How to Address Portfolio Risk Volatility Through Economic Uncertainty - Part 2

Building resilience into customer acquisition

If we think of a lending portfolio as a night club, its underwriting policy acts as the doorperson, checking IDs and making sure anyone trying to enter meets documented criteria. Most underwriting policies base acceptance on someone’s attributes and behavior at or before the time of application, considering how other similar applicants have behaved in the past. In both the real and metaphorical example, it would be helpful to have additional upfront insight about how people might respond to stress, as it becomes more challenging to manage behavior once they are “through the door.”

FICO® Scores, often an important contributor to underwriting strategies, are designed to provide valuable risk rank-ordering through all economic cycles. The introductory blog to this series, ”How to Address Portfolio Risk Volatility Through Economic Uncertainty,” notes that consumer behavior varies under stress based on borrower resilience as measured by FICO® Resilience Index, even within narrow FICO Score bands. Understanding how these performance variations could manifest in a stressed environment contributes to even more informed risk-taking and decision-making than using FICO Scores alone.

The FICO® Scoring Solutions team is often asked: Does FICO® Resilience Index only provide useful insight when economic stress is occurring or anticipated soon? Or does it also add value during benign periods of the economy? This blog illustrates how to use FICO Resilience Index in underwriting strategies during both stressed and unstressed times to maximize its value.

