The Role of Decision Orchestration in Financial Platforms

Just as every orchestra needs a conductor, decision orchestration keeps all the rules and processes firing at the right times in your system

In previous posts, I’ve explored data-related capabilities of a financial platform, such as use of external data, data ingestion, development of a characteristic library and microservices. These explore how data should flow into a decision process at high level. When it comes to real-life decision processes used in financial services and many other industries, the decision logic is far more complex and involves several different external and internal data sources and decision points.

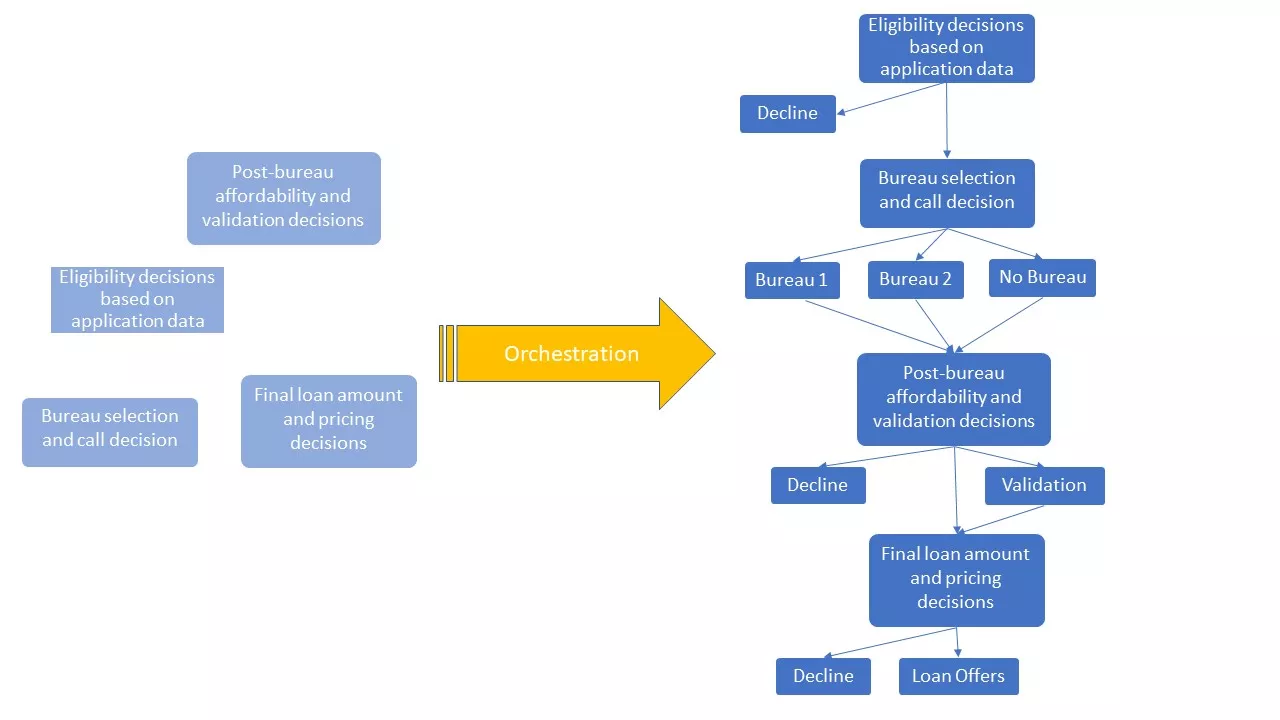

Financial platforms must have an orchestration capability which will enable a graphical representation of the decision processes. For business users, this visualisation and understanding of their decision-making process is critical.

I had mentioned data orchestration in my earlier post “Bank Ecosystems: The Role of Data Ingestion”. In this blog, I will explore the decision orchestration capability as it relates to the execution of operational and functional processes involved in designing a strategy or developing a business logic.

Why Orchestration Is Important

Can you imagine an orchestra without a conductor leading it? The conductors suggest the articulation and tempo and picks up things that are going wrong.

The decision orchestration capability provides similar benefits to a conductor’s role in an orchestra. It defines the sequence and interrelationships of business decisions and enables microservices to be invoked. It helps the business users - the composers, in our analogy - see the missing logic, identify erroneous decision metaphors and optimize their decision models.

