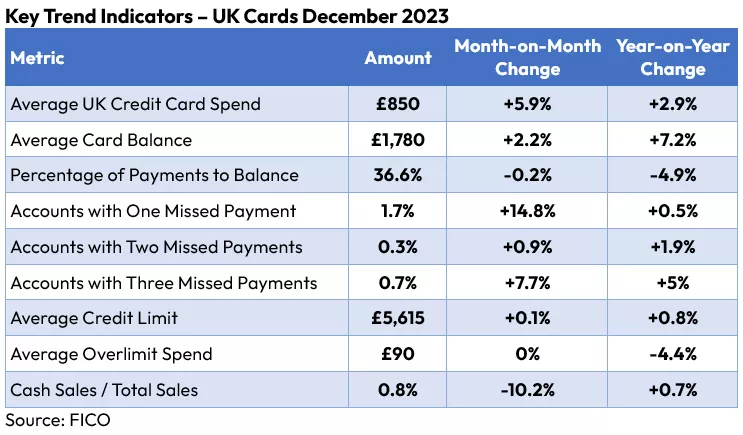

UK Credit Cards: Average Spending and Balances Reach New High

High prices lead to highest average credit card spend and balances since FICO records began

The FICO UK Credit Card Market Report for December 2023 reflects the usual season trends in UK spending and payments. However, it also reflects the impact of continued high prices on credit card balances. This latest report shows the highest levels of both average spending and average credit balances on UK cards since 2006, when FICO first began benchmarking credit card use and payments in the UK.

Highlights

- Average UK spending on credit cards increased by 5.9% on the previous month, to £850

- Average balance on credit cards rose by 2.2% month-on-month and 7.2% year-on-year, leading to an average balance of £1,780

- 14.8% more UK consumers missed a credit card payment month-on-month and 0.5% more compared to the same month in 2022

- There has been a 1.3% decrease in the average credit balance for those consumers missing one payment

