How to Improve Collection Decision Strategies with Analytics

Predictive analytics, optimization and omni-channel communications can transform collections strategy efficiency and performance

Organizations managing delinquent debt today must balance three critical objectives: maximize cure rates, minimize operational expenses, and preserve valuable customer relationships. With economic headwinds creating financial stress for consumers worldwide, uniform treatment strategies are proving inadequate for modern challenges.

The transformation to data-driven collection strategies represents more than an operational upgrade to the collections process. This is a change that is revolutionizing the way collectors work and the results they achieve. Organizations leveraging advanced analytics, mathematical optimization, and customer-centric digital engagement as part of their strategies are both improving results and strengthening long-term customer value.

The Strategic Shift from Intuition to Intelligence

Traditional collection operations have historically relied on institutional knowledge and seasoned judgment to guide strategy development. While veteran collectors possess valuable insights, this approach creates scalability limitations and inconsistent outcomes across different accounts and market conditions.

Modern collection strategy transformation begins with systematic data analysis that reveals patterns invisible to human observation. Organizations implementing analytical frameworks can identify which customers respond effectively to automated digital outreach versus those requiring personalized agent intervention, creating efficiency gains that compound across entire portfolios.

Mathematical Optimization as a Game Changer

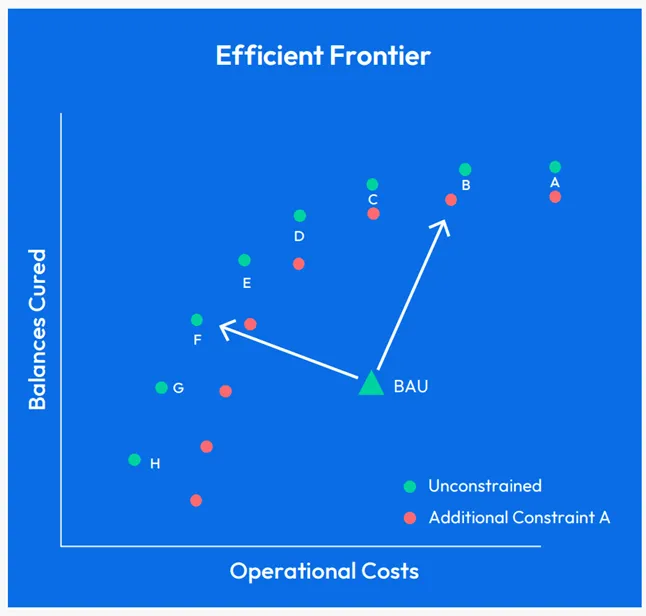

Rather than developing collection strategies through trial and error, optimization technology starts with clearly defined business objectives and operational constraints. The system then evaluates millions of possible strategic combinations to identify approaches that deliver optimal performance against specified metrics.

This methodology enables collection managers to quantify trade-offs between competing targets—such as balance cure rates, loan loss provisions, customer satisfaction scores and operational costs—and make informed decisions about resource allocation and treatment intensity based on quantitative analysis rather than assumptions.

Six Fundamental Challenges in Contemporary Collection Strategies

Challenge 1: Achieving Personalization at Enterprise Scale

No two customers with overdue payments are the same. Modern collection strategies must deliver individualized treatments across portfolios containing thousands of diverse customer profiles. This requires integrating traditional credit data with behavioral indicators, economic factors, and real-time financial circumstances to create comprehensive customer intelligence.

Advanced analytical platforms can analyze these multidimensional data to route accounts toward self-service resolution channels while directing complex cases requiring empathetic human intervention toward experienced collection specialists.

Challenge 2: Demonstrating Quantifiable Business Impact

Collection departments face increasing pressure to prove their contribution to organizational profitability beyond simple recovery metrics. Stakeholders now expect visibility into how collection strategies influence customer lifetime value, retention rates, and brand reputation alongside traditional charge-off reduction.

Sophisticated measurement frameworks evaluate the complete financial impact of collection activities, including downstream effects on customer purchasing behavior and referral generation, providing collection managers with compelling business cases for strategic investments.

