Evaluating the inclusion of BNPL data in FICO® Scores

FICO is working with major Buy Now Pay Later service provider to thoroughly analyze new credit data source

One of the fastest-growing categories in U.S. financial services is Buy Now Pay Later (BNPL). BNPL offerings are generally short-term loans that allow people to pay for purchases in installments over time, often with no interest if payments are made on time and in full. According to eMarketer, nearly 100 million Americans will use BNPL services in 2024, and total BNPL loan spending is projected to grow to more than $80 billion.

At FICO, we regularly monitor industry trends, like BNPL financing options. We do this to ensure our ongoing innovation in credit scoring reflects the latest trends in borrower credit behavior and provides a highly accurate and predictive snapshot of credit risk for lenders. We are always exploring whether new credit data sets and data sources may be used to enhance the FICO® Score’s predictiveness and help more people gain access to the credit for things like getting an education, purchasing a car, buying a first home, or starting a business.

Our guiding principles for evaluating new types of data, such as BNPL, include accuracy and predictiveness. We take great care to protect the integrity of our scoring models, and ensure we fully understand the potential impact before we include new data sources. The FICO® Score can impact the origination and underwriting of billions of dollars of consumer credit, so it is imperative that we thoroughly and responsibly evaluate potential new sources of credit data.

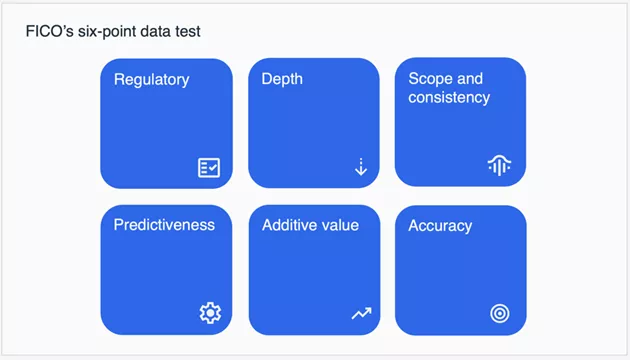

When evaluating potential new sources of credit data, such as BNPL, we are also guided by the application of a six-point test that covers regulatory compliance, depth of information, scope and consistency of coverage, predictiveness, additive value, and accuracy.

When it comes to BNPL, we are working closely with a major BNPL loan provider, as well as our credit bureau partners, to thoroughly analyze this potential new credit data source. We are seeking to determine the potential impact that the inclusion of BNPL data could have on the FICO® Score.

When we conducted a preliminary study in 2022 to analyze the impact of BNPL data on the FICO Score partnership with Experian in 2022, we identified a number of important considerations. For example, how a BNPL lender reports these accounts to a credit bureau (such as, as revolving debt vs. as installment loans) can materially influence the impact these short-term loans ultimately have on a credit score. We also found the impact of the inclusion of BNPL data on the FICO Score is dependent on a consumer’s overall credit profile (for example, a reported credit history of missed payments, or if the consumer is brand new to credit).

The use of new financial products, such as BNPL, continues to grow, FICO remains committed to assessing consumer borrowing trends to help ensure that FICO® Scores continue to be the industry standard in accurate and reliable evaluation of borrower credit risk.

To learn more about the potential impacts the reporting of BNPL loan data may have on credit scores, please visit:

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.