Traditional underwriting strategy approach in stressed versus unstressed economy

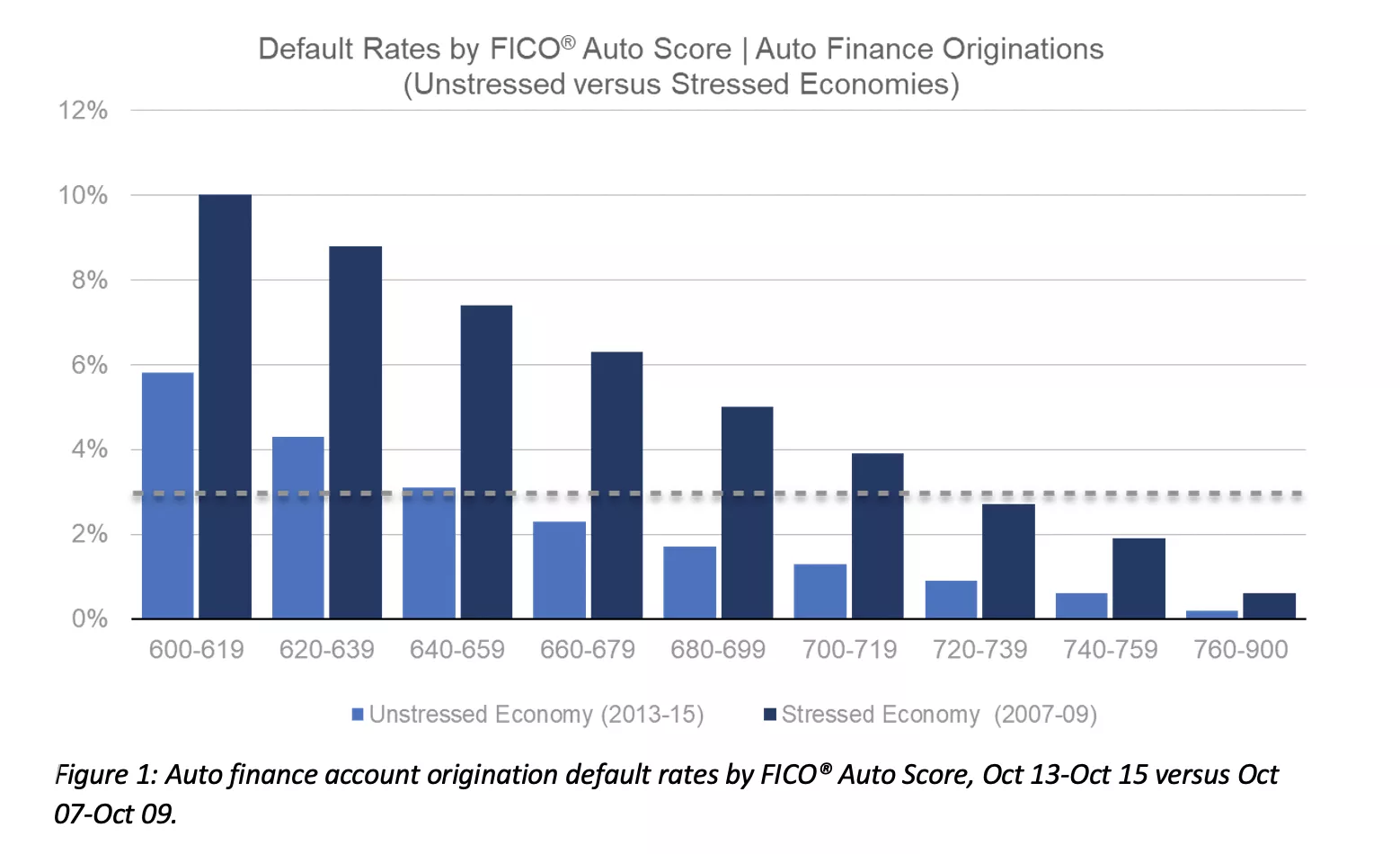

Assume an auto finance portfolio’s current underwriting policy requires applicants to have an expected 24-month default rate less than 3%. As seen in Figure 1, in the unstressed economy of 2013-15, this would have aligned with a simple FICO® Score cut-off of 660 or higher. However, in the stressed economy of 2007-9, this would have aligned with a FICO Score cut-off of 720 or higher.

During the highly uncertain time of the Great Recession, most lenders raised FICO® Score cut-offs significantly to maintain the same overall risk profile for accepted applicants. Some even paused new account underwriting altogether.

Using FICO® Resilience Index under stress

Economic Scenario

Severe economic stress is occurring or expected to start imminently.

Business Challenge

Raising FICO® Score cut-offs can help manage overall risk levels, but can also eliminate the potential to acquire more resilient consumers in FICO Score ranges just below the cut-off. In addition, less resilient consumers that meet the FICO Score cut-off may significantly underperform in a stressed economy.

FICO® Resilience Index Solution

Using FICO® Resilience Index together with FICO® Score, lenders can leverage information about consumer resilience to differentiate payment performance through periods of economic stress.