Challenge 3: Creating Operational Transparency

Collection strategy development often occurs in organizational silos, making it difficult for stakeholders to understand how competing business priorities influence tactical decisions. This opacity can lead to suboptimal resource allocation and misaligned performance expectations.

Modern optimization platforms analyze how adjustments to staffing levels, contact frequency, or treatment intensity affect multiple business outcomes simultaneously, enabling collaborative decision-making based on shared understanding of strategic trade-offs.

Challenge 4: Enabling Rapid Strategic Adaptation

Economic volatility, regulatory changes, and shifting customer expectations require collection strategies that can pivot quickly without extensive system modifications or lengthy implementation cycles.

Cloud-based analytical platforms enable collection managers to modify treatment strategies in real-time, immediately modeling the projected impact of proposed changes across different customer segments and operational scenarios before implementation.

Challenge 5: Ensuring Regulatory Compliance

Regulatory frameworks increasingly emphasize fair customer treatment and affordability assessment, requiring collection strategies that balance recovery objectives with consumer protection requirements across multiple jurisdictions.

AI-powered compliance monitoring systems can embed regulatory constraints directly into treatment logic, ensuring that contact frequency, assessment protocols, and forbearance offerings meet current requirements while maintaining collection effectiveness.

Challenge 6: Strengthening Customer Relationships During Financial Stress

The manner in which organizations interact with customers experiencing financial difficulties and facing mounting late payments creates lasting impressions that influence future business relationships and brand perception in the broader market.

Research demonstrates that customers receiving respectful, solution-oriented collection treatment are more likely to maintain positive brand associations and continue business relationships after resolving their payment difficulties.

Organizations working with FICO and addressing all six challenges through comprehensive optimization are achieving meaningful improvements across multiple dimensions. For example, Cox Communications, the largest private telecom company in the US, is using FICO® Platform’s Intelligent Decisions, Omni-Channel Engagement, and Enterprise Optimization capabilities to transform its customer experience. It achieved a $2M+ annual cost reduction, 40% increase in customer self-service payments, and 50% reduction in call centre transactions through optimized digital outreach strategies.

Leveraging Predictive Intelligence for Collection Excellence

The Four Dimensions of Collection Analytics

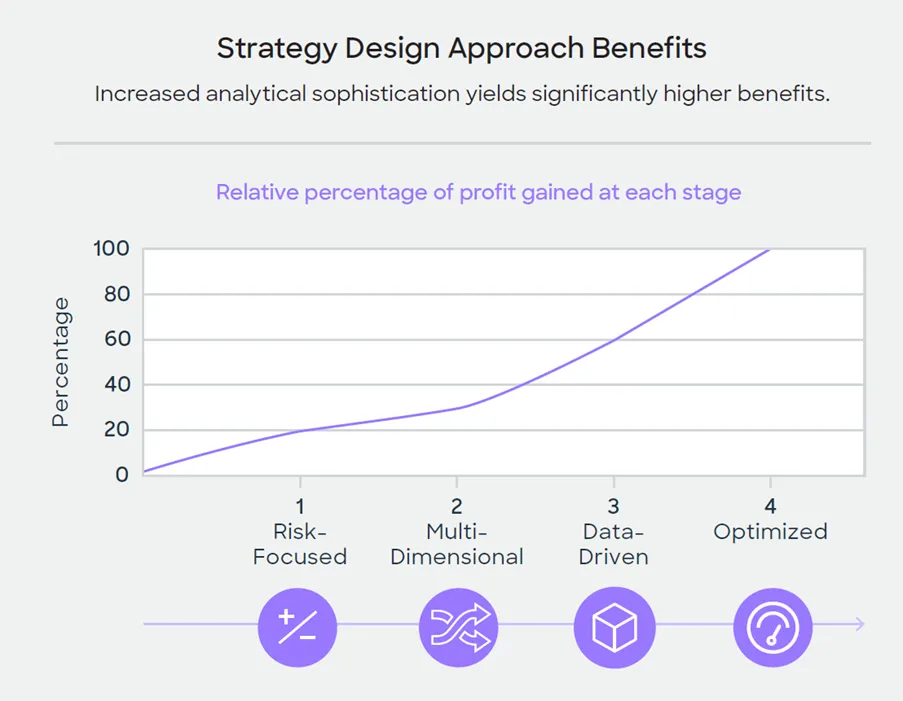

Collection analytics encompasses multiple analytical approaches that provide increasingly sophisticated business insights:

- Historical Analysis reveals patterns in past collection performance, identifying successful strategies and highlighting areas for improvement across different customer segments and economic conditions.

