Why Should Banks Automate More Fraud Communications?

Fraud communications and other interactions are increasingly seen as a vital part of the customer experience.

It used to be that KPIs for the fraud department focused only on loss prevention, aligned to the amount of fraud stopped and money saved – this is no longer the case. Fraud communications and other interactions are increasingly seen as a vital part of the customer experience.

In a recent survey, we asked heads of fraud where they thought the most revenue was lost. Almost half reported that the amount lost to poor customer experience, as a result of false positives, was higher than the amount lost to genuine fraud.

Fraud departments that step up to play their part in customer retention and satisfaction are transforming themselves on the balance sheet to a revenue-generating center. To this end, today’s fraud department is likely to have additional targets that include:

- Customer satisfaction

- Reduced false positive ratios

- Reduction in cost of operations

- Target levels of automated fraud communications (to remove friction from the customer journey, improving customer experience)

Those businesses that don’t respond to consumer demand for convenience will ultimately fail. We’ve already experienced this; once-ubiquitous brands such as Blockbuster and Woolworths have disappeared. Conversely, those that offer a friction-free customer experience prosper; Netflix, Amazon and Monzo are some examples.

What Interactions Can You Automate?

The fraud team can inadvertently block a smooth customer journey, but automation helps by:- Making alerts to suspected fraud fast and appropriate. This is done by using automated channels to contact customers with fraud communications on their preferred channel. Because there is no need to wait for a human operative to take action, disrupted processes can be put back on track quickly.

- Giving customers more control. Automated methods allow them to make decisions that make their lives easier — for example, to freeze a card, or prove a transaction is legitimate and allows it to proceed.

- Letting customers use the channels they love to access other areas of the bank quickly. For example, customers can use touchID to authenticate when trying to start a conversation with an agent in telephone banking.

Despite the focus on customer experience, the fraud department must still meet objectives related to identification of customers and resolution of fraud cases. Fortunately, we found that the role of automation is equally important in delivering this. We have seen a direct correlation between the amount of automation and the overall resolution of all fraud cases. The more channels and processes that were automated for fraud management, the more likely it was that a case would be fully resolved, even outside of the automated channels.

How Many Interactions Are Fraud Departments Automating?

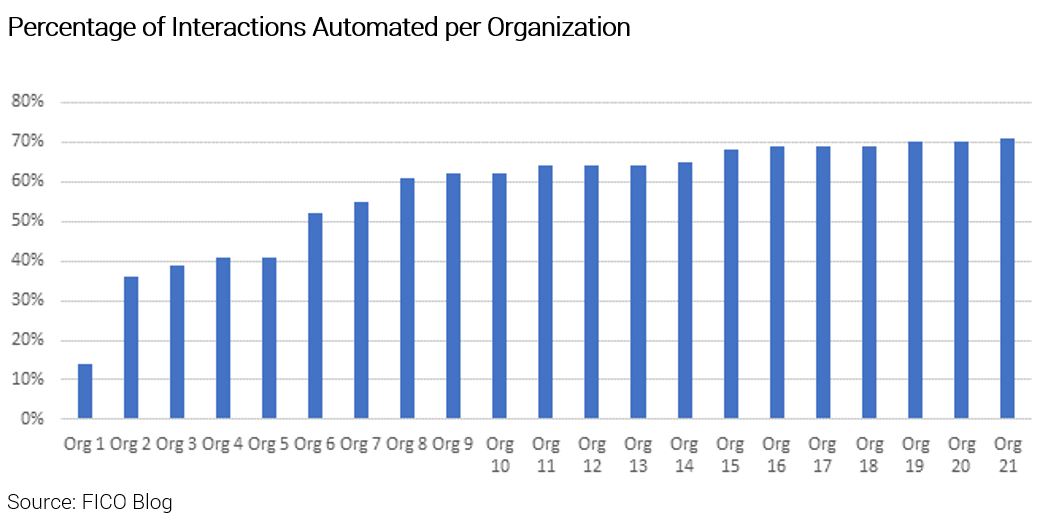

Despite the clear benefits of automating fraud interactions, there is a wide range in the amount of automation deployed, as shown below.

Since automation improves both customer satisfaction and case resolution, those at the lower end of the adoption scale are taking a big risk. The reputation of their brand, the value of their organization and ultimately their own jobs are at risk – a fraud department that is not performing is a candidate for outsourcing, and we have seen this happen.

There are legitimate reasons why some organizations have not yet embarked on fuller automation programs. They may have concerns about the security of automated channels or had negative customer feedback about a previous attempt at automation. In my next blog post I will write about these challenges and how they can and should be overcome.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.