Let's Expand Credit Access Responsibly

We are launching a campaign to counter the widespread misinformation regarding important credit scoring facts and how to expand credit access responsibly.

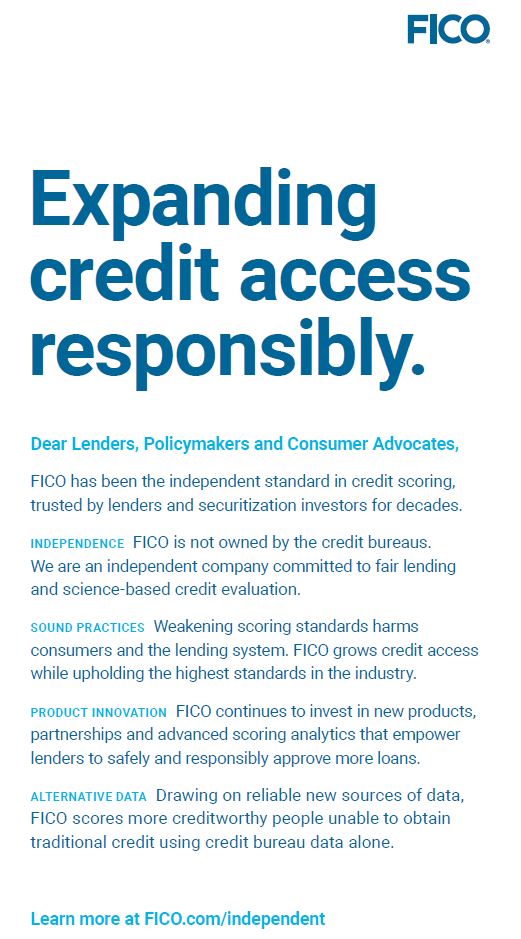

Today, FICO took out a full-page ad in the Wall Street Journal. This is the start of an initiative to clarify and bring transparency to credit scoring standards in the mortgage market. With calls by VantageScore, a credit scoring company owned by the three major credit bureaus, to retool the entire mortgage ecosystem to adopt new credit scoring models, the stakes are high to get this right. Therefore, we are launching a campaign to counter the widespread misinformation regarding important credit scoring facts and how to expand credit access responsibly.

One quick example: VantageScore is calling for updated scoring models on the basis that consumers should benefit from their telco and utility payment data. What it deliberately ignores, however, is that the longstanding FICO Score models integrated into Fannie Mae and Freddie Mac already incorporate this very data, that is whatever telco and utility data exists in the traditional credit bureau files. Lenders and other stakeholders deserve to know the truth about this and other important credit scoring facts.

FICO has long been committed to finding solutions that actually drive credit access. For over 25 years, FICO has been recognized as an independent and trusted partner to all stakeholders in the mortgage market — investors, GSEs, lenders, consumers and regulators. We are working to expand credit access to millions of Americans responsibly, without compromising the standards that keep our lending system secure.

Please take a moment to learn more about the issue at FICO.com/independent.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.