UK Cards: Spend and Balances Rose in March / April 2023

Unpredictable consumer spending puts banks on high alert as deadline for new Consumer Duty Guidance nears

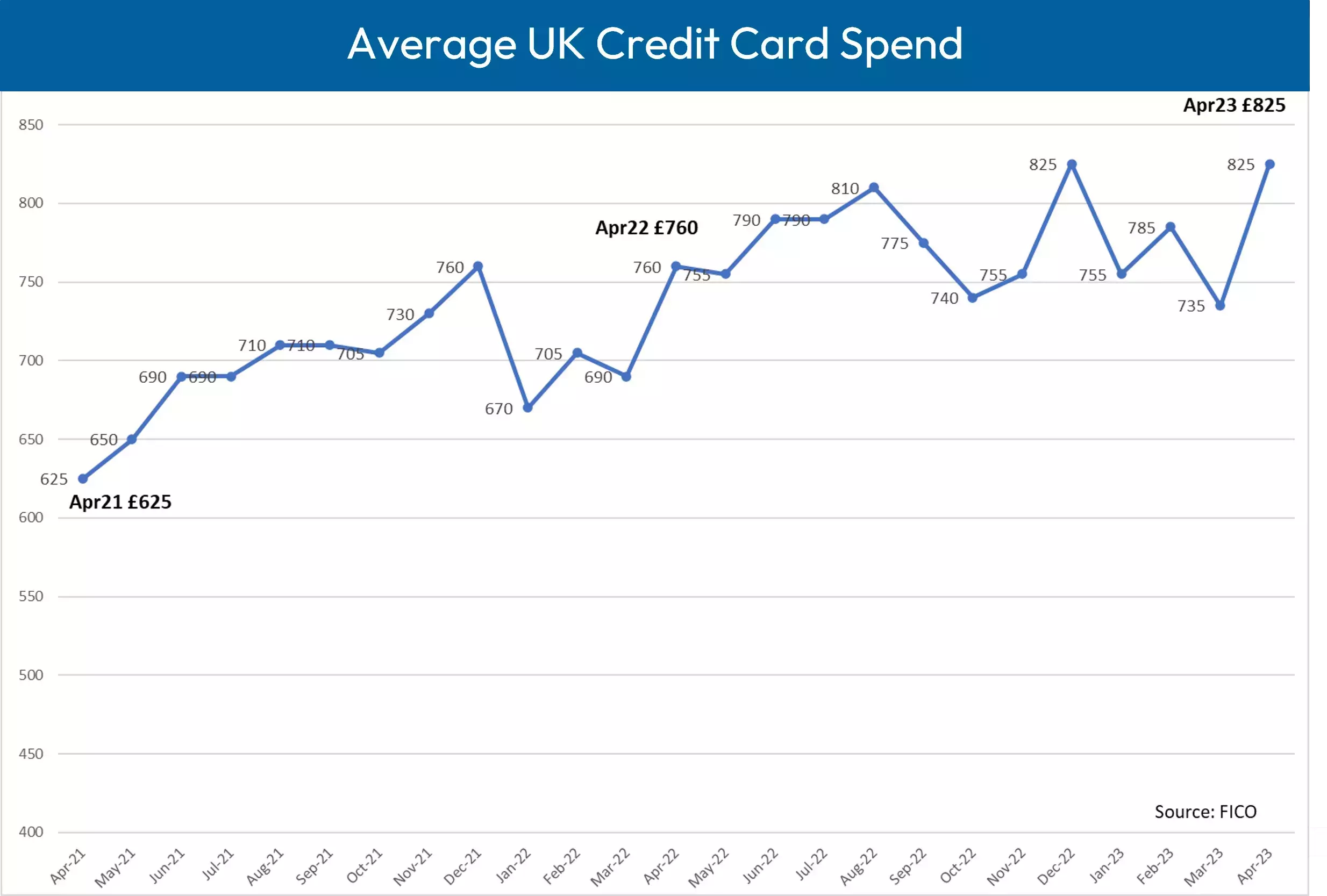

How are consumers in the UK managing their finances in a period of high inflation and interest rates? Our latest data on UK credit card trends shows financial volatility and higher levels of credit card spend, compared to 2022 – with monthly spend up by 6.7 percent in March and 8.7 percent in April.

