How Is Credit Card Fraud Changing in Europe?

The FICO European Fraud Map shows how Card Not Present fraud is rising across Europe, and why a unified approach to fighting fraud is vital

Credit Card Fraud Trends in Europe

While the growing impact of scams has been the dominant topic in fraud for the past few years, stronger defences against scams have made it harder for criminals. This has caused them to shift some of their energy back to an old favourite: credit card fraud. The FICO European Fraud Map reveals how and where this increase has happened, based on data from Euromonitor International and, for the UK, UK Finance.

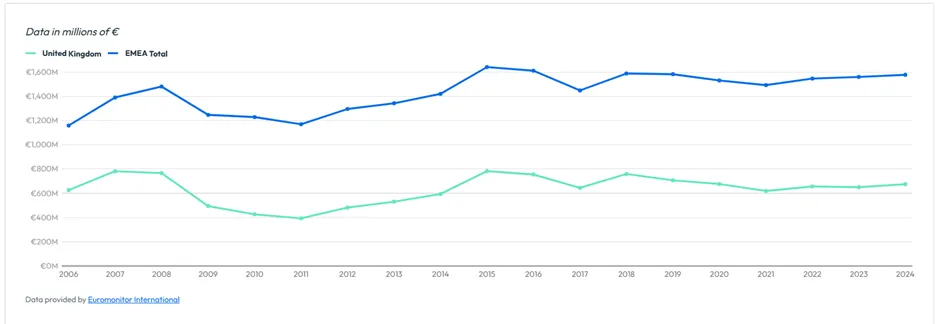

Credit card fraud losses across EMEA for the 18 countries studied in our interactive map have risen from €1493M in 2021 (the last time we published the map) to €1578M in 2024. While this is still lower than the peak in 2015 of €1642M, the last few years indicate that fraud is steadily rising back up towards this figure.

Review the FICO European Fraud Map

What Types of Card Fraud Are Rising the Most?

Card-not-present fraud was the main driver of both overall card fraud loss and the upward loss trajectory across many countries in 2024. E-commerce fraud, e-wallet, social engineering and QR code fraud or “quishing” are all rising as well. Social engineering plays a large role, as victims are often persuaded to hand over key information such as OTP codes for e-wallets, allowing fraudsters to spend large amounts with minimal friction. Ultimately, the weak link in the chain for fraudsters is always the customer themselves, and the damage done once a customer has been social engineered into helping a fraudster bypass security controls can be monumental.

Another notable concern is identity fraud which, although far lower than card-not-present fraud, still poses a significant problem for banks in the wake of advancements in technology to create fraudulent synthetic IDs and deepfakes.

Older fraud typologies such as counterfeit and lost & stolen remain steady and low, seemingly because digital channels make it easier to commit fraud from a safer, hidden location and target a much wider audience of potential victims.

Which Countries Have Seen the Biggest Increases in Card Fraud?

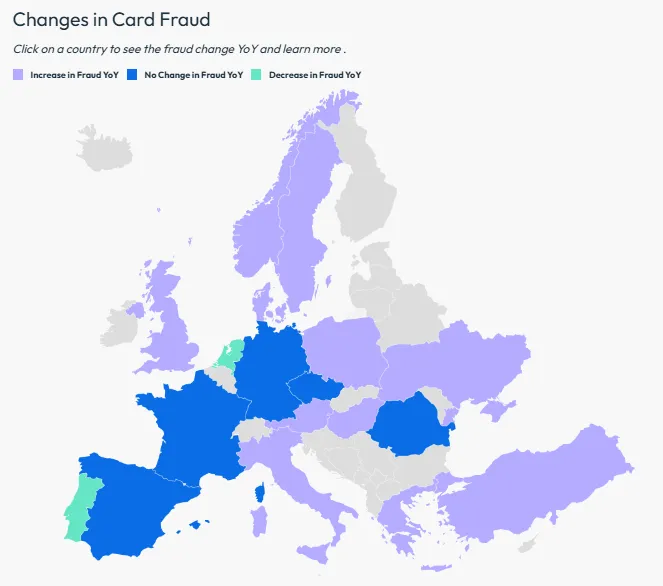

Key countries driving the overall increase since 2021 are:

- Norway, where fraud losses have dramatically increased from €14M to €26.4M

- Denmark, with a more than twofold increase in fraud losses (€19.6M to €47.6M)

- Hungary, which has jumped from €3.3M to €22.4M

- Greece, with a twofold increase from €13.4M to €28.4M

- Sweden, where losses have risen from €13.1M to €24.2M, an increase of around 85%.

