FICO Fact: Is a 700 FICO Score the Same as a 700 VantageScore?

Inappropriate comparisons between credit scoring models could threaten liquidity and consumer access to affordable credit

Securitization plays a key role in driving increased liquidity in the mortgage and other industries, ensuring that lenders can fund more loans at lower cost. This in turn gives borrowers greater opportunities for access to affordable credit.

FICO® Scores, of course, play a critical role in the risk management and transparency that powers the secondary market. With the Federal Housing Finance Agency currently in the process of implementing a requirement that lenders deliver both FICO® Score 10T and VantageScore 4.0 credit scores with each single-family mortgage sold to Fannie Mae and Freddie Mac (GSEs), new questions have arisen about whether the two credit scoring models are directly comparable, particularly for the purposes of securitization. It’s time to set the record straight.

FICO Fact: Even though they share the same credit score range, the FICO® Score and VantageScore do not share the same odds-to-score relationship, meaning the consumer credit risk associated with a given score value is different. The relationship between the two credit scores is not constant, and any analysis that attempts to map the two via a fixed spread is most likely to be unreliable over time.

The secondary market requires all participants to effectively model credit risk and prepayments. The FICO® Score is an important input into credit default risk and prepayment models.

If the credit risk or prepayment modeling is challenged or becomes uncertain in the MBS or other secondary markets – such as by attempting direct translations between two non-equivalent credit scoring models – it would likely cause market disruption. Uncertainty reduces confidence of investors and the secondary market as a whole, which can result in higher yields and lower prices for securities. This, in turn, can lead to higher costs and restrictions in access to affordable credit for consumers.

The secondary markets depend on stability, transparency and the ability to understand performance across a full market cycle. As the gold standard in credit scoring, FICO® Scores play a critical role in the securitization of mortgage-backed securities (MBS), comprising pools of mortgages such as those issued by government-sponsored enterprises (GSEs), and other asset-backed securities comprising pools of auto loans, or telco contract receivables. FICO Scores are widely-understood and trusted by investors as key indicators of the default risk of a given pool of loans or other assets to be securitized, which informs how much investors are willing to pay.

When a 700 Isn’t a 700: Can Other Credit Scores Compare?

VantageScore adjusted its recent credit score models to be on the same 300-850 score range as the FICO® Score (prior VantageScore models were on a 501-990 score range). The fact that both of these credit scoring models now have the same score range, however, does not mean that scores from these models are the same— they’re not. This means that the risk associated with any given score across the score range is most likely different for each model. And, any relative difference in risk is not likely to be the same or constant at each point through the score range.

Put simply, a pool of consumers that each have a 700 FICO® Score likely have different, and potentially meaningfully different, repayment risk than a pool of consumers that each have a 700 VantageScore. While the two scoring models have the same 300-850 range, the models have important differences that, if misunderstood or not considered, would likely result in less accurate projections and poor lending and investment decisions, with potential downstream consequences for borrowers, taxpayers, and other market participants, and for the affordability of credit.

In addition to the expected disconnect in the odds-to-score relationship between FICO® Scores and VantageScores, there are fundamental differences in the design blueprints of these two scores. For example:

- Differences in the minimum scoring criteria. As articulated in a prior FICO blog post, consumers with very sparse credit bureau files or credit history (e.g., the millions of credit files with no updates in the past 4 years or more) do not receive a FICO Score, to ensure that scores are only delivered in cases where a robust and accurate assessment of the consumer’s credit risk can be provided.

- Differences in the statistical techniques used to build the model. FICO uses a robust scorecard technology that has been refined and improved for over 30 years to build thousands of credit risk models around the globe. The power of this technology and our credit scoring models has been tested through varying economic cycles, and has withstood the scrutiny of regulators, while also bringing tremendous value to tens of thousands of lenders.

The FICO® Score and other credit risk scores are not generally designed to provide a specific, fixed estimate of credit risk. Rather, as discussed in this prior blog post, the relationship between a given score value and a consumer’s likelihood of loan repayment shifts over time and across economic and financial cycles. These shifts can be driven by factors outside of what is captured in the credit file (such as changes in macroeconomic conditions, and lender underwriting practices) that can also play a substantial role in consumers’ go-forward risk of repayment. Importantly, the severity and impact of these shifts will almost certainly be different from model to model, especially when comparing models with key design differences.

