex coding, it becomes far easier to sell through multiple channels and close any gaps restricting new business.

This level of flexibility is key to achieving market share as an already competitive environment becomes more competitive still. Open architectures have allowed the lines between ‘traditional’ lenders, fin-techs and tech-savvy, non-finance organisations, like Apple to become blurred. It’s important for banks to respond through the adoption of their own similarly open and adaptive decision architecture.

2. Flexible Data Models

API-enabled architectures connecting to new data sources, need to be supported by the ability to make data readily available for use. It’s vital to have a decision system with a flexible data model to facilitate the use of new data, from across the organisation or from third parties, quickly and efficiently. Consider the pace of change within Open Banking, Open Finance and Open Data ecosystems, where new data sources are continually emerging. Open Payroll, where salary data can be shared directly with lenders, provides a recent example of the continued growth of structured data that's available to underpin automation of originations processes.

The quicker banks can leverage the ever-expanding data universe, the greater the competitive advantage will be, especially when it comes to delivering a first-class customer experience, whilst retaining robust risk controls.

3. Advanced Analytics Enhance Originations Decisions

It’s not enough to be able to connect to and accommodate all the new data sources. The rich vein of customer insight needs to be found so the all-important informed view can be operationalised quickly without introducing avoidable delays.

Longstanding components of an origination's decision, such as credit scoring, income verification, affordability assessments, application fraud and AML checks already require an array of analytical techniques to enable their most effective decision development and execution. Harnessing new data sources, such as the increasing use of Open Banking data for more robust assessments of applicants with little to no credit history, further embeds the need for a range of advanced analytical capabilities. For a combination of commercial and regulatory reasons, an increasing number of banks are seeking to harness the rich vein of customer insight this data provides, with one FICO client reporting the ability to accurately score more applicants, due to the transaction data providing 3,000% more data for modelling purposes.

Consequently, when boardrooms make decisions about their analytics and back-office systems, they need to think carefully about the extent of the capabilities provided - and whether they are sufficiently extensible to make best use of new and emerging data sources. Richer data and more advanced analytical capabilities are also extending traditional decision making, to provide personalised, alternative deals for customers. They allow automated promotion of alternative products and pricing, based on what is identified as being important to each customer as an individual. Typical benefits include:

Accept rates can be improved by identifying products for which an otherwise declined customer is eligible.

Automation of the counter-offer process leads to higher conversion rates.

Personalising offers ensures better alignment between customer and product, supporting the better customer outcomes required by the UK Consumer Duty

While the potential for greater levels of decision sophistication is increasing, the December 2023 ruling from the Court of Justice of the European Union regarding credit decisions that draw strongly on 3rd party credit scores signposts the importance of maintaining decision transparency and explainability. The solutions firms put in place must also support transparency from the point of analytical development, all the way through to decision execution.

How FICO Is Helping

By combining the three assets described above, within their decision system architecture, lenders can overcome the challenges presented to their originations teams. FICO Platform ensures the delivery of a first-class originations experience, without sacrificing risk controls, through any number of sales channels. In doing so, lenders can maximise conversion rates and help guard against loss of market share from leaner and more agile competitors.

Find out how real-time onboarding increases digital transactions by more than 60%

Explore our solutions for originations and onboarding

Watch the webinar with FICO and McKinsey on digital-first decisions

Read the blog post FCA’s Consumer Duty Mandates Sharper Use of Technology

Watch a video on why customer-centric service is critical

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.