- Causal Investigation determines why specific collection outcomes occurred, connecting customer behaviors and external factors to payment patterns and treatment responsiveness.

- Behavioral Forecasting predicts future customer actions based on historical data patterns, enabling proactive strategy adjustments before account deterioration occurs.

- Strategic Optimization recommends specific actions that maximize desired outcomes while respecting operational constraints and regulatory requirements.

Transformative Benefits of Analytical Collection Strategies

Enhanced Customer Segmentation: Advanced modeling identifies distinct customer behavioral patterns that enable targeted treatment strategies, moving beyond one-size-fits-all approaches to deliver personalized collection experiences that improve both recovery rates and customer satisfaction.

Intelligent Channel Selection: Analytical systems determine optimal communication channels and timing for individual customers, reducing intrusive contact while increasing engagement rates through preferred communication methods.

Resource Optimization: Predictive models guide allocation of expensive collection resources—such as experienced agents and legal proceedings—toward accounts with highest recovery potential while routing routine cases through automated digital channels. This streamlines the collections outreach for many accounts.

Proactive Compliance Management: Analytical frameworks continuously monitor collection activities against regulatory requirements, automatically adjusting strategies to maintain compliance while preserving collection effectiveness.

Building Empathetic Digital Collection Experiences

The use of predictive analytics and optimization not only improves targeting and treatment, it provides the customer understanding needed to increase customer satisfaction, which is always difficult in a collections scenario. It leads to what customers see as compassionate or empathic treatment.

Treating customers fairly and considering their financial circumstances is a regulatory imperative in many markets. But organizations prioritizing empathetic customer treatment also generate significantly higher financial returns compared to those employing aggressive collection tactics. Research indicates that companies demonstrating genuine concern for customer welfare achieve superior long-term profitability through increased customer loyalty and positive brand reputation.

Financial institutions implementing compassionate collection strategies report substantial operational cost reductions alongside improved customer promise fulfillment rates, demonstrating that ethical treatment practices align with business performance objectives.

