Credit Card Fraud Detection: 2025 Trends and Interventions

Uncover key trends driving the surge in credit card fraud losses, and gain insight into tactics and gaps impacting fraud prevention experts

Credit card and debit card fraud is the unauthorized use of someone’s payment card or card details to make purchases, withdraw cash, or conduct other transactions without the cardholder’s consent, often through theft, data breaches, skimming devices, phishing scams, or account takeover. Card fraud is as old as the presence of credit cards themselves, but it is evolving, and card issuers need to pay attention to the novel and radical approaches fraudsters now adopt.

While financial institutions have spent the last few years building defences against application fraud, Authorized Push Payment (APP) fraud, and real-time payment scams, card fraud quietly evolved into something more dangerous. Reports from around the world now show a dramatic surge in card fraud losses, and the tactics being used are exposing significant gaps in current defence strategies.

Fraudsters Move to Where Defenses Are Lowered

Credit card and debit card fraud never went away. It simply waited. As banks shifted resources to combat emerging payment threats, fraudsters recognized an opportunity. They've now returned to cards with an arsenal that combines old-school face-to-face tactics with enhanced by AI capabilities.

Today, fraudsters are literally knocking on doors, convincing victims to hand over physical cards and PINs. These courier scams or impersonation scams represent a brazen return to face-to-face crime. Yet simultaneously, the same criminal networks are using generative AI to create deepfakes and synthetic documents that fool even the most experienced customers.

This blend of high-tech tools and brazen physical tactics breaks traditional fraud models. These criminals follow no rules and adopt new tactics faster than banks can respond.

Social Engineering Drives Card Fraud

The most successful fraudsters no longer attack systems. They attack people. By targeting human psychology rather than technical vulnerabilities, criminals bypass millions of dollars in security infrastructure with a simple phone call.

Forget phishing. Modern social engineering has gone far beyond this. Fraudsters now guide victims step-by-step through security protocols, teaching them to override the very controls designed for protection. They craft communications that are indistinguishable from those that are legitimate interactions with banks. They know exactly when to create urgency, when to build trust, and when to strike.

Financial institutions increasingly label these incidents as "scams on cards". It’s a term, however, that significantly understates their sophistication. When criminals manipulate customers into voluntarily surrendering card numbers, CVVs, and one-time passcodes, traditional transaction monitoring becomes irrelevant.

The Fake Store Epidemic

The barriers to online selling have all but disappeared. Now, anyone can launch an online store in minutes. This, however, has also handed fraudsters the perfect vehicle for crime. Today, criminals set up fake online stores with professional designs, targeted social media campaigns, and even counterfeit versions of trusted brands.

These operations exploit fundamental consumer behaviours. They prey on consumer instincts to trust professional designs, recognised brands, and peer reviews. Victims discover the deception only after products never arrive and merchants disappear. By then, the fraudsters have moved on, often relaunching under new identities within hours.

Silos Are a Criminal's Best Friend

Once, fraud detection relied on simple rules - flagging high-risk merchant categories, monitoring unusual locations, identifying suspicious amounts. Not anymore.

Modern fraud prevention demands a symphony of data points. Internal data that could inform a holistic view of customers’ behaviors and vulnerabilities is housed in different systems that are frequently inaccessible for fraud decision making. Data from third-party providers such as device IDs, geolocation, authentication signals, digital wallet provisioning, behavioral biometrics and third-party intelligence sits trapped in silos.

Most banks keep this data locked in separate boxes that never talk to each other. Card systems can't see mobile activity. Online banking doesn't talk to call centers. Having a full picture of a customer and their transactions that can assess their vulnerabilities to fraud is impossible without a fundamental shift in how data is accessed across a financial institution.

This gives fraudsters the upper hand. They see everything and connect every dot, while financial institutions see scattered pieces. Fixing this is both a technology problem and an organizational one.

Fraudsters Innovate Fast – This Is an Arms Race

Fraudsters innovate faster than banks can respond. While banks plan their next move, criminals are executing theirs. Current threats include:

- Automated bots testing thousands of stolen credentials per minute

- SIM swap attacks intercepting authentication codes

- Remote access tools hijacking legitimate sessions

- Advanced skimming devices on ATMs and POS terminals

- Generative AI creating convincing scam content at scale

Traditional defences in the form of static rules updated quarterly and models retrained annually do not stand a chance against this speed. A Gartner survey found only 48% of AI projects reach production, typically after 8+ months. In fraud terms, that's an eternity.

Minor adjustments are a recipe for disaster. The solution lies in transformation, not iteration. Machine learning models must adapt in real time, learning from new patterns as they emerge. General purpose AI, however, won’t be enough. Only models trained specifically on financial services data will be able to keep pace and deliver the precision and speed that this challenge needs.

The Art of Fraud Intervention

Declining a suspicious transaction represents the beginning, not the end, of fraud prevention. How institutions communicate in that critical moment determines whether they stop fraud or alienate customers. This is not just about preventing card fraud - timely confirmation that a transaction is legitimate reduces the negative impact of a false positive on customer experience, allowing them to proceed with their intended purchase.

Generic messages such as "Did you make this transaction?" are no longer enough. Leading institutions now hyper-personalize every interaction. This means selecting the optimal channel for each customer, crafting sensitive messages that distinguish between fraud and scam scenarios, and timing interventions for maximum impact.