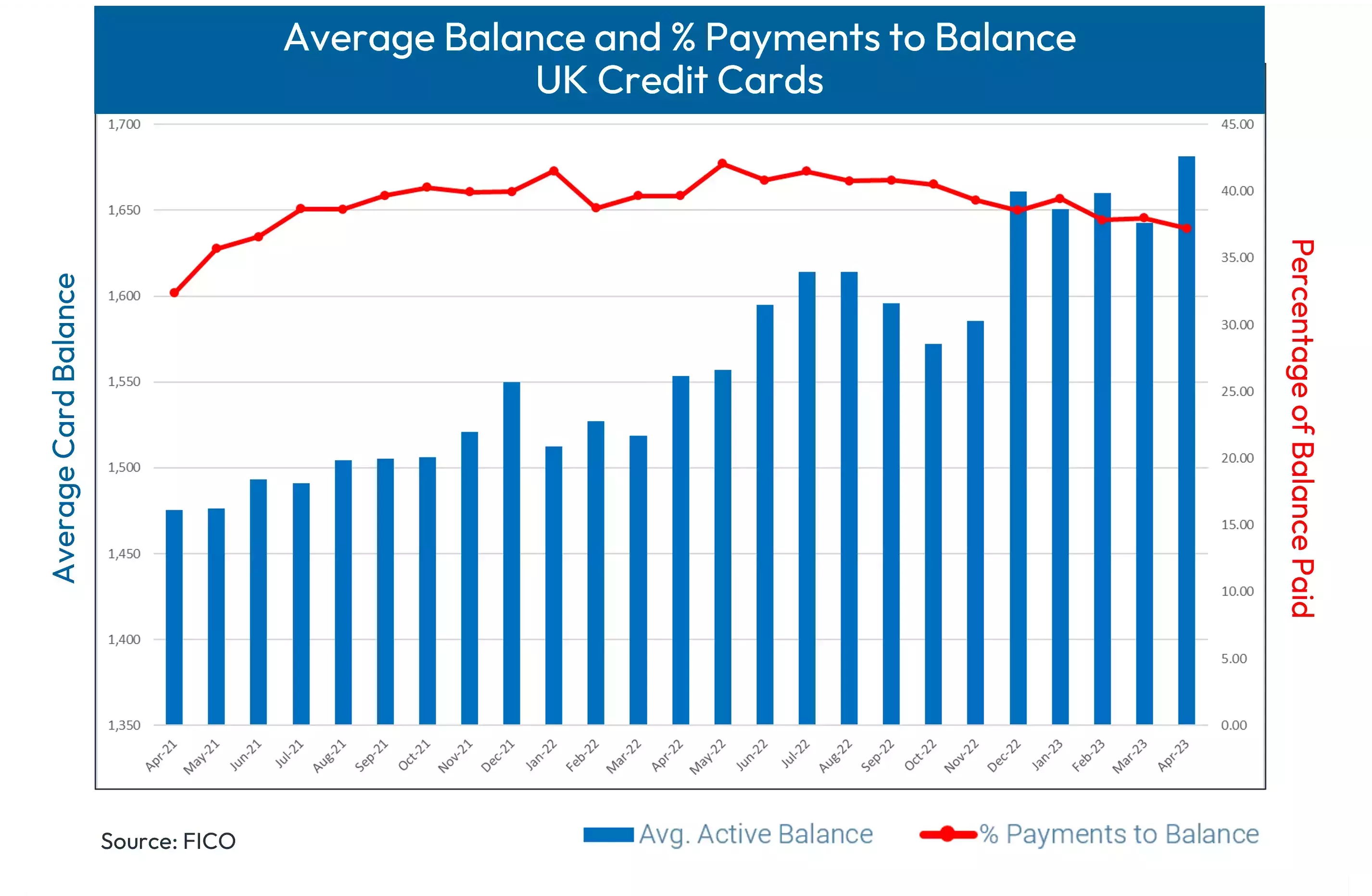

This forms part of a long-term trend; spend in April 22 was already 21% higher than the equivalent period in 2021. As a consequence of these increases in transactions and spend, the average active credit card balance for both March and April 2023, is 8.2 percent higher than last year.