Methodology and Results

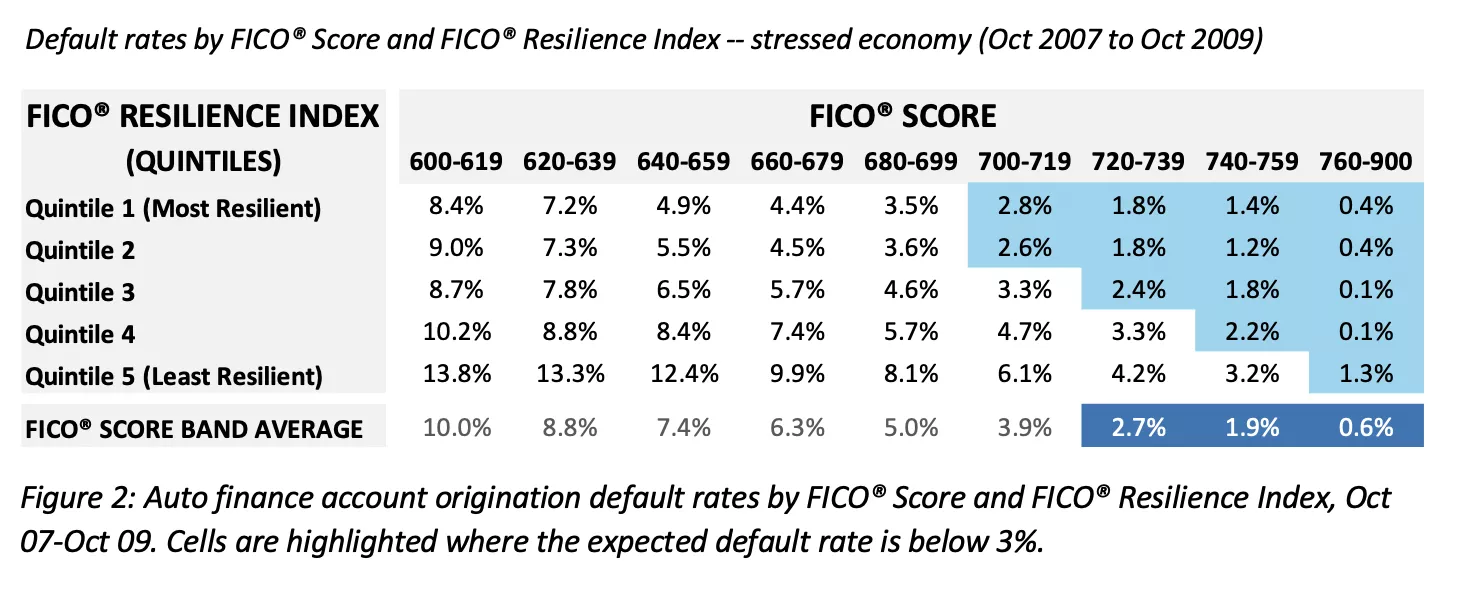

Continuing with our auto finance example, applying the same 3% cut-off based on both scores versus FICO® Score alone leads to a “swap in” population of more resilient applicants in the 700-719 FICO Score band and a “swap out” population of less resilient applicants in the 720-739 and 740-759 FICO Score bands, as seen in Figure 2.

Using FICO® Resilience Index in an unstressed economy

Economic Scenario

A benign economy is expected in the immediate future. However, it is recognized that downturns are now a regular part of the economic cycle.

Business Challenge

In a benign economy, lenders need to build resilience into their underwriting decisions; however, without insight into how individual consumers within certain FICO® Score bands will fare during times of economic stress, they are creating an unknown potential for additional risk during downturns.

FICO® Resilience Index Solution

FICO® Resilience Index is designed to continue to rank-order borrower resilience during benign periods, resulting in greater portfolio resilience and differentiated credit risk performance observable during periods of economic stress.

Methodology and Results

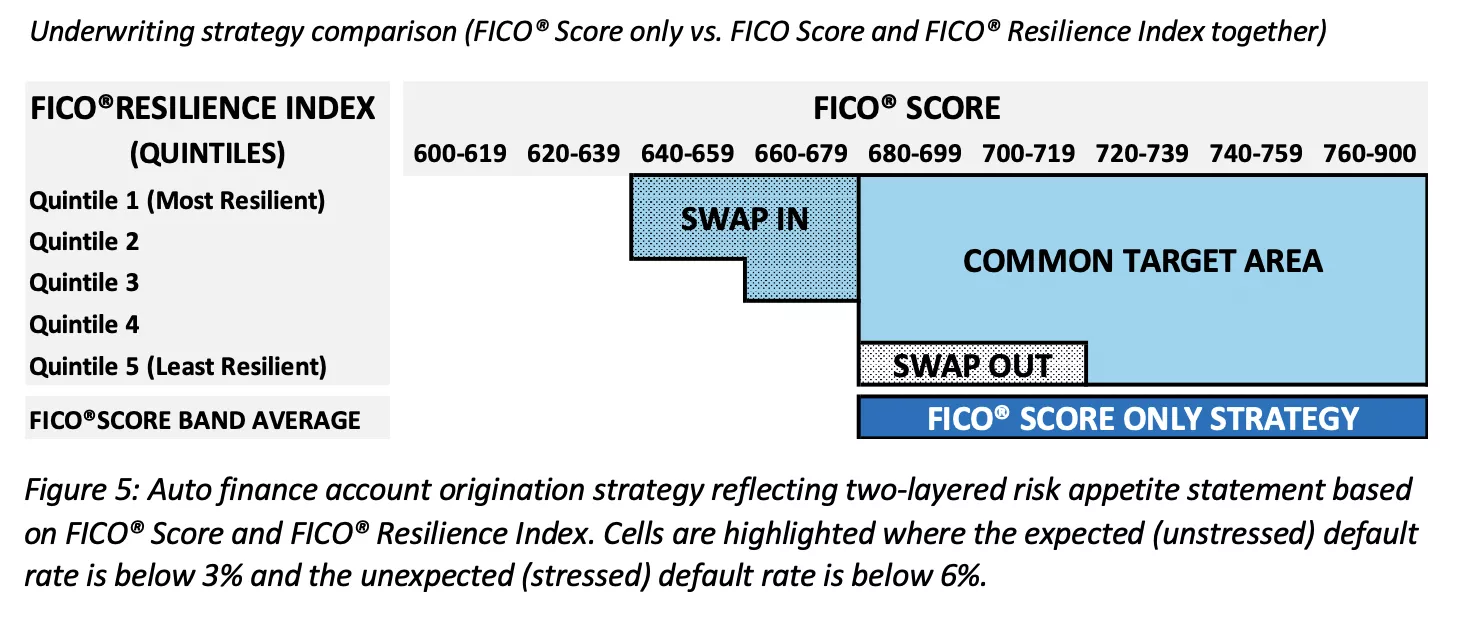

One framework we recommend incorporates a two-layered risk appetite statement in the following form: We will accept applicants with expected default rates less than X% and stressed default rates less than Y%. When times are benign, Y may be significantly higher than X to protect against remote downside risk; in more uncertain times, Y and X may be more similar.