The integration of telecommunications data, for example, represents a major breakthrough. When telco signals indicate a customer is potentially on a scam call while attempting a transaction, banks can intervene during the crime, not after.

Building Defenses that Work

Three decades of FICO's AI innovation have proven what works when it comes to beating fraud: models that learn globally, analytics that adapt instantly, platforms that deploy rapidly and unite both internal and external data and customer engagement that arrives precisely when needed. The latest developments, including agentic AI that helps analysts work cases more effectively, shows the potential when technology amplifies human expertise.

But technology alone won't win this war. Success requires financial institutions to match fraudsters' speed, dismantle data silos, and embrace genuine agility rather than just talking about it.

Why Card Fraud Must Be Tackled Now

The resurgence of card fraud isn't a temporary spike; it's a fundamental shift in the threat landscape. Financial institutions must now work on evolving their defences to match modern realities, or they will find themselves watching the losses mount while customers lose faith.

The tools exist. The strategies are proven. What's missing is urgency. While banks debate their response, fraudsters are already executing their next attack. In this fight, standing still means falling behind. And this in turn means failing the customers who trust financial institutions to protect them.

The question isn't whether to act. It's whether institutions will act fast enough.

How FICO Helps

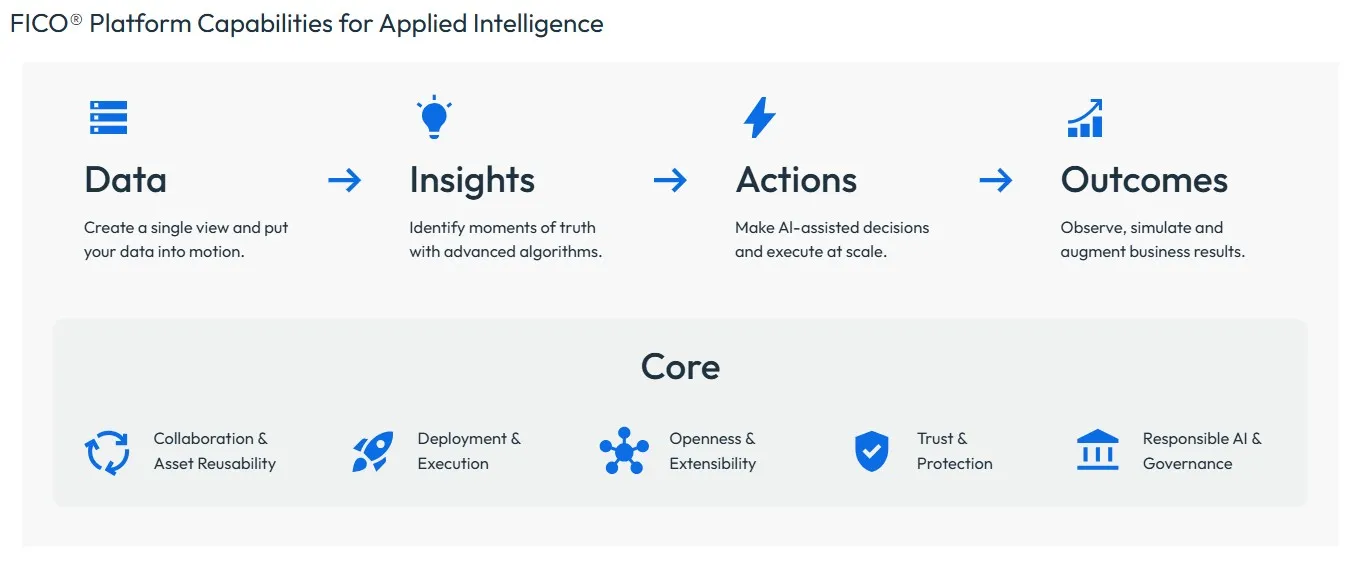

FICO® Platform uses advanced AI, machine learning, and real-time analytics to accurately detect and prevent card fraud. By continuously analyzing transaction patterns and behavioral signals, it identifies anomalies that signal potential fraud, often before a transaction is completed. The platform breaks down data silos, enabling organizations to access and leverage all relevant data in their fraud decisioning.

Rapid API integration with best-in-class solutions including biometrics, bureau data, and device intelligence empowers fraud prevention specialists with seamless orchestration of both internal and external data sources. Operational efficiency is enhanced through intuitive case management and agentic AI support, maximizing the effectiveness of fraud teams. Omni-channel engagement ensures customers are contacted through the most appropriate channel to confirm transactions or alert them to potential fraud, keeping them informed, engaged, and confident in their protection.

Learn More About Stopping Card Fraud

- Read the card fraud hot topic Q&A with expert Neil Mason

- Understand more about modern approaches to enterprise fraud with the six E’s of enterprise fraud

- Watch our expert spotlight video – combatting card fraud in an era of new technology

- Read the Datos Insights analyst paper: Beyond point Solutions, orchestrating the future of fraud prevention

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

It’s 2021. Do You Know What Your AI Is Doing?

New "State of Responsible AI" report from Corinium and FICO finds that most companies don’t—and are deploying artificial intelligence at significant risk

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.