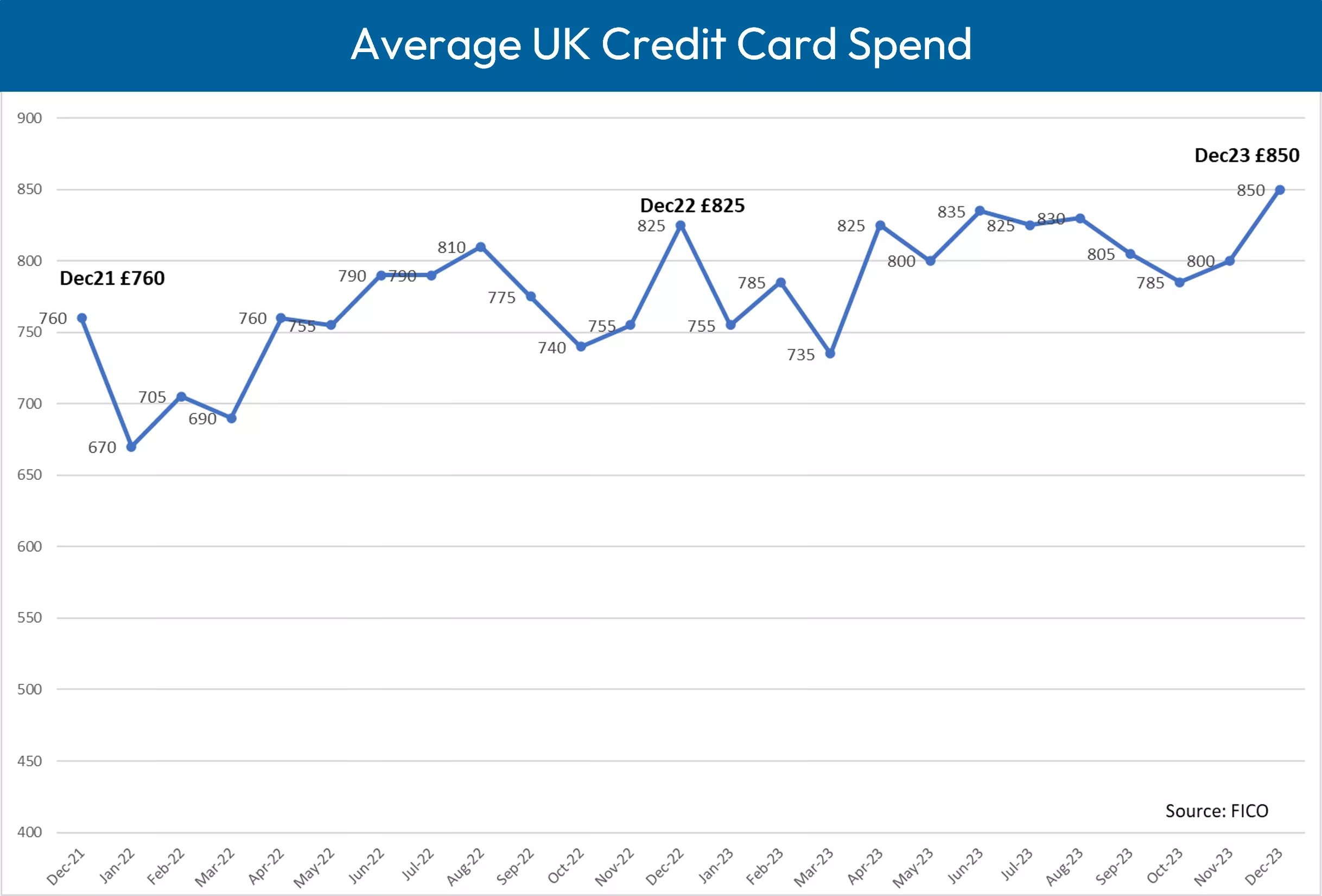

Increased spending on credit cards always occurs in December, and 2023 was no exception with a 5.9% month-on-month rise, taking the average spending to £850. This is the highest spending in the UK since FICO records began in 2006.