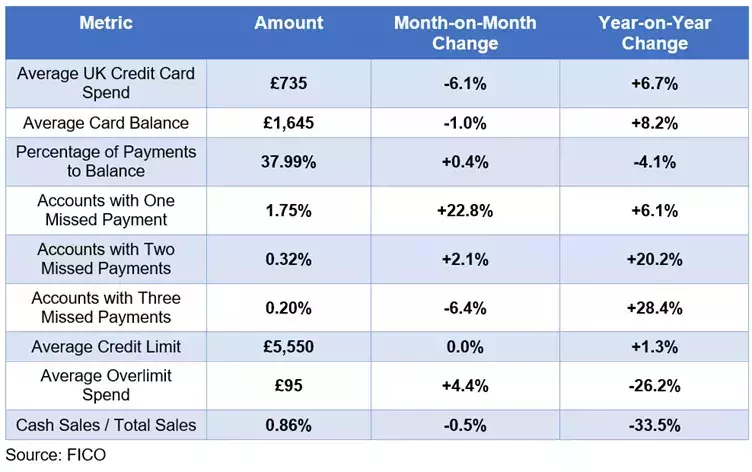

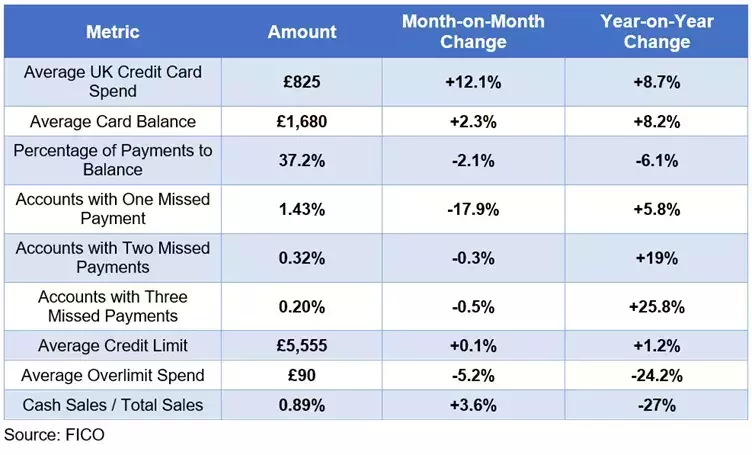

When comparing month-on-month movements in spend and arrears, the continuing juggling act being performed by many consumers becomes apparent. Data for March and April shows a continued see-saw in spend and card repayments patterns. In March, spend was down 6.1 percent compared to February 2023; the percentage of accounts missing one credit card payment was up 22.8 percent. In April there was a 17.9 percent drop in accounts with one missed payment, whilst the percentage of accounts having missed two payments reduced slightly. This suggests that many customers are juggling their finances, skipping payments one month and trying to make it up the next month.

Highlights

- Average total sales down month-on-month by 6.1 percent in March and up 12.1 percent in April at £735 and £825, respectively

- Percentage of payments to balance fell year-on-year in both months – by 4.1 percent in March and 6.1 percent in April

- Month-on-month, after falling by 15.6 percent in February, the percentage of accounts missing one payment jumped back up in March by 22.8 percent and then fell again in April by 17.9 percent

- Accounts with two missed payments were relatively stable month-on-month in March and April. However, year-on-year they are still significantly higher - by 20.2 percent in March and 19 percent in April

- Average balances across both months are up 8.2 percent year-on-year to £1,645 in March and £1,680 in April

- Another sign of financial stress is the use of credit cards to take out cash – in April this increased month-on-month by 4.5 percent and 9.4 percent year-on-year

Consumer Duty Guidance Deadline Nears

The yo-yo pattern of financial management — seen for the last few months — reflects the general economic uncertainty, particularly for mortgage holders. With increased scrutiny as the new Consumer Duty Guidance comes into force on 31st July, lenders will be wanting to apply the highest levels of account management.

Areas of particular concern will be the pattern of increased spend but reduced percentage of payments to balance. The average credit card balance has generally been trending upwards since the pandemic slump, and is now back at levels seen pre-COVID.

How consumers are managing their existing financial commitments — especially those who have found themselves, perhaps for the first time, with one missed payment — will also be important to monitor. As the percentage of accounts with one missed payment yo-yoed from March to April, lenders will be looking for any signs of increased financial stress, for example if the percentage of those missing two payments increases.

Currently it seems that cardholders are making a concerted effort not to roll arrears forwards, with the percentage of two missed payments only increasing by 2.1 percent in March and actually decreasing by 0.3 percent in April. However, with such volatile conditions, lenders will want to remain focused on these trends in the next few months.

Key Trend Indicators – UK Cards March 2023

Key Trend Indicators – UK Cards April 2023

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80 percent of UK card issuers.

How FICO Can Help You Manage Credit Card Risk and Performance

- Explore our solutions for customer management

- See my post on UK Credit Card Trends: From 2008 Crash to Cost-of-Living Crisis

- Read more posts on UK cards

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.