Are You Catering For The ‘Unhappy Path’ In Digital Journeys?

Bridging the expectation gap through decision planning to improve the customer experience

The Customer Journey Less Travelled Can Cost You

Pandemic lockdowns and social distancing pushed us online to discover how to do business with everyone from the local grocer, cafes, yoga teachers, furniture stores, pharmacies, and banks to name just a few. Our experience of these digital journeys varied enormously. Some businesses were already on the front foot with e-commerce. Others had to scramble online or risk seeing a significant drop in income. But what really stood out to me was that the pandemic exposed the businesses that had only modelled the typical customer path with many failing to invest in planning the unhappy path.

What do we mean by “unhappy path”? It’s the experience a consumer has when something has gone wrong, or when they want to engage the business on a less standard matter. Think things like wanting to cancel a membership, having a problem with the online checkout, or receiving the wrong item.

Many businesses plan for the most common or obvious problems, but of course just because something occurs infrequently doesn’t mean that it isn’t important. Many businesses don't properly detail the ‘unhappy’ path sufficiently, assuming (or rather hoping) most customers will follow the 'happy' path. A poor customer experience can negatively impact customer retention and seem them switch to a competitor that offers a more sophisticated, streamlined approach.

The Experience Of Returning Rotten Eggs

Take, for example, my experience the other day shopping on Amazon. I was looking for a couple of dozen eggs for a lockdown baking task (don’t ask!) and when the items arrived, I discovered that some of them were rotten.

I decided that I wanted to return the item. What happened next, was an excellent example of a company that has considered the “Unhappy Path” and used analytics to optimize the customer experience. In fact, the user experience of the ‘return goods’ was as good as the journey of buying them in the first place. Three qualities stood out to me.

- Speed: I received a confirmation of the concern (ticket) within a few minutes and an outcome within the hour.

- Personalized: The message I got was personalized for my unique situation and directly addressed my concern.

- Outcome: I received confirmation that I would be credited for the purchase amount within a few hours, allowing me to use that money for my next purchase. Furthermore, I didn't have to bother to return the goods in this instance, so minimizing the inconvenience to deliver the best outcome.

The following things stand out the way that this “unhappy path” was planned.

- Outcome-based decisioning: The speed with which the decision to credit back my purchase amount indicates that some type of calculation is made using analytics. It most likely involves a calculation of my lifetime value to Amazon, a review of any returns I had made as well as returns on that product or reseller and the cost to the company of asking or not asking for the item to be returned. This information is then probably delegated to a team member at the consumer service level, to review before a quick decision is made to maximize my chances of being a satisfied and profitable customer.

- Clever Template communication: While the outcome confirmation communication sounded personalized, after reviewing more closely it was clear that it was a clever template that allowed for mass customization. While most of the message was standard, several parts directly addressed my unique concern.

- Test & Learn: As mentioned above the favourable decision likely took into account many factors to help determine the likelihood of fraud as well as how to treat the reseller and customer. This is a constant learning loop, which becomes more sophisticated as the company learns from added data or a shift in behaviour patterns.