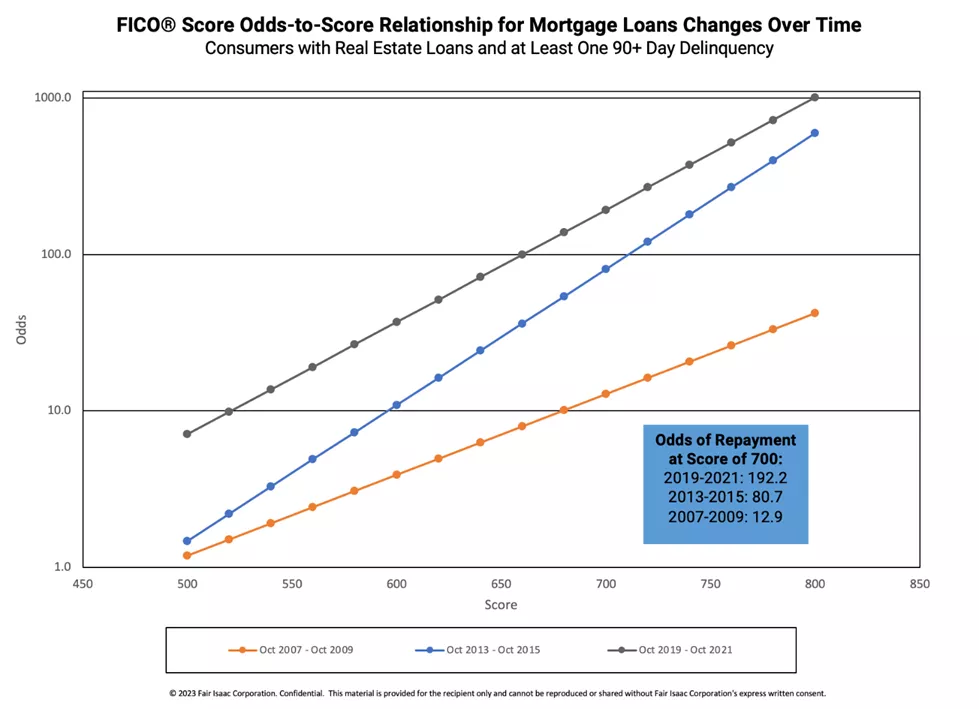

In addition to shifts in the relationship between FICO® Score and default risk over time, this relationship also varies across credit products (e.g., credit cards, personal loans, auto loans, mortgages), each exhibiting different repayment rates at a given score band. Additionally, because mortgages are more complex than other common credit products such as credit cards or personal loans, the relationship between FICO Scores and mortgage default risk typically is too, and it can vary substantially through different phases of the economic cycle and across geographic regions. As shown below, the odds of satisfactory mortgage repayment for consumers with a FICO Score of 700 jumped almost 15-fold over a decade: from ~13:1 (13 satisfactory payers for every 1 payer seriously delinquent on a loan) during the worst of the mortgage crisis to 192:1 in more recent times of relative strength in the housing industry.

Given the fundamental differences in model design between FICO® Scores and VantageScores, the odds-to-score relationship varies across these two models at any point in time and will shift in different ways over time. And due to these differences in proprietary model design, any attempted mapping or alignment between the two scores is unlikely to be reliable, particularly over time and as economic conditions change.

Conclusion: Differences in credit risk levels represented by FICO® Scores and VantageScores are not the same or constant across the score range. Mapping these differences between FICO Scores and VantageScores via a fixed spread is unlikely to be reliable, particularly over time.

Interested in learning more about what sets the FICO® Score apart from other credit scoring models? See our other posts in the FICO Fact series:

FICO Fact: No Credit Score Versus Low Credit Score

FICO Fact: How Alternative Data Enhances the Accuracy of Consumer Credit Profiles

FICO Fact: Does FICO’s Minimum Scoring Criteria Limit Consumers’ Access to Credit?

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.