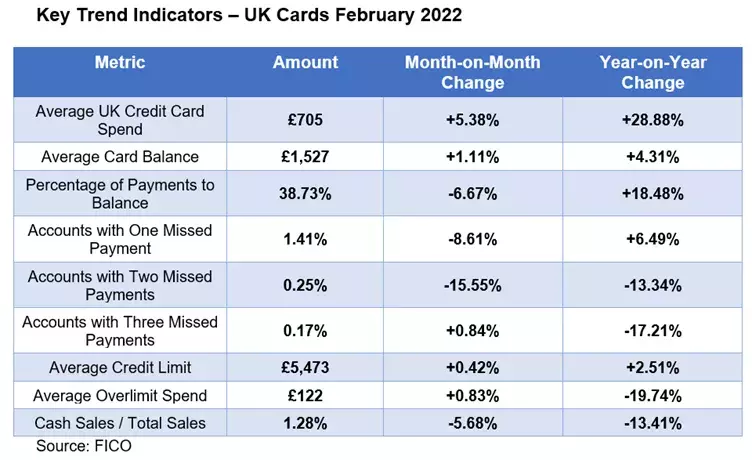

UK Cards Report: Repayments Not Impacted by Cost of Living Hike

The FICO Credit Market Report for February 2022 shows UK card trends following typical post-seasonal spend and repayment patterns - will the cost of living rise show up soon?

The FICO Credit Market Report for February 2022 shows UK card trends following typical post-seasonal spend and repayment patterns. It’s as yet unclear whether pandemic savings are masking the early impact of the cost of living hike.

Highlights

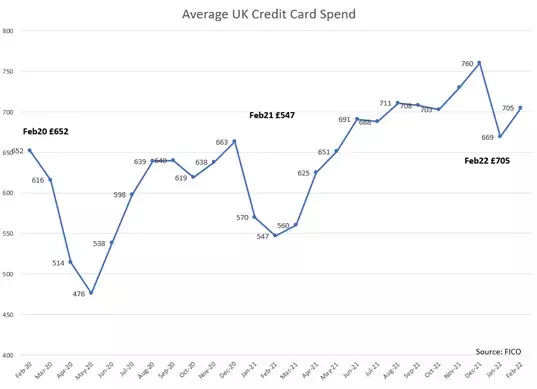

- Average card spend climbs by over 5 percent compared to January and nearly 30 percent compared to February 2021

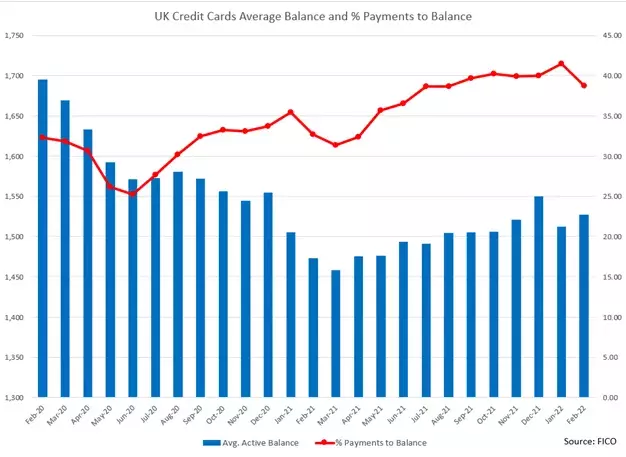

- Small lift in average active balance – just over 1 percent – follows typical post-seasonal behaviour

- But percentage of payments to balance drops by more than 6 percent, which could be early signs of financial stress

- Percentage of accounts with one and two months missed payments drops compared to January – another typical behaviour after the Christmas period

The cost of living hike that started to become evident in February did not have an immediate impact on credit repayment behaviours; indeed, the percentage of accounts missing payments reduced in accounts with one and two missed payments.

However, with average spend showing a more than 5 percent increase month-on-month, and the average card balance also increasing by more than 1 percent, there could be a risk that consumers started to rely on credit during February to counteract pressure on disposable income.

The rapid increase of prices for essentials may have contributed to the increased average spend and the increased average card balance, yet payment trends remain reassuring that consumers are trying to keep balances relatively lower than in pre-pandemic times. Remaining vigilant to repayment trends over the next few months will be critical for lenders to ensure vulnerable households are given the support they need.

Customers paid down credit cards when stimulus payments hit the marketplace. Given the dependence on online spend and online ordering, having sufficient “open to buy” was a critical survival mechanism. Seasonal trends are still visible, but it’s clear that consumers are still in pay down mode.

Lockdown savings and the inability to spend as much, especially on large purchases such as holidays, has helped to reduce balances. Consumers may be keeping available credit for when they do have the confidence to book holidays.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service produced by FICO® Advisors, the business consulting arm of FICO®. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80 percent of UK card issuers.

Learn More About UK Cards Trends

I participated in the How to Lend Money to Strangers podcast, talking with host Brendan Le Grange about the trends in the UK cards market. You can hear it on the following platforms:

Spotify: https://open.spotify.com/episode/6MJKJTpJzjo606Fv28LylV?si=Q3wL2SYESGKhuFCKmv0c8A

YouTube: https://youtu.be/qVHtjnn21wg

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.