Debit Card Compromise in 2024: Events Up, Number of Compromised Cards Down

Debit card skimming in the US in 2024 was a mixed bag, with increases in reported incidents but decreases in total number of compromised cards

In what’s become an annual tradition, about a year ago I shared insights about the state of card skimming in the US in 2023. We recently reviewed data from the entirety of 2024, and while there is some cause to celebrate, we continue to see the need for vigilance and action from issuers.

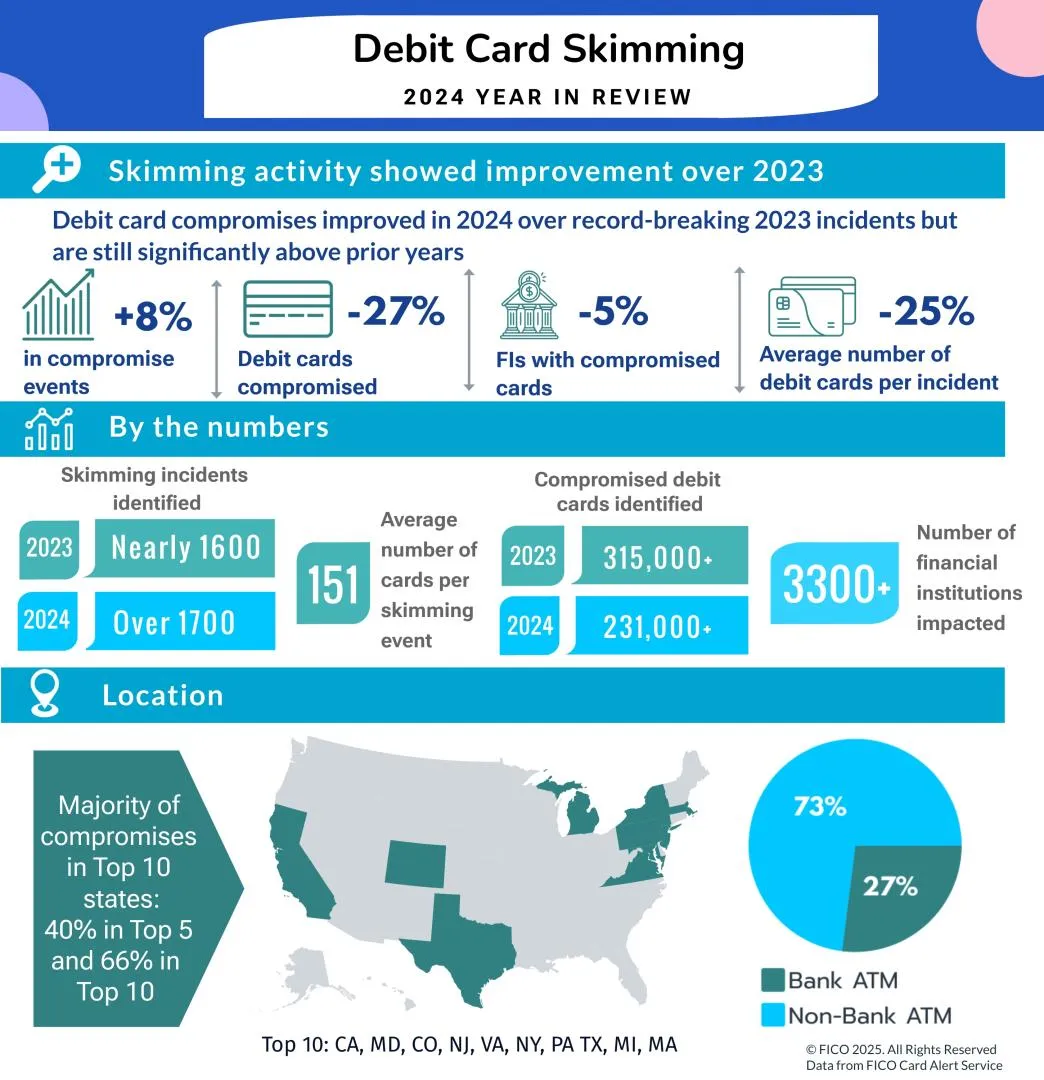

For 2024, we saw a welcome decrease in the total number of compromised cards resulting from skimming activity. Total compromised debit cards were down 27%, with 231,000+ cards impacted (compared to the more than 315,000 cards impacted in 2023). There was also a slight decrease in unique financial institutions (FIs) impacted, down from roughly 3,500 in 2023 to 3,300 in 2024.

