The Impact of COVID-19 on the UK Credit Card Market

FICO UK Credit Market Report – May 2020

Since the start of COVID-19, we have been tracking its impact using data reported by the UK’s leading credit card issuers, through the FICO® Benchmark Reporting Service.

We are planning to report the impact monthly - but even at this early stage, we expect further significant impact into 2021, especially on delinquency rates, as payment holidays for over 960,000 cardholders expire, furlough contributions are reduced and then withdrawn (over nine million) and the expected increase in staff redundancies takes place, increasing the financial stress on UK adults.

Highlights for May 2020

- Average spending on UK credit cards dropped by more than a quarter (26.5% for the period January to May 2020)

- The average amount overlimit has increased by 19.5% since January

- Monthly payments experience a sharp fall – hitting a two-year low

- New account openings are down by 25%

£90 Billion in Credit Available

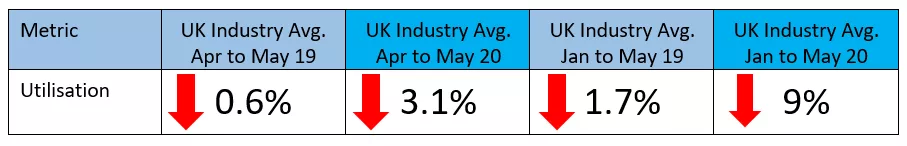

Other notable year-on-year trends highlighting financial caution included a drop in card usage as the percentage of active accounts decreased at a faster rate than normal. Utilisation on active accounts also fell and was at over a two-year low. However, during May there was no sign of card limit decreases and average limits continued to slowly grow, reaching their highest levels since 2002, and noticeably higher than in April 2008 during the last financial crisis.

As spending options increase with the re-opening of many non-essential shops, and the hospitality and travel sectors, we expect many consumers to start using their card more as their confidence grows. This is combined with the consumers whose credit card is — or becomes — their only available source of spend. This is of concern as some consumers will turn to the unused credit on their cards to help finance themselves over the coming months, and with over £90 billion available, there is scope for large balance builds.

Monthly Payments Experience Sharp Fall

The percentage of payments to balance experienced its sharpest fall yet, reaching over a two-year low in May. An increase in payment deferrals, lower payments (perhaps due to lower balances) and missed payments may all have contributed to a 16.6% drop compared to May 2019.

The percentage of consumers paying less than the amount due has also risen. From January to May 2020, the percentage increased 25.1%, compared to a marginal decrease of 0.2% for the same period in 2019. And the percentage of consumers paying the amount due was 7.7% lower than a year ago, despite increasing 18.5% in May compared to April.

In Q4, we should start to see the true picture of the financial impact on consumers’ ability to continue or resume their payments, with many potentially paying a lower monthly amount.

For more data from the May report, see our news release: FICO UK Credit Market Report Shows Sharp Fall in Spending and Monthly Payments

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80 percent of UK card issuers. Issuers wishing to subscribe to this service can contact me at staceywest@fico.com.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.