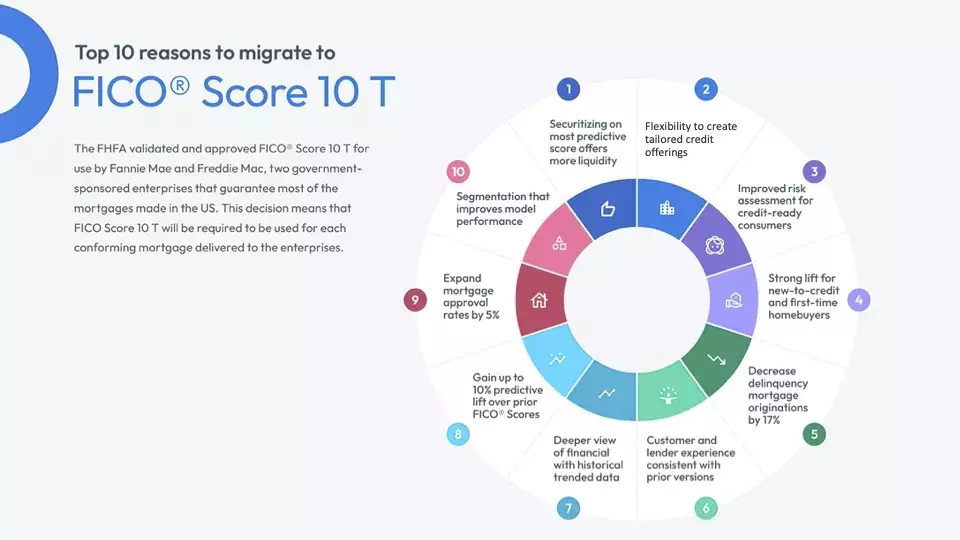

Top 10 Reasons to Migrate to FICO® Score 10 T

Leveraging FICO’s heritage of scoring expertise, FICO® Score 10 T is built with trended credit data enabling a higher level of predictive power

For 30+ years, the US lending marketplace and lenders have relied upon the industry standard FICO® Score to help drive their consumer credit risk assessment and underwriting decisions. In October 2022, the FHFA validated and approved FICO® Score 10 T for use by Fannie Mae and Freddie Mac, two government-sponsored enterprises that guarantee most of the mortgages in the US.

Here are the Top 10 Reasons to migrate to the new FICO® Score 10 T:

1.) Securitizing on most predictive credit scores offers more liquidity

FICO® Score 10 T is the most predictive FICO® Score in the industry. A more predictive credit score means more predictable cash flows which are, in turn, more attractive to investors for all types of securitized assets (e.g., mortgages, auto loans, credit cards, etc.) offering continuity and stability for lenders, investors, and consumers.

2.) Flexibility to create tailored credit offerings

With FICO® Score 10 T’s greater performance precision, lenders and investors have the flexibility to create tailored credit offerings. The updated model reflects the evolving credit landscape and credit behavior to help better inform a higher level of consumer credit risk prediction.

3.) Improved risk assessment for credit-ready consumers

FICO® Score 10 T addresses lenders’ desire for more effective credit risk assessment for consumers with limited credit history, thin files or new to credit. The validation results for FICO Score 10 T demonstrate improved credit risk prediction for this segment of the population.

4.) Strong lift for new-to-credit and first time-homebuyers

FICO® Score 10 T shows robust performance for prime thin and new-to-credit files such as first-time homebuyers. FICO Score 10 T also validates well in various segments such as near prime and sub-prime populations.

5.) Decrease delinquency mortgage originations by 17%

FICO® Score 10 T delivers a significant lift in the mortgage origination space with a five-point gain in Kolmogorov–Smirnov (KS) over the FICO Score versions most used by the mortgage industry. This would translate to a roughly 17% relative reduction in default rate at a cutoff of ~680.

6.) Customer and lender experience consistent with prior versions

FICO® Score 10 T was developed from a consistent blueprint — enabling a step up to a higher level of predictiveness along with consumer behavior insights without sacrificing the trusted FICO Score minimum scoring criteria and user experience. The model has a similar odds-to-score relationship as prior FICO Score versions.

7.) Deeper view of financials with historical trended credit data

FICO® Score 10 T integrates trended credit data, reflecting FICO’s practice of continual innovation to address market and data advancements. The model incorporates trended credit data variables to drive a more refined assessment of the trajectory of borrower credit behavior.

8.) Gain up to 10% predictive lift over prior FICO® Scores

Demonstrating greater predictive power over all previous versions of the FICO® Score, FICO® Score 10 T was developed on recent datasets that inform an even higher level of consumer credit risk prediction. These improvements in predictive power can help lenders safely avoid unexpected credit risk and better control default rates, while making more competitive credit offers to more consumers.

9.) Expand mortgage approval rates by 5%

Building off new data samples and refined variable weighting, FICO® Score 10 T provides predictive lift over all previous versions of the FICO® Score, with distributions very consistent with prior models. Using FICO Score 10 T can lead to a 5% relative increase in mortgage approval rates compared to versions most commonly in use today, without adding incremental risk.

10.) Segmentation that improves model performance

FICO® Score 10 T’s multi-scorecard model outperforms previous FICO Score versions, with segmentation that improves model performance. The model delivers increased predictive power while preserving the trusted and proven FICO Score minimum scoring criteria and utilizing a consistent odds-to-score relationship as the prior FICO Score version.

The FICO® Score is the independent standard measure of consumer credit risk used by 90% of top US lenders and 97% of asset-backed securitizations in the US. With deep historical experience, the FICO Score empowers decisions throughout the credit ecosystem. Reliable across multiple economic cycles, and trusted by lenders around the globe, FICO Score delivers insight, analytics, actionable intelligence, and innovation.

To learn more about migrating to a newer version, visit FICO Score Migration Resource Center or refer to FICO Score 10 T Migration Guide

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

FICO® Score 10 T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10 T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.