FICO Research: Student Loan Explosion Hurts Other Borrowing

The student loan crisis in the US is getting much worse — student loan debt is over $1.3 trillion and is increasing by more than $2,700 per second. Lenders cannot ignore the impact…

The student loan crisis in the US is getting much worse — student loan debt is over $1.3 trillion and is increasing by more than $2,700 per second. Lenders cannot ignore the impact of that debt on individual borrowing.

Our latest research shows that:

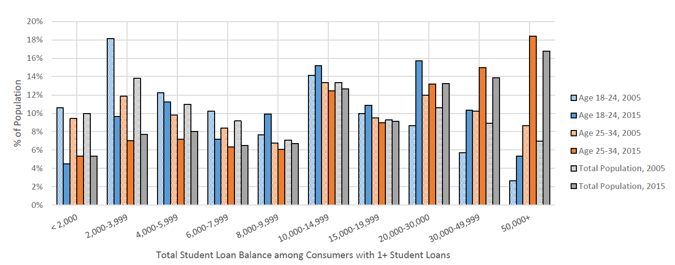

- The number of US consumers aged 25-34 with student loan debt of at least $50,000 doubled from 2005 to 2015.

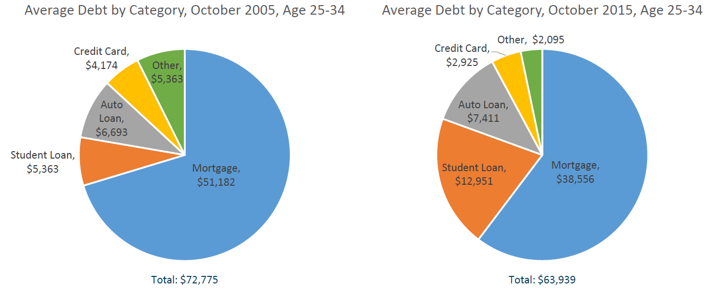

- During that same time, the average student loan debt across all age 25-34 consumers also doubled — by comparison, average credit card debt and mortgage debt for this population actually fell.

- While the number of consumers age 25-34 with student loans grew from 2005 to 2015 (from 27% of this population to 40%), there are fewer 25-34 year olds with mortgages or credit cards than 10 years ago.

In fact, our data shows that people with active student loans are far less likely to have mortgages than consumers without student loans. It may be that student loans hinder the capacity and/or willingness of people to buy houses and take out credit cards, or it may be that people unable to pay off their student debt may be less likely to be able to afford mortgages and new credit. Either way, it’s worth reviewing.

Among people 25-34 years old:

- 22% of those who have never had a student loan have mortgages.

- 33% of people who have paid off their student loans have mortgages.

- 17% of those who still have open student loans also have mortgages.

And while the numbers change slightly for older age bands, this trend persists through age 49.

There is also a correlation between higher student loan debt and lower utilization of revolving credit, such as credit cards. From 2005 to 2015, the average student loan debt shot up from $5,363 to $12,951 among consumers aged 25-34. During this time, average credit card debt in this group fell from $4,174 to $2,925. In the United States, with an economy driven largely by consumer spending, this trend may help explain why economic growth has been sluggish for the past several years.

Even in auto loans, where transaction activity has remained robust, the dollar amounts have remained flat. While student loan debt was climbing to record levels, the average balance on car loans only moved from $6,693 to $7,411 for people aged 25-34.

Student loans also have a clear relationship to credit quality. For consumers aged 30-34 who have closed out their student loans, the average FICO Score is 660. The average FICO Score for people in this age group with open student loans is 627. This score disparity is yet another reflection of the drag that student loans are placing on consumer credit activity years after most people are out of school.

There is much talk in the media about the burden of student loans on consumers today and the impact on the nation’s economy. This research suggests that consumers with student loans are making financial decisions to postpone taking on additional debt while focusing on paying off current debt.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.