Despite the overall EMEA loss picture trending slowly upwards, a few countries are seeing a downward trend in their card fraud losses. Notably:

- France’s losses are slowly but steadily decreasing and have done so consistently since their peak at €433.2M in 2018. They now sit at €409.2M, the second highest losses of all the countries in our map, but they set a good example for controlling their losses.

- Turkey reports significantly lower losses at €1.1M for 2024 and have reduced their credit card fraud losses consistently since 2010.

Changes in Credit Card Fraud 2023-2024

| Country | % Change |

|---|---|

| Hungary | +22% |

| Poland | +21% |

| Denmark | +20% |

| Greece | +20% |

| Sweden | +19% |

| Norway | +8% |

| Turkey | +5% |

| Ukraine | +4% |

| United Kingdom | +4% |

| Austria | +3% |

| Italy | +1% |

| Romania | ±0% |

| Czech Republic | ±0% |

| Germany | ±0% |

| France | ±0% |

| Spain | ±0% |

| Portugal | −3% |

| Netherlands | −5% |

How Does Credit Card Fraud Relate to Card Sales?

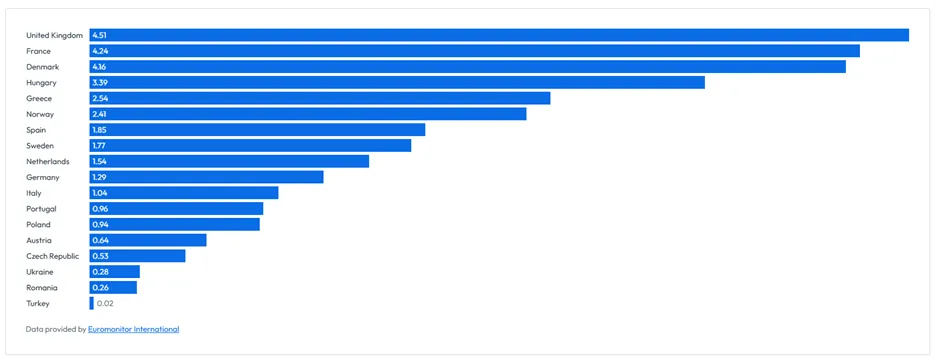

Fraud basis points is a standard measure of card fraud severity and can show how a bank or a country compares to others. 1 basis point is equivalent to 1 cent per €100. It works the same in any currency and provides an indicator of the fraud-to-sales ratio.

In 2024, most countries remained steady with minor changes in terms of their basis points. The UK, France, Spain, Netherlands, Germany, Italy, Portugal, Austria, Czech Republic, Ukraine, Romania, and Turkey have all seen a decrease in fraud value in relation to overall transactional value, while Denmark, Hungary, Greece, Norway, Sweden, and Poland have seen increases.

Some notable countries here are:

- France, where there has been a decrease of 1BPS, despite fraud losses remaining steady

- The UK, which remains steady at 4.5 BPS, despite an increase in fraud losses

- Greece, which has seen an increase in BPS up to 3, driven by a significant increase in fraud losses of 19% from 2023 to 2024

- Denmark, which has also seen a shift from 3.6 to 4.2BPS, driven by a similarly large jump of 20% in fraud losses

What Should Card Issuers Do to Fight Card Fraud?

PSD3 regulations are taking effect across Europe, with a final version of the directive expected by the end of 2025 and an adoption deadline of 18 months later. The changes will enforce stricter authentication and transparency requirements, compelling organisations to strengthen their credit card fraud prevention strategies. With enhanced consumer protection and scrutiny from regulators, lenders will need to adopt more robust fraud detection technologies and real-time monitoring to remain compliant and reduce liability.

What we see at FICO is an increased focus on 360 customer profiling, assessing fraud and financial crime risk across all channels and products and throughout the entire lifecycle of the customer (onboarding through to offboarding). Increasingly, organisations are moving towards a unified approach to fraud risk assessment.

Why is such an approach important? As the European Fraud Map clearly shows, payments fraud changes as criminals adapt to changing consumer payment methods, to lenders’ defenses and to new regulations. Fraudsters will always seek the weakest point in the hull of a lender’s ship. A unified approach (across channels, products, industries, organisations, regions) ensures that there is no easy entry, and uses all the data and technology at a lender’s disposal to offer maximum protection.

Review the FICO European Fraud Map

Learn More: How FICO Can Help Reduce Fraud Across the Enterprise

- Explore how FICO helps fight fraud, regardless of channel or portfolio.

- Get details about the FICO® Falcon® Intelligence Network

- See how Customer Communications Services for Fraud engages customers in real time to fight card and CNP fraud

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.