FICO UK Credit Card Market Report May 2022

Are credit card repayments taking priority? Pragmatic financial management evident as percentage of payments to balance increases month on month

LONDON, 12 July 2022 –

Highlights

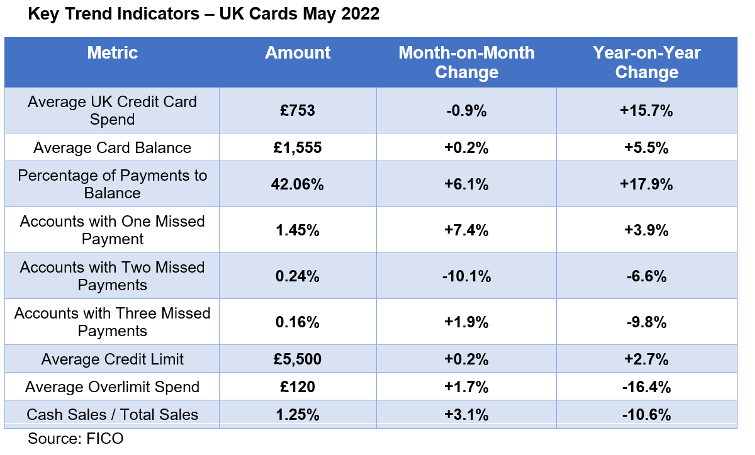

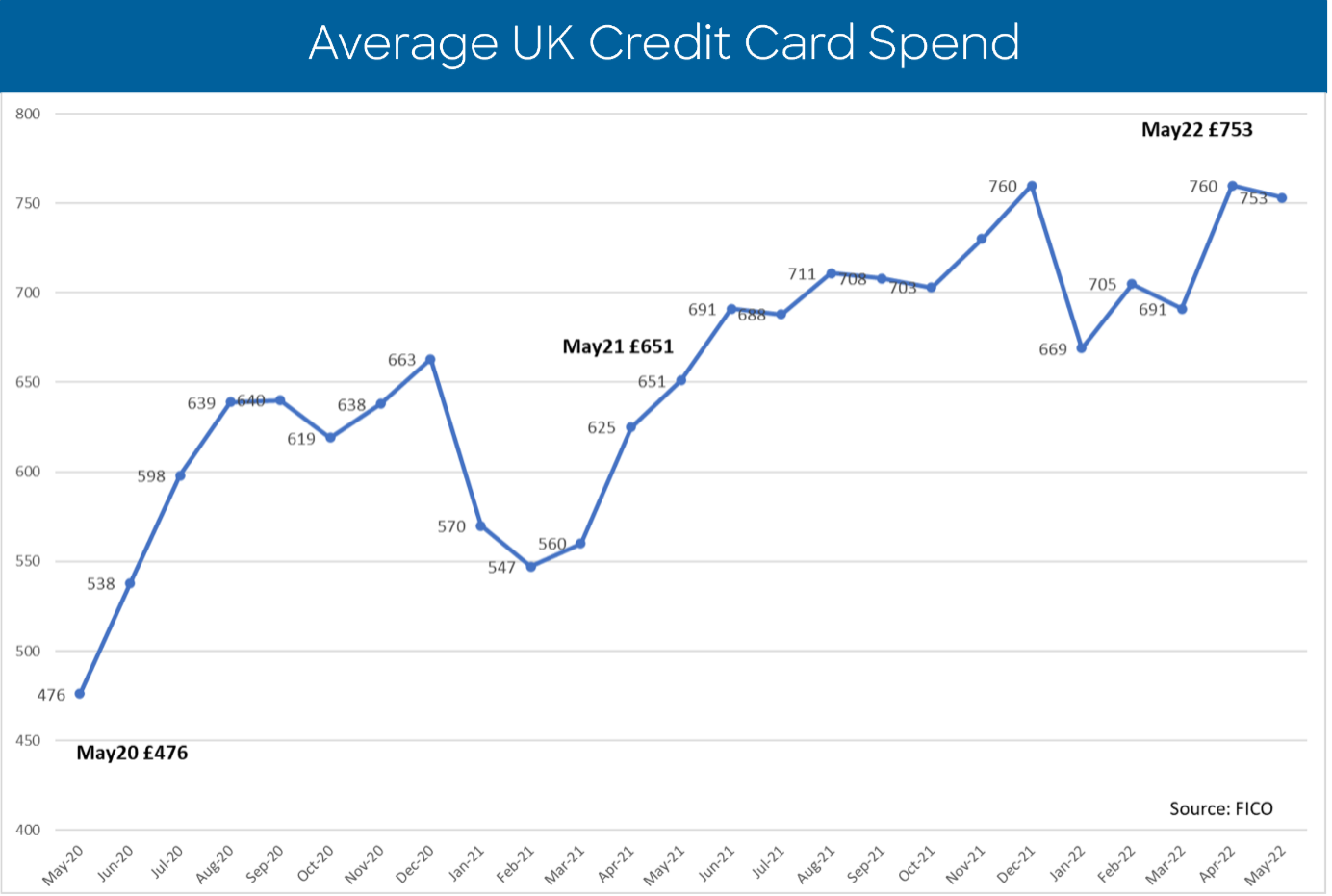

- Average total sales at £753 – a £7 drop compared to April

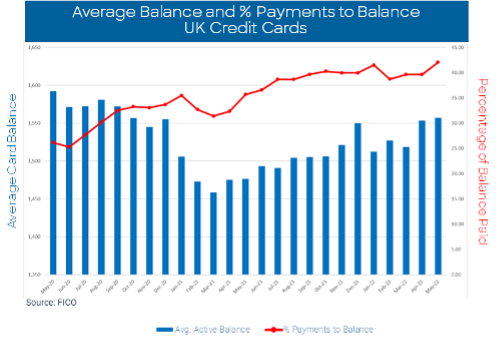

- Average active balance almost static month-on-month – just 0.2 percent rise

- 6.1 percent increase in payments to balance, suggesting continued pragmatic management of credit card accounts

- Small month-on-month rise in average balance for accounts missing 1 and 2 payments is a potential warning sign for lenders

FICO’s report of May 2022 UK card trends suggests that whilst cost-of-living pressures are definitely starting to have an impact, cardholders are also taking a pragmatic approach to financial management. The monthly report based on the largest consortium of UK cards data shows that the percentage of payments compared to balance continues to follow an upward trend. Alongside the fact that average spend on credit cards has dipped by £7 compared to April, the data suggests consumers are being sensible with spend and payments.

FICO Comment

In contrast to some of the other consumer spending data, there are no sharp shocks in how UK consumers are using and managing their credit cards. While spend has dipped marginally month-on-month, there are clear signs that the importance of credit cards in handling daily finances is recognised in how repayments are being managed.

Much like the April data, the signs of the cost-of-living crisis are still limited. Lenders, however, will want to be alert to the early signs of financial distress. The FICO May data shows a 7.4 per cent increase in accounts missing one payment; lenders should track if this pattern — which was already evident in April — continues and the percentage of accounts missing two payments also rises.

Lenders can use segmentation analysis on their portfolios to ensure that their web and mobile applications encourage consumers in distress to make contact at the first indications of difficulty, and to consider establishing special payment plans for those struggling to stay on top.

The Data Charts

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service produced by FICO® Advisors, the business consulting arm of FICO. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80 percent of UK card issuers.

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956, the company is a pioneer in the use of predictive anlytics and data science to improve operational decisions. FICO holds more than 200 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in more than 120 countries do everything from protecting 2.6 billion payment cards from fraud, to helping people get credit, to ensuring that millions of airplanes and rental cars are in the right place at the right time.

Learn more at https://www.fico.com

FICO and TRIAD are registered trademarks of Fair Isaac Corporation in the U.S. and other countries.

For further comment on the FICO UK Credit Card activity contact:

FICO UK PR Team

Wendy Harrison/Parm Heer/Matthew Enderby

ficoteam@harrisonsadler.com

0208 977 9132