Digital Consumers Unhappy With What Banks Deliver

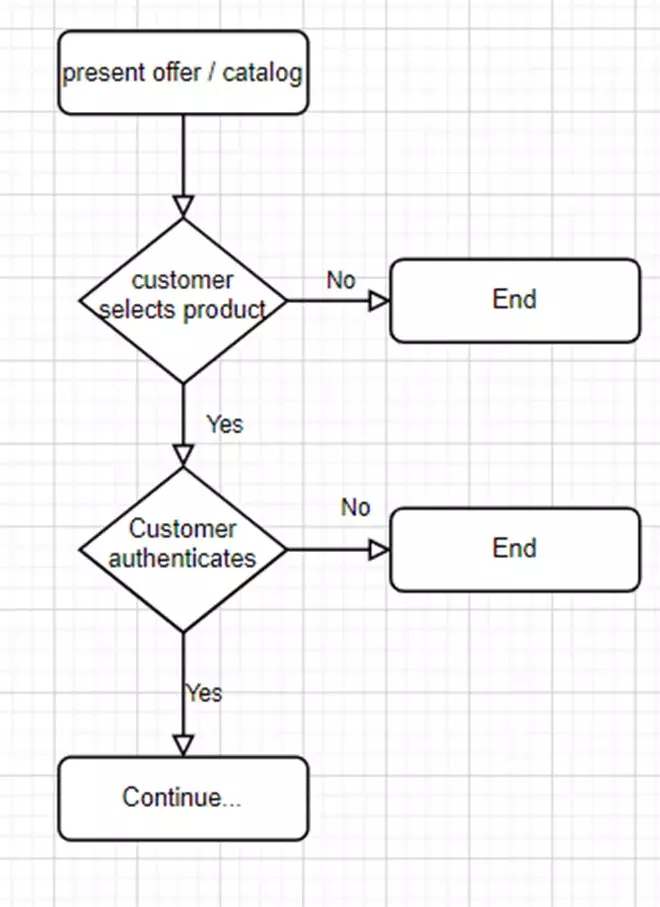

In digital banking, a lot of user journeys assume end-to-end digital and straight-through processing (STP). But organizations fail to anticipate and cater to experiences that require a broken digital experience. Digital Banking should not be considered as STP only, but a consumption experience across products and services wherein Digital channel will play a big part; but not the only one.