Applying this framework to the example above, a lender’s auto finance origination risk appetite statement may read: We will accept applicants with expected default rates less than 3% and stressed default rates less than 6%.

Using FICO® Score alone, Figure 1 reveals that the lowest FICO Score cut-off that meets both criteria is 680. Introducing a two-layered risk appetite statement would therefore shift the FICO Score cut-off 20 points higher during a benign economy than the current strategy.

Incorporating FICO® Resilience Index allows a more precise implementation of the two-layered risk appetite statement due to its ability to differentiate credit risk performance under stress within narrow FICO® Score bands.

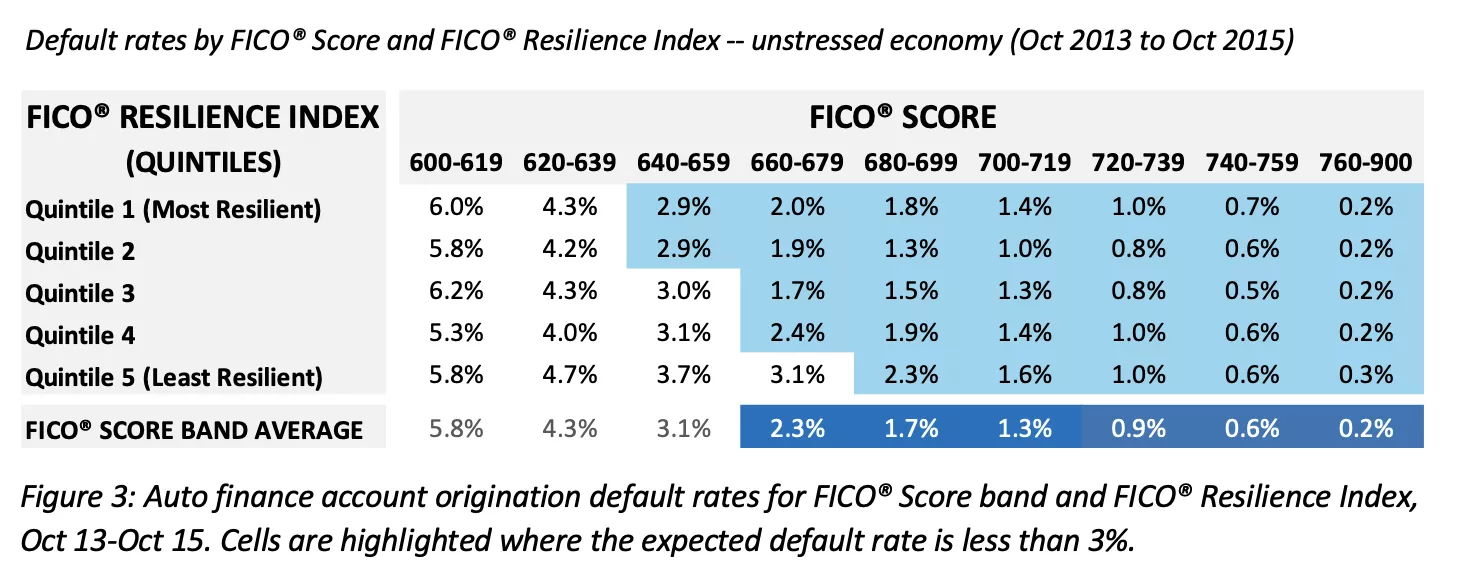

Figure 3 shows auto finance performance through the benign economy of October 2013 to October 2015. As expected during a benign period of the economy, there is no significant difference between the population that meets the desired 3% cut-off based on FICO® Score alone (i.e., a FICO Score cut-off of 660) and the one based on a combination of FICO Score and FICO® Resilience Index.