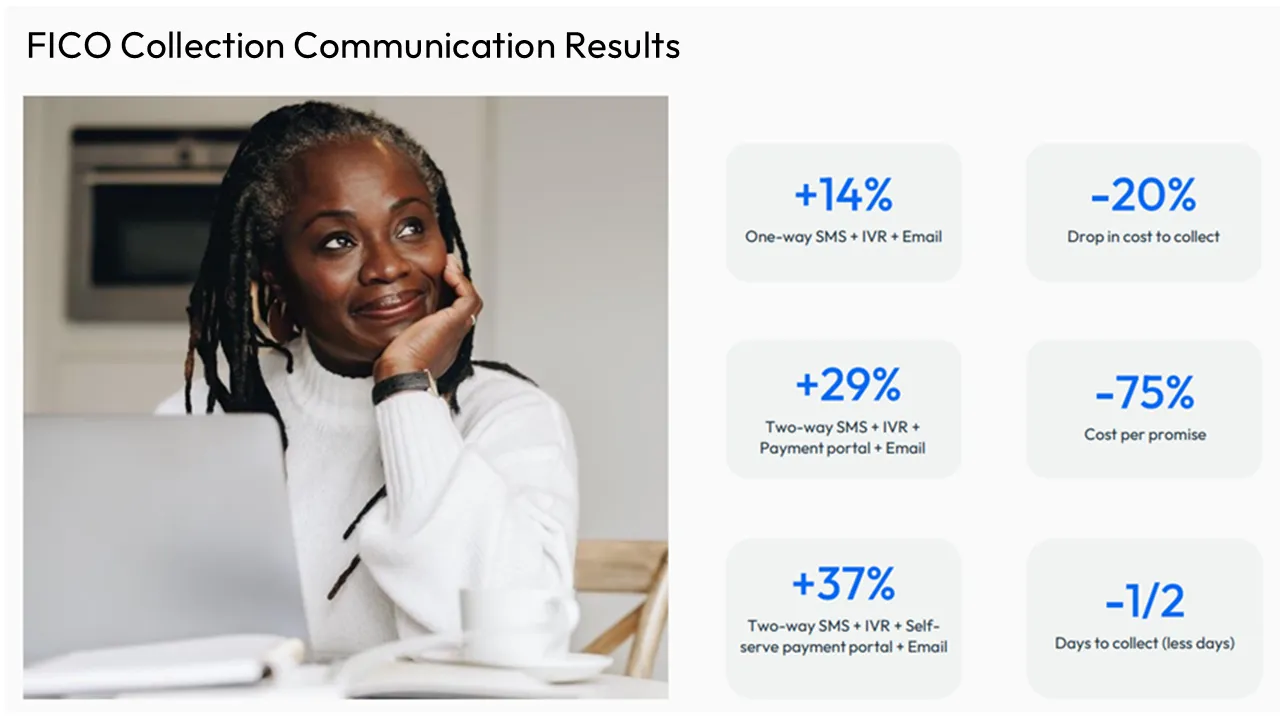

Omni-Channel Communication Strategies

Consumer research consistently shows preference for digital communication channels, with two-way text messaging achieving exceptionally high engagement rates compared to traditional phone-based outreach. Organizations leveraging coordinated digital communication strategies enable customers to manage their financial obligations through convenient self-service options while reducing operational expenses.

Effective omni-channel platforms integrate customer interaction data across all touchpoints, creating unified customer profiles that inform personalized treatment strategies and prevent contradictory messaging across different communication channels.

Implementing Continuous Collection Strategy Improvement

Regardless of whether collection treatment strategies are designed using experience, data-driven segmentation or scientific methods like decision optimization - organizations can systematically improve collection performance by implementing controlled testing frameworks that compare alternative strategies against established baselines. This is known as champion/challenger testing. This approach enables evidence-based decision making that replaces assumptions with quantified performance data.

Sophisticated testing platforms can evaluate multiple strategic variations simultaneously—comparing different contact timing, message content, payment plan options, and channel preferences—to identify and validate optimal approaches for specific customer segments without disrupting overall portfolio performance.

Strategic Cost Management

Effective collection cost management requires matching treatment intensity to recovery potential rather than applying uniform approaches across all accounts. Analytical systems can identify accounts with high payment probability and direct premium collection resources toward these opportunities while routing lower-probability accounts toward cost-effective automated treatments.

This targeted approach enables organizations to achieve superior cure rates while reducing per-account collection costs, creating sustainable competitive advantages in challenging economic environments.

Future-Focused Collection Innovation

The evolution toward artificial intelligence and machine learning capabilities will enable even more sophisticated collection personalization, incorporating real-time data feeds and alternative information sources to create dynamic treatment strategies that adapt continuously to changing customer circumstances.

Organizations positioning themselves at the forefront of this technological evolution will gain sustainable competitive advantages through superior recovery performance, reduced operational costs, and strengthened customer relationships.

Conclusion: Transforming Collection Strategies into Competitive Advantage

The collection industry is experiencing fundamental transformation as data-driven strategies replace traditional intuition-based approaches. Organizations embracing analytical frameworks, optimization technologies, and customer-centric digital engagement are creating sustainable competitive advantages that extend far beyond simple recovery rate improvements.

Success in this evolving landscape requires commitment to continuous learning, strategic flexibility, and genuine concern for customer welfare during financial stress. The organizations that thrive will be those that view collections not as necessary operational burdens but as opportunities to demonstrate organizational values while achieving superior business results.

Learn More in Our Webinar on 24 March

Register Now

How FICO® Platform Can Advance Your Debt Collection Strategies

- See our solutions for debt collection and recovery

- Read Debt Collection Predictive Analytics: Benefits, Types and Uses

- Read Collection Strategies: Best Practices for the Digital Age

- Discover How Loan Restructure Optimization Works

- Understand how to operationalize analytics for Debt Collections on FICO Platform

- Explore How Compassionate Digital Collections Can Improve Your Bottom Line

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.