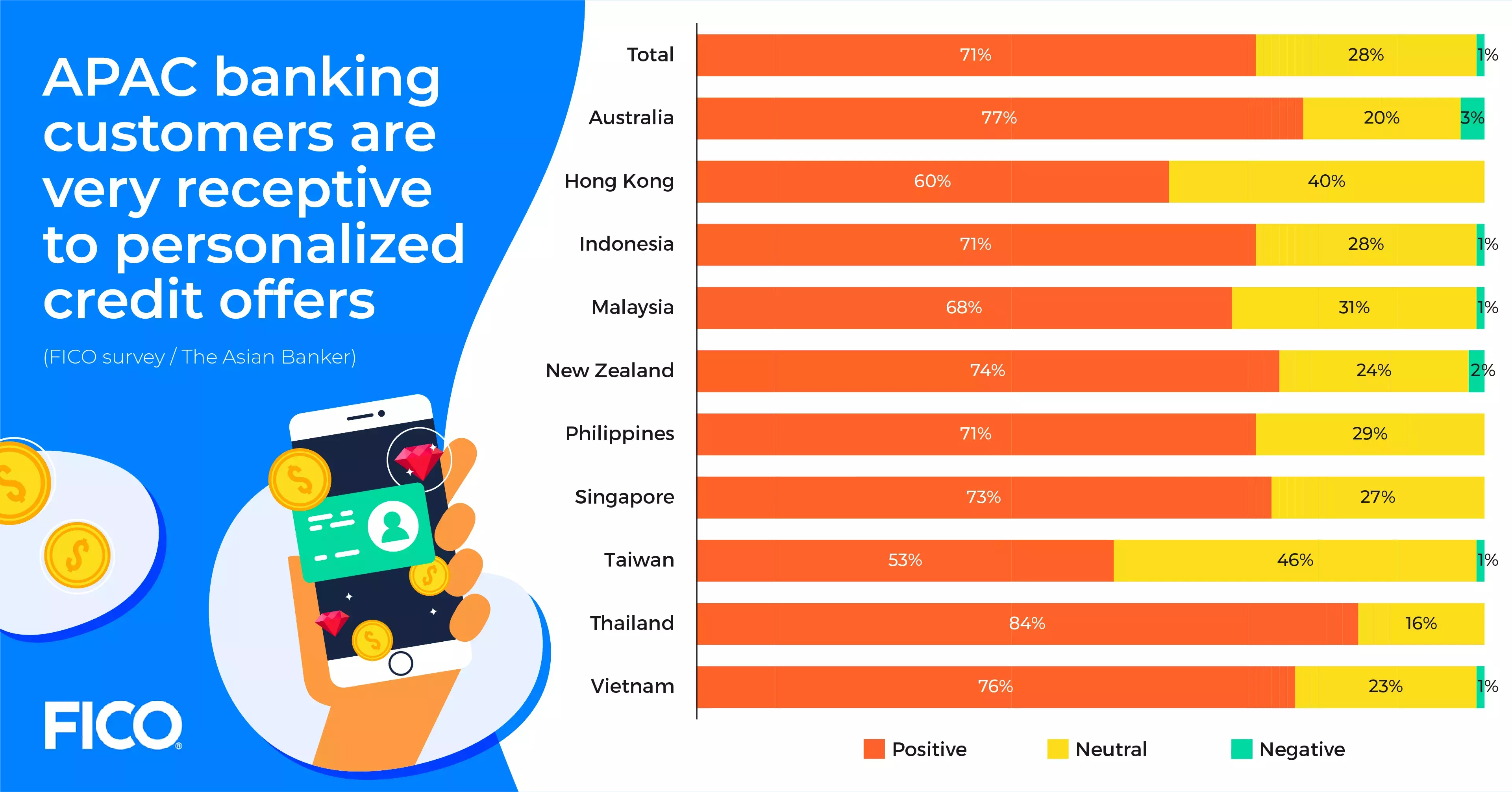

Our recent survey conducted by The Asian Banker, which surveyed more than 5,000 consumers across Asia Pacific, confirms that there is dissatisfaction and indeed an expectation gap when it comes to the consumer experience of many banking products and services.

More than 21 percent of consumers expected the end-to-end journey for a credit application (time expectation for credit approval and funds transfer) to happen within the hour with a further 23% expecting it within a day. In addition, 70 percent of consumers have a positive reaction to getting personalized offers and are willing to share additional data (80%) in return for favourable terms. However, more than 90 percent of respondents mentioned that while the journey was digital, challenges remained in terms of the process taking too long, instructions not being clear or difficulty in getting help when stuck.

This confirms our view that the currently defined banking journeys have been able to sufficiently address the scale, speed and personalization; but not always the completeness.

Organizations will need to address the ‘unhappy path’ equally well in their overall consumption experience when defining their digital banking journeys.

Let’s apply the same pillars mentioned above to address these journeys.

- Outcome-based decisioning: To provide a hyper-personalized experience, organizations must use data and analytics to drive insights and use those insights to make connected and consistent decisions across the various consumption journeys. Importantly, organizations must also ensure that the outcome is perceived favourable by the consumer and directly proportional to the data consumers have shared with them.

- Templating: Organizations can begin by identifying certain key dimensions in a template, say price, fee, card benefits, payment terms, hardship terms in their outcome-based decision framework, which can be personalized for each consumer based on their profile. For example, today there are more than 20 payment card types offered within each segment profile. Perhaps banks can use data and analytics to offer the right personalized card type but what if the consumer wants to have a fusion of two or three feature sets and prefer only a single card? That’s where the break in the happy path happens. Why not offer the card as a combination of features personalized for consumers with further flexibility provided to consumers to choose from?

- Test and Learn: Banks need to improve decision making and overall consumer experience via a fail-fast and fail-safe approach. Our recent survey provides interesting insights across South East Asia and ANZ markets on how consumers are responding to various digital account opening initiatives. One of the key takeaways is that experimentation enables organizations to further refine the personalization of journeys to ensure better outcomes for the consumer. Thus, the decisioning framework should enable test and learn while monitoring outcomes for continuous learning and improvement.

Whilst it is completely understandable that organisations focus on the ‘happy path’, we should ensure that the alternate paths and ‘unhappy paths’ are considered too. Considering the frequency and potential business impact will help us prioritise and decide where most effort should be focussed.

The FICO Platform helps banks to achieve successful digital transformation projects by eliminating silos and providing powerful point solutions such as Strategy Director, Xpress Optimization and Origination Manager.

In this post-pandemic world is seems even more certain that to compete effectively in today’s retail financing environment, speed to market and pricing features may be insufficient and the greatest value-add is centred on products that are bespoke and tailor-made to meet the specific needs of the customer.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.