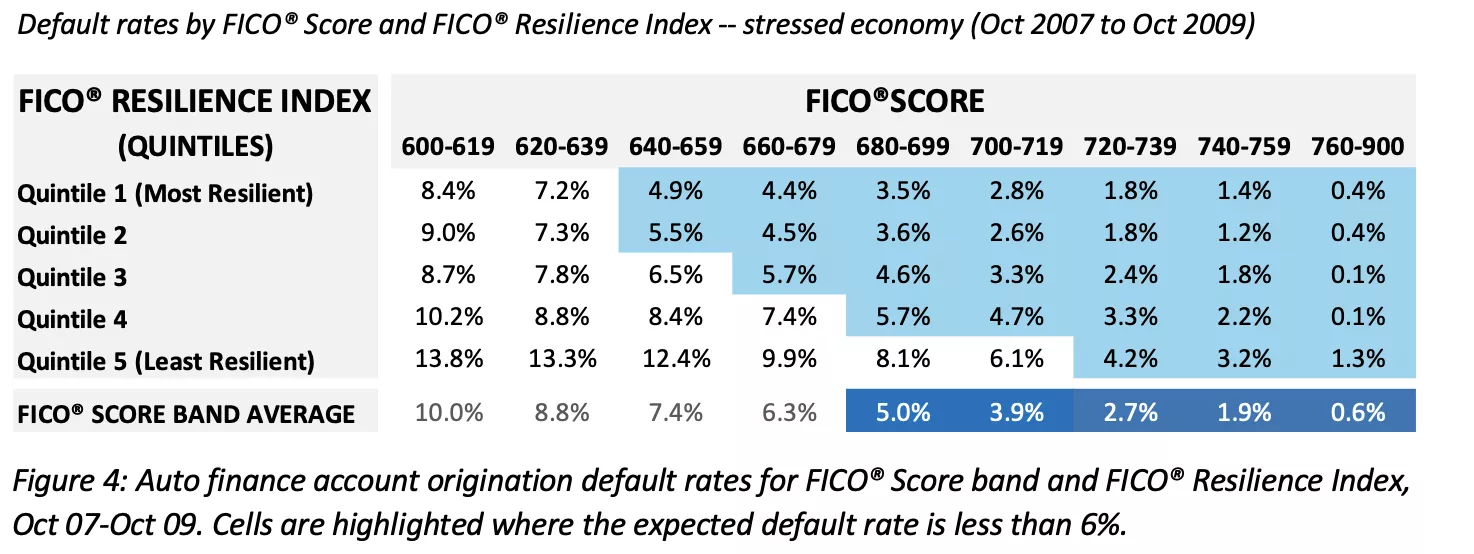

In contrast, Figure 4 shows the same stressed auto finance performance presented in Figure 2, but cells are only highlighted where the default rate fell below the maximum stressed default rate of 6%. Here, FICO® Resilience Index allows a more refined view of the eligible population, as expected.

Implementing the two-layered risk appetite statement therefore identifies the populations that meet the required criteria on both charts. As seen in Figure 5, while the approach using FICO® Score alone would result in a simple FICO Score cut-off of 680, the combined strategy using both FICO Score and FICO® Resilience Index would swap in more resilient applicants just below that FICO Score cut-off and swap out less resilient applicants just above it.

Relevance to other industries

While the above example illustrates the application and benefit of the combined use of FICO® Score and FICO® Resilience Index to adjust auto finance underwriting decisions, lenders can expect to reap similar value across other industries (e.g., bankcard, mortgage, unsecured personal lending), especially when leveraging the upcoming update to FICO Resilience Index, which we will discuss shortly. Further, the ability to rank-order applicants’ resilience to economic downturns (expected or unexpected) offers intuitive value for related account origination decisions such as account pricing, product qualification, and initial loan (or line) assignment.

Improvements ahead for FICO® Resilience Index

The current version of FICO® Resilience Index was introduced in 2020 at all three major US credit bureaus: Equifax, Experian, and TransUnion. We are thrilled to announce that FICO® Resilience Index 2 will be available by Summer 2021, featuring significantly improved rank-ordering performance across products and credit lifecycle decision points.

Incorporating a two-layered risk appetite takes full advantage of FICO® Resilience Index’s ability to differentiate performance under stress. The additional insight from FICO® Resilience Index 2 can provide lenders more refined decision-making power, even during benign periods of the economy.

Look out for the next of our series in the coming weeks, "Building Resilience into Customer Management." Please visit the FICO Blog to keep up to date on all of FICO’s latest insights and offerings.

To gain more background about the FICO® Resilience Index, please visit https://www.fico.com/en/products/fico-resilience-index.

This blog is co-authored with Jim Patterson, senior director, Global Credit Lifecycle Practice - FICO Advisors

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.