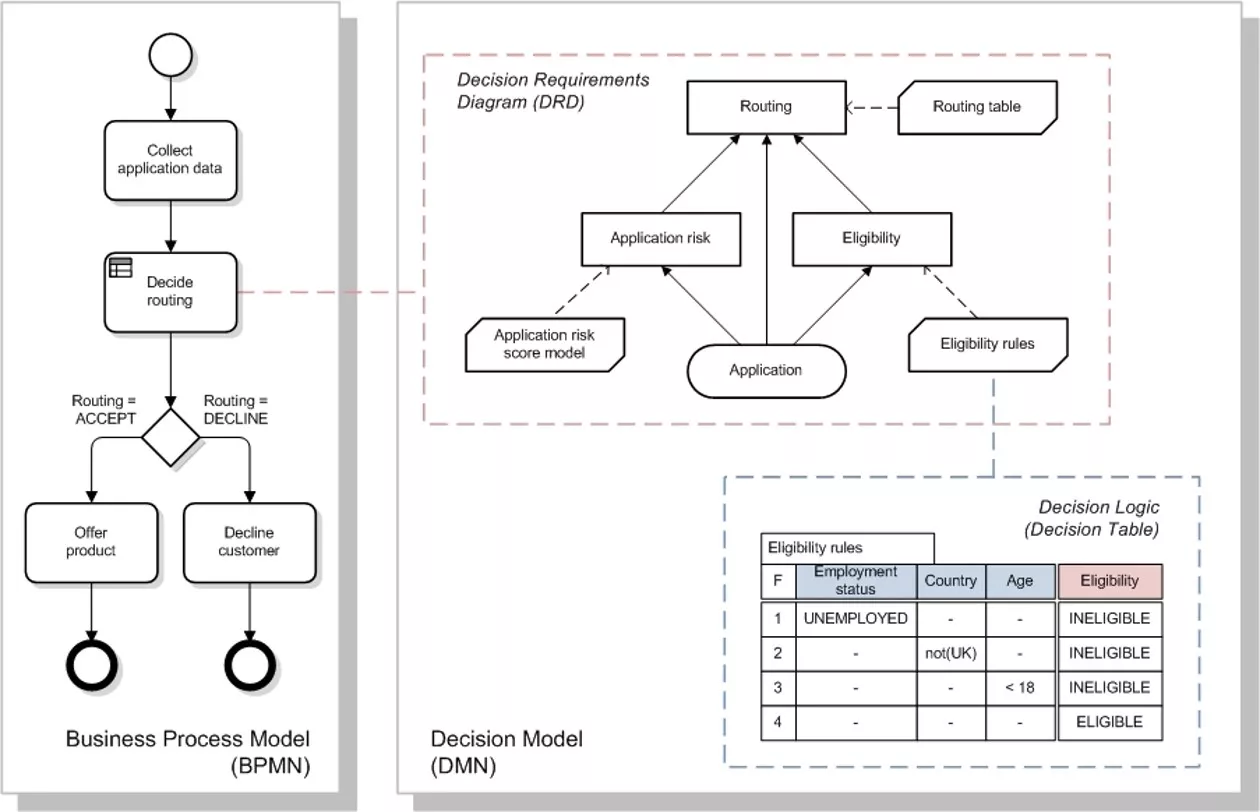

What do we mean by a “decision model”? Decision models are a visual representation of a decision.

To simplify the complex decision logics, business users apply decision model and notation and business process model and notation, standard approaches defined by the Object Management Group. As an outcome of these approaches, business users produce decision requirements diagrams and business process models. These graphical representations allow business users to connect different components of the platform, such as analytical models, decision services and data resources, as well as to document and share them across the platform users, which help break down silos and allow a smooth change management in future.