While those minor declines were encouraging, the results from the second half of 2024 compared to the first half indicate that skimming is back on the rise. The second half of the year had a 30% increase in compromised debit cards compared to the first half of the year, and compromise events increased 46% in the second half of 2024 compared to the first half.

Based on preliminary data from the first quarter of 2025, I expect to see continued increases in skimming points of compromise (POCs) and compromised cards for 2025.

Points of Compromise Remain Sticky

In my last post, I noted the increase in POCs at bank ATMs. That trend seems to have somewhat subsided, with bank ATM POCs now representing 27% of compromise locations. The majority of compromises still occur at non-bank ATMs – like free-standing terminals in convenience stores – so debit card users should remain vigilant and cautious when using any point-of-sale terminal, ATM (in-bank or not), or other location where a fraudster could have planted a card skimmer.

For 2024, we saw several of the same states in the infamous top 10 list again, although we noted new hotspots when compared to 2023 (including Maryland, Michigan, and Massachusetts). The top ten states accounted for 66% of all compromise events that FICO identified last year.

Banks: Protect ATMs, Layer Compromise Mitigation Strategies

Given the number of stories that come across my desk about criminals planting skimmers, police alerts about found skimming devices, and the devastating financial impact of skimming across the country, it’s more important than ever for both banks and consumers to protect themselves. I’ve called out some of these previously, but you can never be too prepared when it comes to preventing fraud.

A recent FICO survey reported that consumers believe the number one action their bank could take to protect them was to have better fraud detection systems. And in the age of increasing consumer expectations, every step you implement can help protect against losses while burnishing your reputation. When it comes card skimming, I recommend several actions to help fight fraud:

Monitor equipment: Regularly inspect ATMs for signs of tampering. Report to law enforcement if found. Utilize video surveillance where possible.

Utilize information: Consider ATM location and out-of-area transactions. Two-thirds of compromises occurred in the top 10 states, and in 2024 many ATMs were compromised more than once. Pay close attention to balance inquiries prior to withdrawals and non-PIN-based transactions.

Use a multi-layered approach: Employ monitoring systems, risk-based strategies, advanced analytics, and customer communications in determining if a transaction is legitimate, potentially fraudulent, or the result of a scam.

Deploy fraud checks: Criminals target more than ATMs; they employ scams and other tactics to defraud consumers. FICO recommends channel-based strategies prior to authorizing any purchase or payment transaction.

Communicate with customers proactively: Engage customers in real-time, in the channel of choice (whether text, email, phone, or in-app messages). Give them the option to have two-way conversations, to confirm or deny specific transactions, update on card status, or provide warnings about known and emerging fraud.

Consumers: Pay Attention to Detail

Utilize tap-to-pay or digital wallets whenever possible. With contactless payment methods like tap-to-pay and digital wallets, card details are obscured through the process of “tokenization”. Instead of swiping the magnetic strip and exposing all the card information, contactless payments convert card specifics into an encrypted digital “token” that protects card details and prevents criminals from stealing payment information.

Closely examine payment terminals. Pay attention when you use a credit or debit card. If, for example, the tap reader isn’t working at a gas pump, that might be a sign that the pump is compromised. At any point of sale or payment terminal, if the keypad feels off, or there is a prompt to swipe your card, take heed and conduct your transaction elsewhere if at all possible.

Use chip and PIN if tap is unavailable. Chip-based transactions are safer than swiping, but you should still make sure you cover the PIN pad in case there is a spy camera hiding somewhere.

Avoid swiping a magnetic stripe if at all possible. This is the least secure payment method, as it exposes all the card information. If a payment terminal has been compromised, it will often only allow swiping. If you experience problems using tap-to-pay or chip and PIN methods, find another place to complete your transaction.

Skimming is one of many malicious tactics that criminals use to steal from unwitting consumers. They will also continue any number of other ways to build their ill-gotten gains, including impersonation scams and purchasing personally identifiable information from data breaches to commit fraud across all channels. Banks and other FIs can fight back, with technology like AI- and ML powered fraud detection models, to help spot and stop fraud while minimizing friction and impact for legitimate customers.

How FICO Fights Card Skimming Fraud

Get more details on FICO® Card Alert Service and how it helps protect US consumers

Explore how Customer Communications Services for Fraud can intervene in real time to prevent fraud losses.

Follow me on LinkedIn for more insights about FICO’s innovative fraud fighting efforts.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.