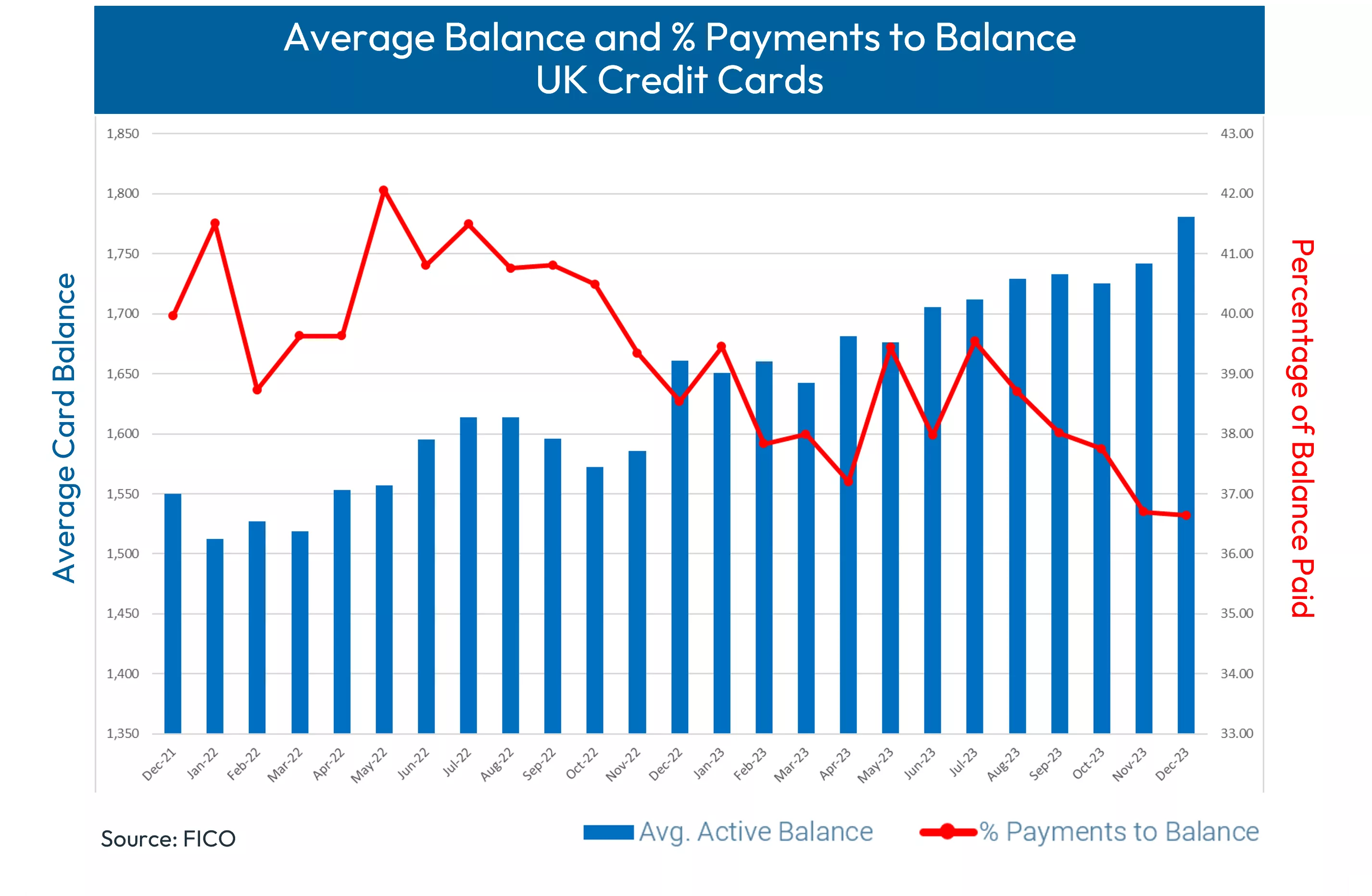

The average credit balance in the UK continued to trend upwards, as expected in the lead up to Christmas. December 2022 saw record average balances on credit cards. In December 2023 that record was broken with average credit balances up 2.2% month-on-month and up 7.2% year-on-year. The average balance now stands at £1,780. It is anticipated that this trend will fall post-Christmas, however with prices remaining high lenders will want to monitor closely how much it will fall, and for how long it will remain lower.

Another pattern typical of December was the amount paid off credit card balances as UK consumers focussed their cashflow on Christmas spending. In December 2023 the average balance paid off dropped slightly, by 0.16%, month-on-month. However, this measure has been trending down since July.

Balances and Late Payments

Pre-COVID-19, for UK consumers the average credit card payment compared to the overall balance was approximately 30%, but with lockdown and increased savings this rose to 42%. The FICO data now shows this dropping back, although it is currently still 6% higher than before the pandemic.

Another sign of pressure on finances was the number of UK consumers missing one, two and three credit card payments. This increased from November to December 2023, with the largest increase seen for those missing one payment: a 14.8% increase month-on-month and a 0.5% increase compared to 2022. Again, seasonality influences results with similar volumes expected in January as a result of the post-Christmas spending hangover. Lenders will also want to be mindful that higher numbers of UK consumers missing one credit card payment in December are likely to roll over into two payments in January.

Issuers should note that established cardholders – those who have had their credit card between one and five years – are the most likely to miss payments. This group contains customers whose 0% offers have expired, and they are now paying off balances at the standard rate. FICO recommends monitoring this group for signs of vulnerability and indebtedness. Now is a great time to review existing collections strategies and examine whether anything more can be done to proactively identify and assist financially distressed consumers.

These credit card performance figures are part of the credit data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80% of credit card issuers in the UK. For more information on these credit trends, contact FICO.

How FICO Can Help You Manage Credit Card Risk and Performance

- Explore our solutions for customer management

- See my post on UK Credit Card Trends: From 2008 Crash to Cost-of-Living Crisis

- Read more posts on UK cards

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.