Mapping the Impact of Change

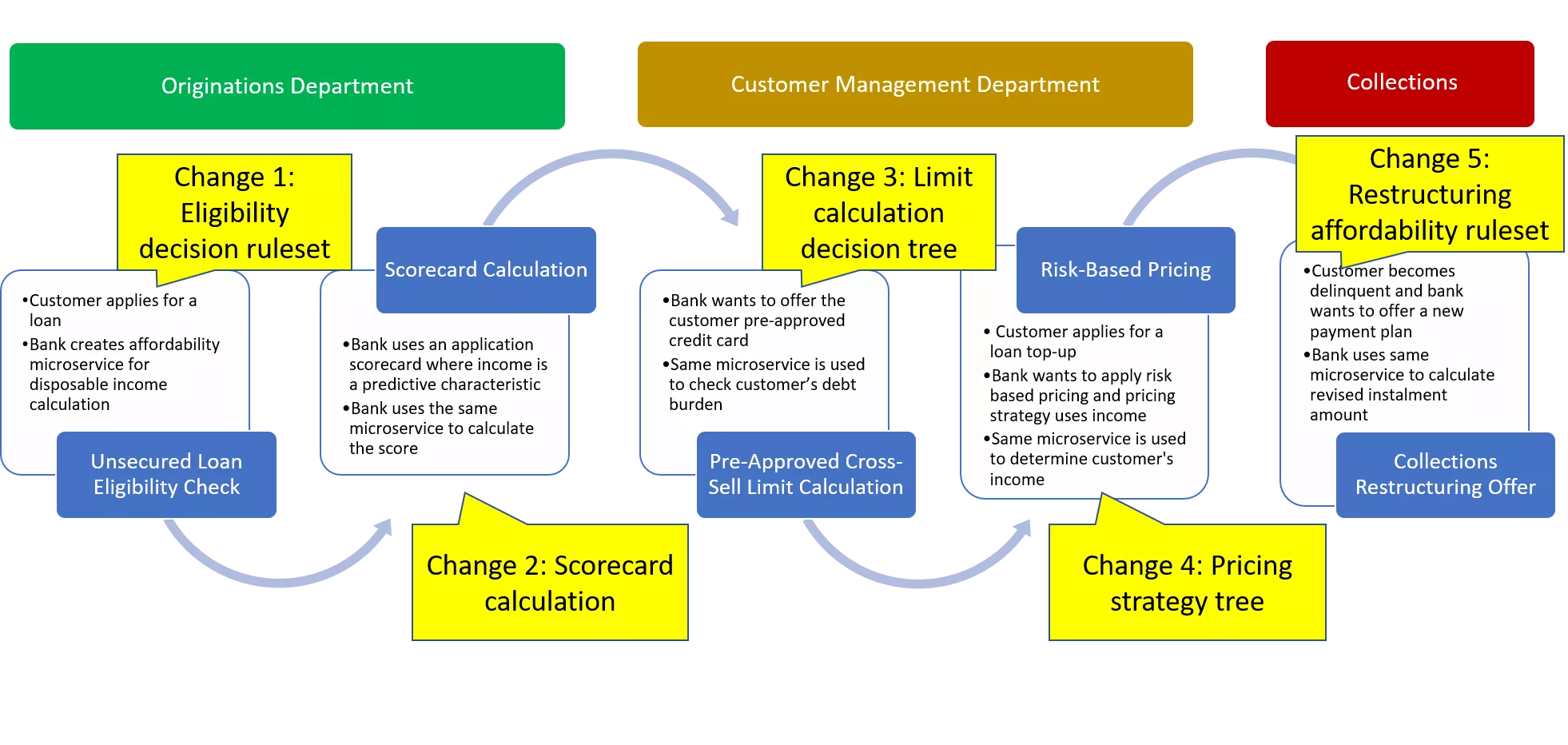

Financial strategies and decisions undergo many changes in very short time periods, such as a quarter or a month. Some of these changes are triggered by regulations and some are triggered by business requirements. Financial platforms will need to be rapidly changed and adapted too. Business users need to apply these changes as quickly as possible in order to comply with the regulations on time or catch up with the market trends.

With the implementation of changes, business managers would like to learn the business impact of the changes in decision services, such as whether this new validation will impact the approval rate or how much it will impact the customer experience. To provide this information, the business user will need to apply a simulation analysis; to be able to design simulation scenarios, business user needs to identify the interrelationships of the revised decision services with others. To do this, business users utilize the orchestration capability of platforms.

In my last post, I illustrated the potential journey of an unsecured instalment loan customer within the bank. To enable this journey, a team of business users equip the platform with required data aggregation logics, decision services and decision flows across several products. When the business users need to comply with a new regulation — which, say, requires a validation of a customer’s income each time it is used — the business user needs to identify which decision services use income.

The additional challenge with the new regulations is that typically they have a due date. Orchestration helps business users meet this deadline by making the change management process easier.

A good orchestration capability in a financial platform significantly helps financial service companies comply with the regulation on time, rapidly make changes to get ahead of its competition.

Learn more about the use of service orchestration and decision models and FICO DMN Modeler.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.