Merchant Acquiring Mastery: Three Game-Changing Strategies for Competitive Advantage

Merchant acquirers now demand sophisticated onboarding automation, dynamic pricing intelligence, and predictive analytics to win and retain profitable merchant relationships

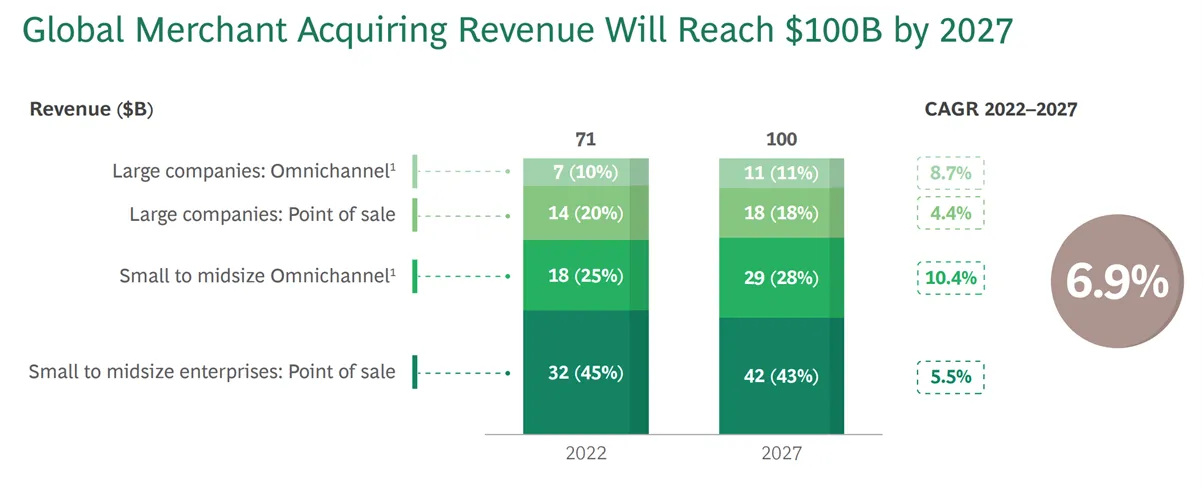

The merchant acquiring industry is not about basic payment processing—it's about strategic customer relationship management that drives measurable business growth. This industry is expected to reach a $100 billion market by 2027, according to a BCG report, with a growth rate of 6.9% between 2022 and 2027, where SME merchants with fewer than 250 employees are expected to make up 70% of the revenue base.

Source: https://media-publications.bcg.com/Surviving-the-Merchant-Acquiring-Paradigm-Shift.pdf

For newbies on this matter, who seek to understand how the agents of this industry interact from within, comes the question, “What is a merchant acquirer”?

