FICO’s Score A Better Future Program Helps Empower Consumers

94% of attendees said that the event gave them an improved understanding of tools they needed to manage their finances better in the future.

What is a financial goal that you would like to achieve?

Attendees at FICO’s recent Score A Better Future events in St. Louis and Atlanta told us their goals range from starting a business, to owning a home to saving for retirement, to paying down debt.

In fact, for many, these goals were key motivators for attending the events. In speaking further with the attendees, we found that many could quickly and specifically articulate their long-term financial dreams, yet understanding the key financial concepts and steps required to achieve those dreams was more challenging.

For example, according to surveys of attendees in St. Louis and Atlanta:

- Less than one-third (31 percent) of respondents knew their FICO® Score;

- Fewer than two-in-five (38 percent) understood the factors that determine FICO® Scores; and,

- More than one-quarter (26 percent) thought annual household income was a factor used to calculate a FICO® Score (it’s not – but this is a common misconception).

That’s why the Score A Better Future program – an ongoing series of free educational events to help Americans learn about credit scores and other relevant financial tools – focuses on helping consumers better understand credit scoring, dispelling myths about how FICO® Scores are calculated, and providing free, one-on-one counseling from certified not-for-profit counselors tailored to their individual financial health and goals.

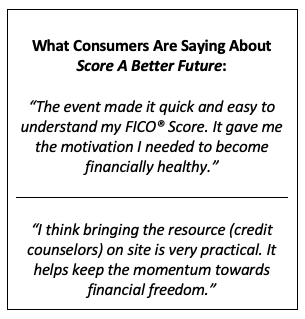

And, the program has already shown to help empower attendees:

- According to our event attendee survey, 82 percent said that the Score A Better Future events were very useful for helping them better understand how to achieve their financial goals.

- And 94 percent agreed that the event gave them an improved understanding of tools they needed to manage their finances better in the future.

Several attendees mentioned the opportunity to work with a counselor on a plan tailored to their specific needs and goals as particularly valuable, helping them feel more motivated to work on improving their FICO® Score going forward.

For more event highlights, check out The Finance Bar video blog recapping Score a Better Future in Atlanta. It includes interviews with the Urban League of Greater Atlanta and Clark Atlanta University as they recap tips on how consumers can feel financially empowered throughout the entire year.

We can’t wait to bring Score A Better Future to more communities across America this year. Our next event will be in Las Vegas, NV on March 18. You can learn more about our upcoming events at https://www.fico.com/en/sabf.

You can also find out more about the FICO Score Open Access for Credit and Financial Counseling program here.

.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.