FICO World 2023: Four Enterprise Fraud Management Takeaways

Enterprise fraud management was a big topic at FICO World 2023, and this post explores four key themes that presenters and attendees discussed at the event

In May, I was fortunate to be at FICO World 2023 in Hollywood, Florida. Beyond the pleasure of leading a FICO Falcon Fraud Manager User Forum and moderating a couple of panel breakout sessions, I I was also able to catch up with many of the fraud-focused attendees from around the world.

In my conversations with these professionals, I heard a handful of key themes for enterprise fraud management repeated over the week: the prevalence of scams; the consolidation of point solutions for specific portfolios; the need to balance fraud management practices with customer experience; and the potential future impacts of AI on financial fraud. Let’s dig in a little deeper.

Scams: A Top Fraud Concern

Scams are becoming a leading fraud concern, all around the world. From Australia to the UK to the USA, consumers and financial institutions are facing a scourge of authorized push payment (APP) and authorized user fraud.

The global figures are staggering — $8.8 billion in estimated authorized user/scam losses in the US in 2022, £485 million lost in the UK in 2022, 125 million scam victims in Brazil in 2021 (a shocking 59% of the population). Clearly, fraudsters are taking advantage of the growing real-time payments landscape to inflict real financial damage to individuals.

But scams, and the impact of scams, extend beyond individual bank accounts. New regulatory considerations are emerging, like the Payment Systems Regulator issuing new liability frameworks in the UK. There is also growing impact to traditional card portfolios, not just demand deposit accounts (DDA) and real-time payments channels.

FICO is committed to helping identify and stop scams, including through award winning, patented machine learning models. The people I talked with about scams were thrilled to learn more about putting technology in place to help curb this insidious and alarming type of fraud.

Replacing Silos with Enterprise Solutions

As more organizations are embracing digital transformation initiatives, I was pleasantly surprised to discuss the changes happening in fraud management strategy. Many of the people I spoke with expressed their continued interest in enterprise level solutions that provide more customer-centric decisioning.

It was also encouraging for me to hear that organizations are moving away from portfolio-specific silos, in favor of a more holistic approach to customer experience and management. A lot of individuals I chatted with were understandably excited about the potential for FICO Platform to radically transform their enterprise decision management — not just for their fraud operations, but for their company as a whole. While they’re working to deliver personalized customer experiences in fraud management, they’re also working to advocating for that same approach across every customer touchpoint, every time.

Balancing Customer Experience with Sensible Friction

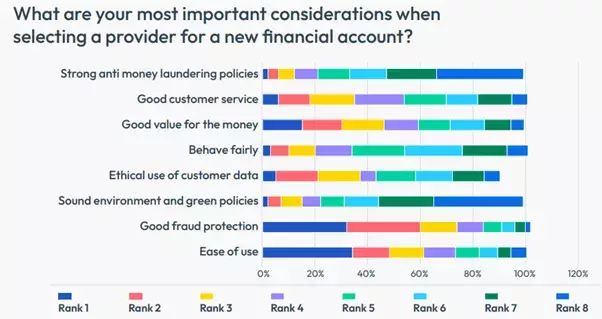

Along that same line, people were talking about the need for balance between friction and customer experience. In many fraud contexts, friction used to be considered negative, but customers now see improved fraud detection as a must have — and companies can use that as a competitive differentiator.

My colleague TJ Horan recently published a thought-provoking piece on the need to introduce more “sensible friction” into enterprise fraud management. In fact, recent FICO research shows that 70% of worldwide consumers would feel positive about their bank if it stopped a scam payment before the payment happened, showing a strong appetite for bank intervention to help fight criminals.

I agree that there is an opportunity for banks to strategically add more friction in the payments process to help provide more layers of protection for customers and their businesses. One straightforward way to do this is to improve and enhance communication with customers.

Using real-time, omnichannel communication capabilities to connect with the customer in their preferred channel can give banks a leg up in the fight against fraud. By proactively sending ‘warnings’ before transactions — via SMS, email, in-app notifications and more — banks can embrace their role as guardians of the customer and their funds, as well as improving overall communications.

Good vs Evil: The Future of AI in Fraud

Finally, the omni-present topic of artificial intelligence (AI) and machine learning (ML) was a hot topic of conversation among fraud fighters. While generative AI tools like ChatGPT came up frequently, the interesting take was a look at how criminals are using tools like this to refine and “professionalize” their targeted fraud messaging.

In multiple sessions, our presenters showed how generative AI can facilitate fraudulent communications that can potentially trick customers into sending funds to criminals as part of a scam. That in turn highlighted the need for ongoing and in-depth consumer education about how AI can be used for both good and evil, what kinds of flags to look for, and how to best confirm whether any outreach is legitimate.

That educational aspect can be a big deal and another differentiator for banks, especially since FICO’s own recent research shows that nearly a third of customers say banks aren’t providing enough education about real-time payment scams.

All in all, I was so excited to share ideas and discussions with my fellow fraud-fighting professionals from around the globe. If you weren’t able to attend, start making plans now for FICO World 2024, happening April 16-19, 2024 in San Diego. I would love to chat with you there about your fraud challenges and approaches!

How FICO Helps Your Enterprise Fraud Management Strategy

- Check out the recent FICO World 2023 fraud presentations

- Explore FICO’s award-winning Retail Banking model 3.0 with scam detection score

- Learn how Customer Communications Services for Fraud helps improve overall customer experience while helping mitigate losses from fraud

- Read more about FICO Platform and the power of reusability

Follow me on LinkedIn for more insights about FICO’s enterprise fraud management solutions.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.