Credit Union Borrowers Use and Seek Credit More Than National Bank Borrowers

Credit union lenders need to be mindful of balancing opportunity and risk with their credit decisions

Credit Union Borrowers Show Higher Credit Activity

In a previous blog, we shared the average FICO® Score for credit union borrowers has slightly decreased in each of the last two years due to higher levels of delinquencies and growing debt levels over time.

As we further explore the credit union customer population, the FICO Analytics team has found credit union borrowers use credit more than national bank borrowers, in the form of higher debt levels, searches for new credit, and greater likelihood to have an open auto loan, mortgage, personal loan, or student loan. These findings provide credit union lenders with deeper credit decision insights and opportunities to safely grow their lending portfolios. This also means that lenders need to be aware of emerging credit risks.

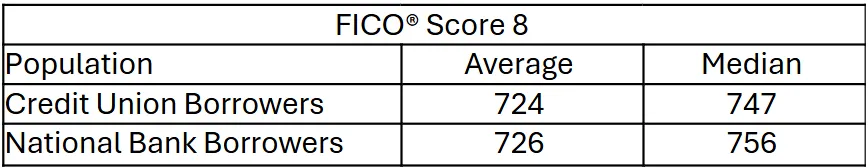

Evaluating data from January 2025, we found that 23% of the FICO scorable population has at least one open credit account at a credit union in their credit history, while 88% have at least one open account at a national bank. The average FICO® Score for the credit union population was 724, two points lower than the average credit score for the national bank population (726), as seen in Figure 1.

Figure 1: Average and median credit scores as of January 2025

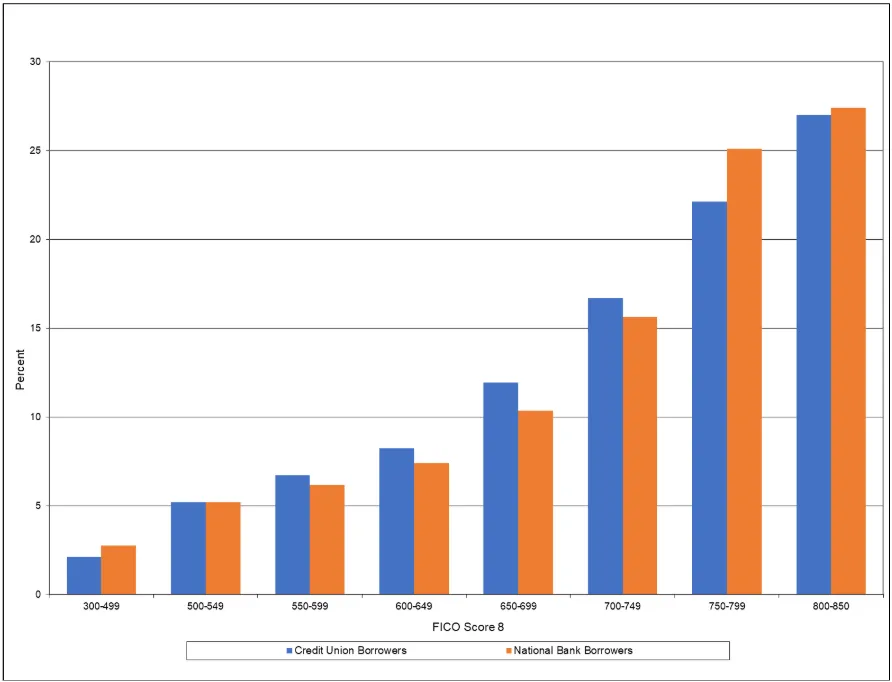

Meanwhile, the median credit score for credit union borrowers was 747, which is 9 points lower than national bank borrowers, who had a median score of 756. Credit union borrowers are more likely to have credit scores in the middle of the score range than national bank borrowers. As seen in Figure 2, we found that 44% of credit union borrowers have a credit score of 550-749, while only 40% of national bank borrowers have a credit score in this range.

Figure 2: Score distributions as of January 2025

Missed Payments Higher Among Credit Union Members

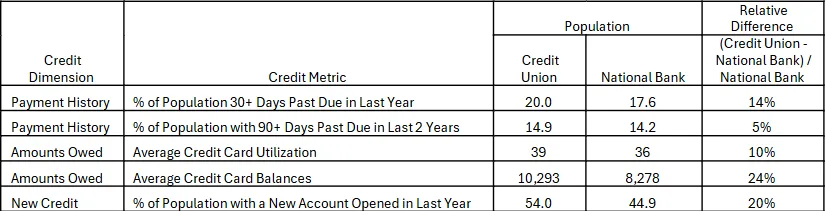

Digging further, we see in Figure 3 that those with a credit union account have higher rates of missed payments compared to their national bank counterparts. The percentage of credit union borrowers with a missed payment in the last year is 20.0%, which is higher than the corresponding percentage for national bank borrowers of 17.6%, a relative difference of 14%.