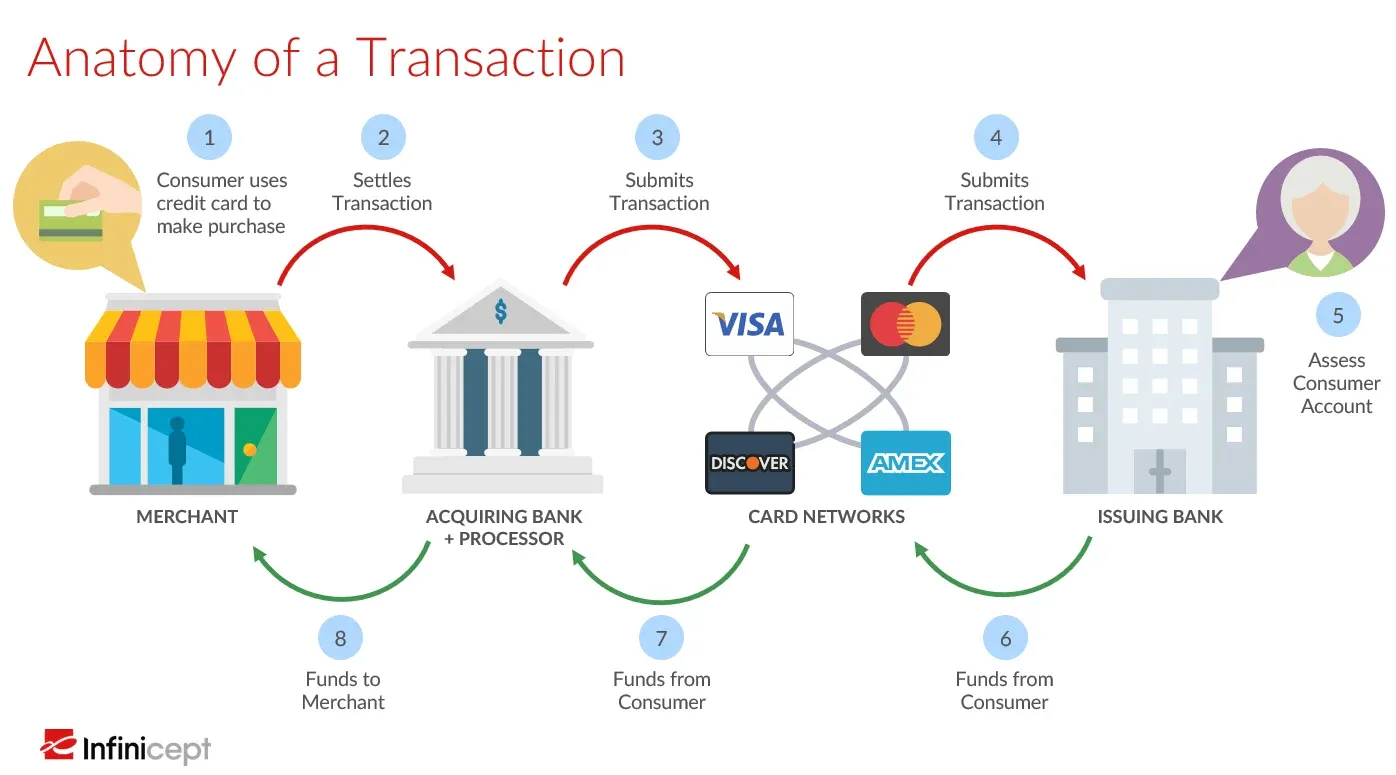

An acquirer, also known as an acquiring bank or merchant acquirer, is the financial institution that partners with businesses to process their credit and debit card transactions. It plays an intermediary role between businesses, payment processors, and issuing banks, ensuring that transactions are authorised, processed, and settled securely. From the perspective of electronic payment, acquirers play a role in establishing and maintaining merchant accounts – they allow businesses to accept card payments, they facilitate the authorisation and settlement of transactions between the business and issuing bank, and lastly they assume the risk of chargebacks, fraud and disputes.

During a card transaction, the acquirer acts as an intermediary by forwarding the payment request via a card processor and network the customer's card-issuing bank. Upon receiving approval from the issuing bank, the acquirer completes the transaction process and transfers the funds to the merchant's business account, typically within several business days.

Acquirers are essential for enabling businesses to accept card payments and handle the settlement process seamlessly. Nonetheless, this is a commoditised service, and the fierce competition additionally to changes in the regulatory scenario are compressing the margins.

The transformation need is stark: merchant acquirers now demand sophisticated onboarding automation, dynamic pricing intelligence, and predictive analytics to win and retain profitable merchant relationships.

Three Strategic Imperatives for Merchant Acquiring Excellence

1. Perfect Your Onboarding Machine

In every customer journey, the first impression is a key item to success, as a seamless onboarding process is fundamental for an outstanding relationship between the merchant and acquirer. From a technical optic to measure success, time to activation (TTA) is a critical competitive weapon that can be measured to deploy a state-of-the-art experience.

As leading acquirers seek to deliver seamless merchant onboarding experiences and solutions, it is crucial to focus on automated digital KYC, facial recognition and real-time screening to reduce friction and increase merchant activation rates; that can be seen on the latest Worldpay GPR report, where “Merchants seek fast, frictionless payment without increasing fraud risk”.

Success Formula: Prioritise user experience simplicity, cost-effectiveness, robust SLA-backed support, and proven market reputation when selecting onboarding technology.

2. Deploy Dynamic Pricing Across Customer Lifecycles

Static MDR (merchant discount rate) models are obsolete. Advanced acquirers segment merchants by MCC codes, sales volume, card type distribution, and chargeback rates to optimize pricing continuously. This means real-time MDR adjustments during onboarding and periodic portfolio reviews that balance profitability with retention are crucial to evaluate the optimal approach to provide the most accurate MDR for that specific account.

The pricing itself is not only limited to the MDR calculation, but also to how to tailor and design an appropriate offer, as pricing process affects each new and legacy merchant across the portfolio, where pricing periodic review is necessary – as the pricing process might also include operationalising rental fees calculation monthly, as per the options below:

- Rental fees calculation, exemption period

- Simulate results before implementing seasonal campaigns

- Authority flow for price review

- Governance over different partners and channels’ strategies

Strategic Advantage: Pricing strategies that adapt across acquisition, monetization, retention, and recovery phases deliver superior portfolio performance and competitive positioning.

3. Implement Predictive Portfolio Management

Modern merchant acquiring demands comprehensive risk assessment and profitability monitoring, as each merchant will interact and demand services throughout its life cycle. An integrated history of events and customer interactions by any touch point is needed to guarantee a complete view of the relationship and merchant behaviour, as monetisation and retention can be leveraged based on the merchant’s profile (e.g., credit line offer, chargeback insurance).

Acquirers need cutting-edge technology that provides integrated customer interaction history, proactive maintenance strategies, and AML portfolio monitoring -- with a focus on early identification of volume variations, margin deviations, and financial risk indicators across their entire merchant base.

Case Study in Mercant Acquiring: Worldpay

By the deployment and support of FICO Platform, Worldpay was able to accelerate merchant onboarding, allowing the business to compete against new software and fintech disruptors where merchant onboarding timelines had been drastically reduced. For this specific use case Worldpay sought to reduce manual merchant onboarding process timelines from up to nine days to just minutes.

The Competitive Imperative

Merchant acquiring success now demands precision execution across onboarding excellence, dynamic pricing intelligence, and predictive portfolio management as per the recent Capgemini World Payment Report. Acquirers who deploy these customer-centric strategies—supported by comprehensive KPI frameworks—will dominate market share in an increasingly digital payments landscape.

The data is clear: those who transform their merchant relationships through strategic customer management will capture the outsized returns available in this evolving industry. Your competitive advantage depends on how quickly you can implement these proven strategies.

How FICO Can Supercharge Your Acquiring Business

- Read Why Merchant Acquirers Need Digital Decisioning Platforms

- Read our paper Transforming Merchant Acquiring with FICO

- Discover our approach to merchant acquiring

- Read our executive brief Merchant Onboarding & Originations on FICO® Platform

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.