Paying bills on time can positively impact the FICO® Score. The “Payment History” category represents roughly 35% of the FICO® Score calculation. Late payments could have a negative credit score impact.

Figure 3. Credit metrics for credit union and national bank populations

Credit Union Borrowers More Likely to Open New Accounts

Additionally, credit union borrowers have higher debt levels than national bank borrowers. Average credit card balances were $10,293 for those with a credit union account vs. $8,278 for those with a national bank account, a 24% relative difference. Similarly, credit card utilization was 39% for credit union borrowers compared to 36% for national bank borrowers.

Maintaining low balances on credit cards can have a positive impact on the FICO® Score because the “Amounts Owed” category represents roughly 30% of the overall credit score calculation.

Additionally, we see that credit union borrowers are more likely to open new accounts; 54.0% of those with a credit union account opened a new account in the last year while 44.9% of those with a national bank account initiated a new credit obligation in the last year, a 20% relative difference.

Those who refrain from opening new credit accounts can maintain or improve their standing in the “New Credit” category, which represents about 10% of the FICO® Score calculation.

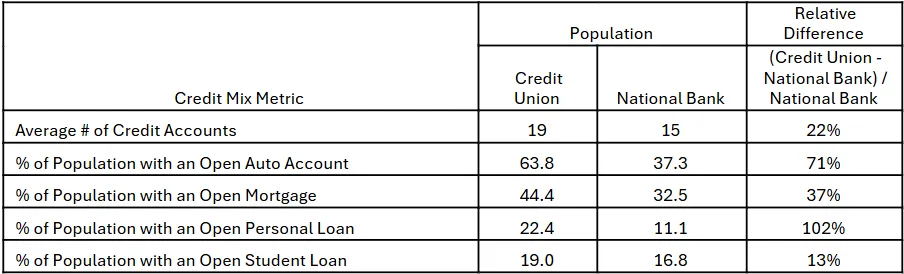

Finally, we see in Figure 4 that credit union borrowers have more credit accounts on average than national bank borrowers with 19 credit accounts on average for credit union borrowers and 15 accounts on average for national bank borrowers. This may be partly driven by the fact that 85% of credit union borrowers also have an open national bank account, while only 23% of national bank borrowers have an open credit union account. On the other hand, the increased usage of credit accounts for credit union borrowers extends to a variety of different types of credit, including auto loans, mortgages, personal loans, and student loans.

Figure 4: Credit mix for credit union and national bank borrowers

Credit union borrowers have higher credit card utilization rates, higher account opening rates, and a broader mix of credit types. This demonstrates that credit union borrowers are generally more likely to utilize credit than their national bank counterparts. Additionally, they are more likely to fall into the middle of the credit score distribution. Ultimately, credit union lenders have both an increased opportunity because the population is more credit hungry and willing to take on new credit than the national bank population but also exhibit increased risk in the form of higher delinquency rates. We encourage credit union lenders to craft their strategies based on their credit risk/reward appetite.

FICO’s Role in Empowering Smarter Credit Decisions

Leveraging advanced analytics, FICO is dedicated to helping lenders gain deeper insights into the credit risk that each borrower represents, enabling them to make more informed lending decisions. Through platforms such as myFICO.com where consumers may check their credit score and initiatives like Score A Better Future and FICO® Score Open Access, we strive to educate and empower consumers. Our commitment to responsible financial inclusion is reflected in our significant investments in alternative, data-driven solutions such as UltraFICO® Score and FICO® Score XD to provide millions of people with a pathway to mainstream credit access.

If you have more questions, please visit these helpful resources:

Lenders and borrowers can explore how credit union members manage financial obligations like mortgage and payment behavior, and how these factors influence their FICO® Score. Learn more by reading, “The Perfect Credit Score: Understanding the 850 FICO Score”, and our eBook “Understanding Your FICO® Scores” which also explains how different types of credit—such as credit union loans—can impact your score, as well as the latest average FICO Score in the US.

Whether you're comparing money-saving strategies, evaluating fee structures, or considering your next mortgage or credit option, staying informed is key myFICO.com explains what is a FICO® Score and why it's important to stay informed

You can also learn about your credit report, how to get a copy, and your rights around credit union and national bank reporting through USAGov

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.